By many accounts, it’s been a rather depressing year for cryptocurrency. The valuations of most major Cryptocurrencies are down by about 90 percent of what they were a year ago, with little sign of recovery anytime soon.

However, there is some indication that the Blockchain and cryptocurrency industries may be doing much better than what seems to be happening on the surface. Although valuations are up, the number of open positions at blockchain firms is at a record high.

Need a Job? Check Out the Blockchain Industry

According to an October report by recruiting site Glassdoor, the need for professionals with experience in blockchain technology has grown immensely in the recent past, with a 300 percent rise in open positions yearly--in August of 2017, there were 446 open positions related to the blockchain industry. In August of this year, there were 1775 in the United States. At the time of writing, there were 2800 open positions.

In addition to the fact that the number of open positions in the blockchain technology sphere is continuing to grow, Glassdoor also reported that the average salary for blockchain industry positions averages around $85,000 per year. At the low end, customer support and similar positions bring in around $36,000 per year; developer jobs sit around $200,000 per year.

7/ Top cities for jobs:

1. San Francisco 2. New York 3. London 4. Berlin 5. Boston 6. Toronto 7. Tel Aviv 8. Hong Kong 9. Singapore 10. Los Angeles — Cryptocurrency Jobs (@jobsincrypto) October 25, 2018

And indeed, it seems that the highest-paying positions are also in the highest demand. Another report by professional social networking site LinkedIn showed that the number of blockchain developer positions has increased by 3300 percent over the past twelve months. Developers with skills in Node.js and Solidity were said to be in the highest demand; Ethereum, ConsenSys, Chainyard, and IBM were listed as the top employers for these positions.

Open positions for blockchain industry positions on LinkedIn also surpass the number of those posted on Glassdoor--CoinTelegraph reported earlier this month that 13,816 blockchain industry-related job posts were listed on the site, and an additional 2,479 cryptocurrency-related job posts were also listed (although it’s important to note that LinkedIn’s open positions were not limited to the US.)

Rise in Open Positions May Be Indicative of a Changing Market

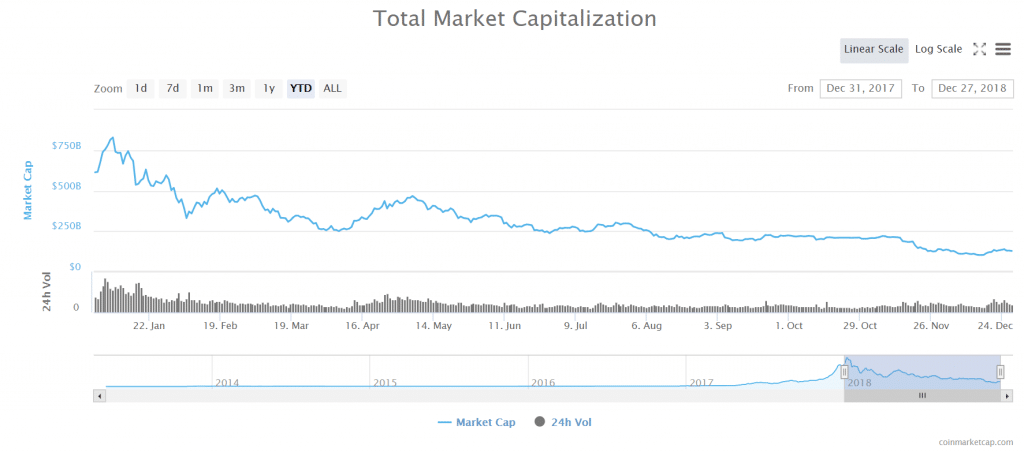

The rise in open positions stands in direct opposition to the absolute bloodbath that was cryptocurrency market capitalization throughout 2018. Bitcoin prices have fallen from roughly $20,000 at the beginning of the year to where they currently sit around $3800; cryptocurrency market capitalization as a whole has fallen from its height of over $800 billion to just $128 billion.

However, the rise in the need for recruitment is in line with the amount of funds raised through ICOs. The ICO market has changed considerably over the past year--what used to be a wild-west, mom-and-pop funded industry has transformed into a highly-regulated investment complex that largely excludes retail investors and welcomes investments from high-volume institutional investors.

As such, the funds raised by ICOs throughout 2018 far surpass those raised in 2017 or any other year. In the first nine months of 2018, $12.3 billion had been raised through ICOs; $5.6 billion had been raised through ICOs throughout all of 2017. This, combined with the rising number of open positions, is evidential of a shift within the blockchain industry away from speculative investment and toward building substantial products.

How does one hire top talent for the blockchain industry?

Although the blockchain industry is rapidly expanding, it’s still brand-new. There are certainly some individuals who have operated within the space for years as developers, traders, and other kinds of professionals, but the industry has expanded so quickly that most people with any kind of viable experience have been quickly snapped up.

In other words, finding talent with experience in the blockchain field is extremely difficult. And with the ever-changing regulatory and technological climate, finding talent that’s capable of keeping on top of regulatory requirements and trends is absolutely crucial.

However, the scarcity of professionals that have expertise in various aspects of the blockchain industry is a real issue. Often, the talent pool of experienced blockchain industry professionals is rather dry--hirers must dip into other industry pools to find the talent that their companies need.

So when searching for possible recruits to work in a blockchain company, how does one establish that a prospective hire is a viable candidate to work in the blockchain industry? Here are a few things to keep in mind.

#1: Demonstrated Interest in Blockchain is Essential

In an article for VentureBeat, head of human resources at IOHK Tamara Hansen recommended that recruiters “[start] from a standpoint of company culture and engagement.”

More specifically, Hansen suggests that the recruiter establishes that in addition to understanding the mission of the company, a recruiter must ensure that the candidate has a good understanding of the current climate of the blockchain industry as a whole.

Hansen also says that if the candidate doesn’t seem to be very well-versed in blockchain industry culture, all hope may not be lost--but it’s important that the candidate does have a parallel set of experiences that have prepared her or him for work in a rapidly expanding, quickly changing industry.

There certainly will come a time when there is a bounty of professionals for hire who have plenty of experience within the blockchain field. Until that time comes, however, candidates who have experience in the tech or financials spheres who have shown a dedicated interest in blockchain are perhaps the best choice when it comes to recruitment.

#2: Unless You Have a Crystal Ball, It Can be Difficult to Predict Which Positions Will Need to Be Filled--But Planning is Key

Because the blockchain industry is so new, recruiters face another, rather unique problem: it’s hard to know the unknown. In other words, as companies continue to expand and change, the need for new positions may turn up--and sometimes, it’s difficult to anticipate this need.

Perhaps this has much to do with the fact that many blockchain companies--including trading app giant Coinbase--started with the “two guys in an apartment” model. In other words, a small team of people bootstrapping no-frills trading and payment platforms

In the earlier days of the industry, this resulted in the creation of products and platforms that worked well for the people that they served--the niche group of technically-proficient users that were interested in trading cryptocurrency. Some of the earlier trading platforms were so rudimentary that they required their users to input lines of code in order to work. There was little (if any) user support; legality and regulatory compliance were hardly a concern for most of these platforms.

#3: Different Skill Sets Are Needed at Different Stages of Company Growth

Now, a new subset of required positions has emerged onto the scene--skilled communications professionals, legal experts, customer service gurus, and marketing strategists are all an important part of the new blockchain industry, but they aren’t often considered necessary until a company has made it past its startup phase.

One new position that has emerged in many later-stage blockchain companies is the role of the “Community Manager,” which is a bit like a PR manager that operates on a micro-level. “The rise of the Community Manager is interesting,” wrote Daniel Adler, creator of hiring site Cryptocurrency Jobs, in an October tweet.

“Applicants sometimes misunderstand the nature of the role, and view it as an entry-level social media type job. Equally some companies seem to make the Community Manager a catch-all job title for multiple responsibilities and the role loses value.”

The bottom line is that although hard technical skills are essential to build a baseline product, there is an undeniable need for soft-skill professionals later in the game.

4/ Jobs distributed across roles:

- Customer support: 8% - Design: 6% - Engineering: 47% - Marketing: 10.5% - Operations: 12% - Other [finance, product]: 11% - Sales: 5.5% — Cryptocurrency Jobs (@jobsincrypto) October 25, 2018

Hansen recommends that therefore, HR professionals need to take the long view in order to succeed. Recruiters should establish a hiring strategy that anticipates the kinds of professionals that will be needed throughout a company’s lifecycle.

This strategy should also take into consideration the fact that internal protocols may also need to evolve as a company moves throughout its lifecycle, and that they should include some self-cleaning practices, including regularly scheduled performance reviews and training programs.

And of course, the bottom line of any hiring strategy is clarity. “Regardless of size or scale, every incoming person should feel adequately prepared for their given position and understand the requirements expected of them. This cannot be overstated,” Hansen wrote.

#5: Think Out-of-the-Box to Find Talent

Because it’s difficult to predict exactly which positions will be needed at which stages of a company’s growth, it’s important to think out of the box. This also extends to where companies source their talent--while professionals from other industries may be a safe bet, companies who can establish working relationships with universities and research programs may be the first to onboard top talent that is joining the workforce for the first time.

Hansen writes that IOHK’s partnerships with several tech programs in universities around the world “lets us take our candidate search directly to the classroom, informing students about the promise of blockchain and inspiring them to solve real-world problems in this space.”

The Bottom Line: Planning is Key

In this rapidly expanding industry, recruiting and keeping top talent is a major challenge. In spite of the difficulty, however, HR professionals must remember that no matter how talented an individual may be, their skills can be rendered meaningless if they aren’t a team player.

Indeed, it can be easy to lose sight of what’s important when the scramble to find talent is more frantic than ever. Still, careful planning and proactive thinking can prevent disaster and promote a healthy work culture and a successful company.