Cryptocurrency trading is becoming an increasingly popular form of investment for both institutional and retail traders. There is a growing number of user-friendly platforms for crypto trading but knowing which kind of platform and which kind of investment products to seek out can be difficult.

Are you an institutional or retail trader? Are you searching for an anonymous trading platform, or one that is fully regulated? Are you seeking crypto derivatives products? Read on to learn about what is available to you as a cryptocurrency trader.

Cryptocurrency Exchanges

Cryptocurrency exchanges operate similarly to stock exchanges. They allow for Cryptocurrencies to be traded with one another; some cryptocurrency exchanges allow their users the option to trade fiat currencies (i.e. USD, EUR) with one another.

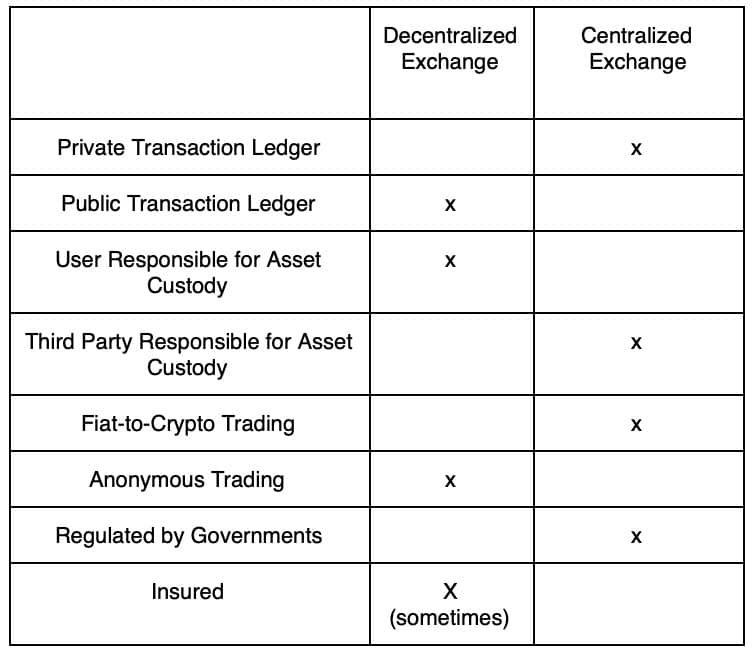

There are two kinds of cryptocurrency exchanges: centralized exchanges (CEX) and decentralized exchanges (DEX). Centralized cryptocurrency exchanges require their users to deposit their funds into the exchange’s platform before they can trade; decentralized exchanges are designed in such a way that users maintain control of their own funds at all times.

It’s important to note that cryptocurrency exchanges – centralized or decentralized – do not fall under the same regulations that other kinds of asset exchanges do. A report by the TABB Group entitled Crypto Trading - Platforms Target Institutional Markets reads that “Entities describing themselves as cryptocurrency exchanges appear similar to regulated financial exchanges; however, this assumption can break down upon closer inspection.”

“Even the most prominent crypto exchanges have a number of important differences in management of client funds, execution transparency, trade reporting and verification, regulatory oversight, and risk,” the report explains.

Centralized Cryptocurrency Exchanges

Each centralized exchange has its own custody arrangement for its users’ assets. This is often problematic, as a lack of transparency around cybersecurity practices, security audits, and server locations can lead to questions about how secure any given centralized exchange truly is.

Centralized crypto exchanges that do not offer their users the option to trade fiat pairs often have lower fees than those that do. Many centralized exchanges also charge their users fees to make withdrawals.

The often ambiguous regulations that are applied to cryptocurrency exchanges results in a number of legal and compliance issues, including the fact that centralized exchanges keep their own ledgers of transactions. This has its advantages, as client details and holdings are not available for viewing on the public Blockchain ,” the report reads. “However, it also means there is often no way for clients to verify proof of execution and holdings easily.

Daniel Skowronski, CEO of DX Exchange, told Finance Magnates that another significant concern surrounding centralized exchanges is the lack of transparency around market makers on exchanges. “A lot of exchanges add market makers who basically are just there to pump up volume doing buys and sells and cross trades,” he said, adding that trading bots are often created to do the same thing. To counteract this, DX Exchange has instituted a policy in which it only allows approved-third party market makers on its platform.

DX Exchange's Daniel Skowronski and Monica Summerville, Head of Research at TABB Group will both speaking at the London Summit 2018 regarding cryptocurrency trading models. Learn more about their in-depth panel and more of what is in store for attendees by accessing the following link.

Decentralized Exchanges

Essentially, decentralized exchanges fulfill the same function as centralized exchanges: they are platforms on which cryptocurrencies can be exchanged with one another. However, there are a few key differences.

First and foremost, decentralized exchanges are crypto exchange markets that are not reliant on a third-party to store their users’ funds. In other words, when you use a decentralized exchange, you remain as the sole keeper of your coins; centralized exchanges require you to place your funds under their custody before you can start trading.

Additionally, decentralized exchanges do not offer their users the option to exchange fiat currency with cryptocurrencies.

Because decentralized exchanges do not store their users funds in any centralized location, they are generally regarded as being more secure than their decentralized counterparts. However, the TABB group writes that “the technology [behind decentralized exchanges] is not fully mature and, in any case, there is always going to be a need to attract buyers and sellers to ensure liquidity.”

Coinbase UK Zeeshan Feroz told Finance Magnates that he believes that despite their nascent nature, “decentralized exchanges definitely have a place,” and “as the ecosystem matures, we’ll start to see more volume and use cases [for them.]”

Cryptocurrency CFDs

As cryptocurrency enters further and further into mainstream financial spheres, a growing number of different kinds of crypto trading products have appeared on the scene. Cryptocurrency CFDs (contracts for difference) are becoming increasingly popular among retail and institutional investors.

CFDs are derivatives contracts that happen between traders and brokerage companies. The owner of a CFD has the right to receive the difference between an asset’s current value and the value that they predict--if the predicted value is incorrect, the trader will have to cover the loss.

Because of the nature of CFDs, they can be incredibly risky for new investors. Only a small number of firms have been granted the right to offer CFD trading.

Of all of the CFD products launched, “the launch of futures products by the CME and Cboe has gained the most media attention. Cboe Global Markets and CME, the world’s biggest exchange operator by value, both launched cash-settled Bitcoin futures late last year,” TABB explains.

However, “market participants noted that margin requirements are very high due to crypto’s high price volatility; however, volatility is expected to decrease as more institutional money enters the market.”

Due Diligence

No matter which kind of platform or product you choose, always ensure that the individuals and companies that you’re engaging with as a trader are legitimate.

Thankfully, the global cryptocurrency community is very active in informing others about their experiences with various exchanges and other kinds of trading platforms. Before deciding to use a platform, gather as much information as possible about it. Bon voyage!