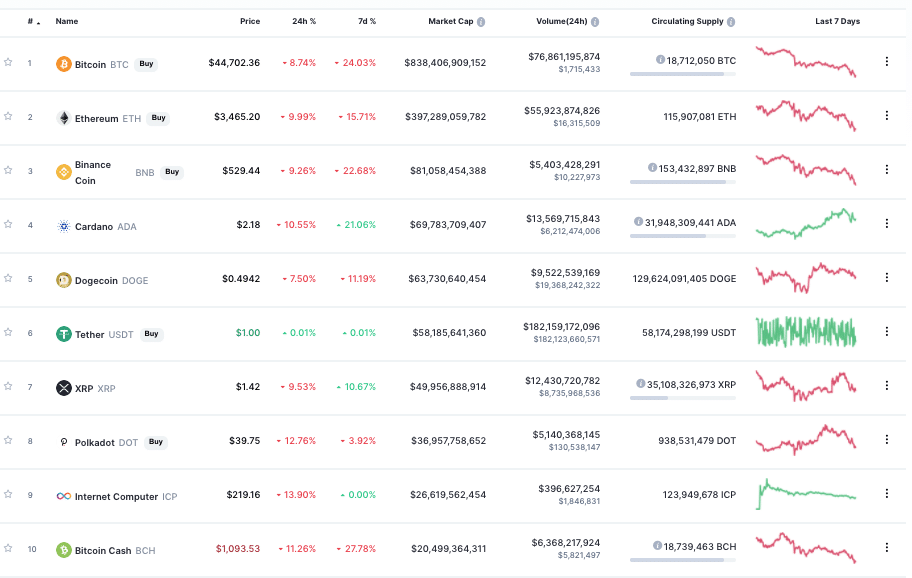

Over the past 24 hours, cryptocurrency’s collective market cap has dropped approximately 10 percent, falling from $2.3 trillion to approximately $2.08 trillion. The losses are not centralized to any specific asset or group of assets this Monday morning, as cryptocurrency markets are seeing red across the board.

Indeed, BTC is down more than 9 percent, sitting at $44.6K at press time; Ether (ETH) is down just over 12 percent with a price of $3.4K. Binance Coin (BNB), DogeCoin (DOGE), Cardano (ADA) and XRP are all down approximately 10 percent.

Once we move past the top-ten largest Cryptocurrencies by market cap, the losses are even larger. PolkaDot (DOT) and Internet Computer (ICP) are both down more than 15 percent, while Uniswap (UNI), Chainlink (LINK), EOS and others are down roughly 12 to 13 percent. What happened?

Some commentators are blaming the downward turn in cryptocurrency markets, and Bitcoin in particular, on none other than Tesla Founder, Elon Musk.

I think many people aren’t mad because of the price, they’re confident Bitcoin will bounce back stronger. They’re mad because Elon is shamelessly spreading harmful misinformation while making countless people FOMO into a high-risk meme coin in the most irresponsible way.

— Lina Seiche (@LinaSeiche) May 17, 2021

Will Tesla Offload Its BTC Holdings?

After Musk announced last week that Tesla would be suspending its acceptance of Bitcoin Payments for its luxury cars, the price of BTC dropped roughly 17 percent in 24 hours.

Bitcoin had not managed to fully recover before Elon Sent out another Twitter hint that Tesla may be offloading some of its BTC holdings seemed to ignite further sell-offs in Bitcoin markets. As the BTC price dropped, investors in other assets seemed to feel a sudden urge to take profits.

Twitter user @CryptoWhale, who has been called a 'scammer' by a number of members of the crypto community, wrote, “Bitcoiners are going to slap themselves next quarter when they find out Tesla dumped the rest of their #Bitcoin holdings. With the amount of hate @elonmusk is getting, I wouldn’t blame him,” to which Elon replied, “Indeed.”

Indeed

— Elon Musk (@elonmusk) May 16, 2021

In addition, Musk clarified that Tesla has not sold any Bitcoin yet.

Elon’s Love Affair with DOGE

This latest tweet, as well as Tesla’s announcement that it would be dropping Bitcoin payments last week, seem to represent something of a heel-turn for Mr Musk, who, for a brief moment, was lauded by the crypto community. Today, crypto Twitter, and perhaps the crypto community at large, seems to be souring on Elon Musk.

When Elon began his public love affair with DogeCoin earlier this year, it was unclear what his intentions were. To some, the fixation seemed like a joke; however, as time went on, it seemed that Elon did have some kind of serious agenda with DOGE. He referred to it as “the people’s crypto”; he offered to buy out DOGE whales to make the currency less centralized. He even asked the public if Tesla should accept DOGE payments.

But, as serious as Elon may or may not be about DOGE, many analysts pointed out the apparent glee that Musk took in with the power that he had over the price of the asset. At one point, he tweeted a meme of himself as Lion King character Rafiki holding a Simba DOGE up to the sun with the caption, “you’re welcome.”

Then, when Tesla announced that it would be accepting BTC payments and adding BTC to its balance sheet, more people seemed to start to see Elon as a sort of champion of crypto that the company’s adoption of Bitcoin could lead the way to an era of corporate Bitcoin adoption.

Tesla’s Change of Heart

But, this hope seemed to be short-lived. When Tesla announced that it would no longer be accepting BTC payments, and would be exploring other cryptocurrencies as possible payment options before then, some members of other crypto communities jumped at the opportunity to get Musks’ attention. Others made it clear that Musk’s touch was unwelcome.

For example, a Cardano (ADA) fan with the Twitter handle @CryptoNelson17 wrote that: “While I would love [Tesla to accept ADA] from a utility-perspective, I feel like @elonmusk is a bit unstable & it could hurt $ADA somehow,” he wrote.

“I mean take this ‘no longer purchasing teslas with $BTC’ thing – you’re telling me Elon didn’t know it wasn’t green? He’s a kid in a candy store, playing (sic).” he wrote. Moreover, members of the XRP community responded negatively to attempts to vie for Musk’s attention.

The Bitcoin crowd is no different. After Musk’s most recent “Indeed” tweet, crypto analyst Michael van der Poppe told Musk that he “look[s] utterly pathetic.”

“If you don’t believe in #Bitcoin, sell them and stop teasing millions of people,” van der Poppe wrote. “We’re done with it.”

You are responding to a scammer and you look utterly pathetic.

— Michaël van de Poppe (@CryptoMichNL) May 16, 2021

If you don’t believe in #Bitcoin, sell them and stop teasing millions of people.

We’re done with it.

Also, anonymous crypto analyst @notgrubles responded with “history has not been kind to people rage selling” alongside a photo of Roger Ver.

Journalist Bede MacGowan wrote, “Let him dump. The crypto community really shouldn’t be so dependent on the whims of one celebrity tweeter.”

Let him dump. The crypto community really shouldn’t be so dependent on the whims of one celebrity tweeter #bitcoin

— Bede Mac (@bedemacgowan) May 16, 2021

Ari Paul, CIO of BlockTower Capital, wrote "Bitcoin isn’t PayPal, it’s a serious attempt at providing permissionless money to the world. You don’t seem to have much to contribute to that endeavor."

Dump it. Use doge as your plaything. Bitcoin isn’t PayPal, it’s a serious attempt at providing permissionless money to the world. You don’t seem to have much to contribute to that endeavor.

— Ari Paul ⛓️ (@AriDavidPaul) May 16, 2021

However, others are sticking up for Elon: "The Bitcoin community celebrated when Musk manipulated the market in their favour, didn't seem to reflect for one second on why that was bad, because it profited them," one Twitter user wrote.

"The second his manipulation hurts them, they act all mad."

What are your thoughts on Elon's crypto-related tweets? Let us know in the comments below.