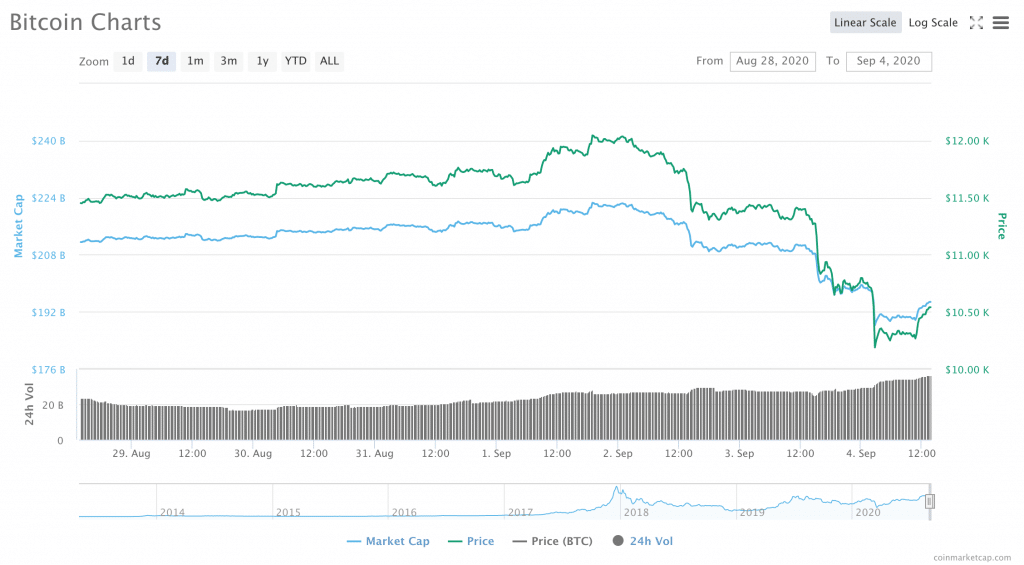

Bitcoin has steadily been falling since Thursday of this week. Last Friday, Bitcoin was sitting comfortably around $11,440, where it largely remained before peaking just over $12,000 on Wednesday.

- However, the reach over $12,000 appeared to trigger a small-scale selloff. By the end of the day on Wednesday, data from CoinMarketCap showed that BTC had fallen around $11,350. At the end of the day on Thursday, Bitcoin had fallen to $10,800. At press time, the price had dipped to $10,450, having dropped below $10,200 at one point earlier in the day.

Some data sources showed that Bitcoin had even briefly dropped just below $10,000. On Binance, the chart tracking the BTC/USDT trading pair showed a dive to $9,990.

Now, though, it is unclear whether the drop will continue. However, this 48-hour price dive does beg the question: will BTC test $10,000 again?

Bitcoin May Be Retracing to Fill in the Latest CME 'Price Gap'

For some analysts, the answer is yes. While Bitcoin is currently back over the $10,000 mark, a number of commentators seem to believe that prices could fall as low as $9,700, a figure that would fall in line with the most recent ‘CME gap.’

The ‘CME gap’ phenomenon takes place when Bitcoin markets make a sharp move outside of the trading hours for CME’s Bitcoin futures markets. This results in a literal ‘gap’ in Bitcoin price charts.

Therefore, these gaps become ‘filled’ if the Bitcoin price retraces to retest the price area that is missing in the gap on the CME chart. Because the gap is around the $9700 zone, it is possible that Bitcoin could fall at least that low.

The most recent CME price gap, via CoinTelegraph/Tradingview

BTC's Dip Could Be Echoing a Drop in Stock Prices

However, the price gap may not be the only reason that Bitcoin seems to be headed back below $10,000. In fact, some analysts believe that the price drop may be related to an increased level of correlation between Bitcoin and traditional asset markets.

Therefore, some analysts believe that the BTC dip is actually an echo of a major hit to tech sector stocks that resulted in a 4 percent crash in the S&P 500 on Friday, September 4th.

Crypto commentator Lark Davis wrote on Twitter that the correlation between BTC and stock markets will only continue to grow stronger as more institutional investors continue to enter into crypto markets: “S&P 500 dumping, and oh big surprise #bitcoin is too!!! As more and more institutions come this is becoming out reality,” he said.

S&P 500 dumping, and oh big surprise #bitcoin is too!!! As more and more institutions come this is becoming out reality. pic.twitter.com/CiJjDBUaCd

— Lark Davis (@TheCryptoLark) September 4, 2020

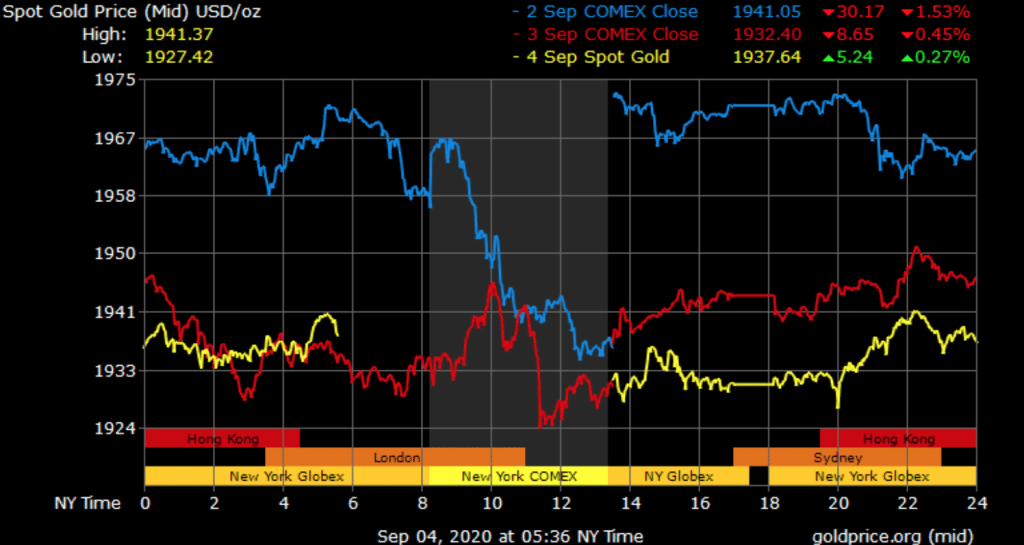

Interestingly, though, dips in both stock markets and Bitcoin prices were much more severe than a dip in the price of gold, as renowned gold bug and Bitcoin bear, Peter Schiff was quick to point out.

“While gold declined, it fell much less than the market,” he wrote on Twitter. “Gold rose in value relative to stocks. #Bitcoin on the other hand fell much more than the market. For #gold owners stocks got cheaper. For Bitcoin owners they got more expensive,” he wrote on Thursday, September 3rd.

This is misleading. While gold declined, it fell much less than the market. Gold rose in value relative to stocks. #Bitcoin on the other hand fell much more than the market. For #gold owners stocks got cheaper. For Bitcoin owners they got more expensive.https://t.co/XTybjujvT6

— Peter Schiff (@PeterSchiff) September 3, 2020

And indeed, by press time, as Bitcoin and stock prices were still in the red, gold appeared to have been making a swift comeback. Price per ounce netted a 0.28 percent gain over the last 24 hours, though it was not insignificant, given the state of markets more generally.

Bitcoin's Dip Rippled into ETH and Beyond

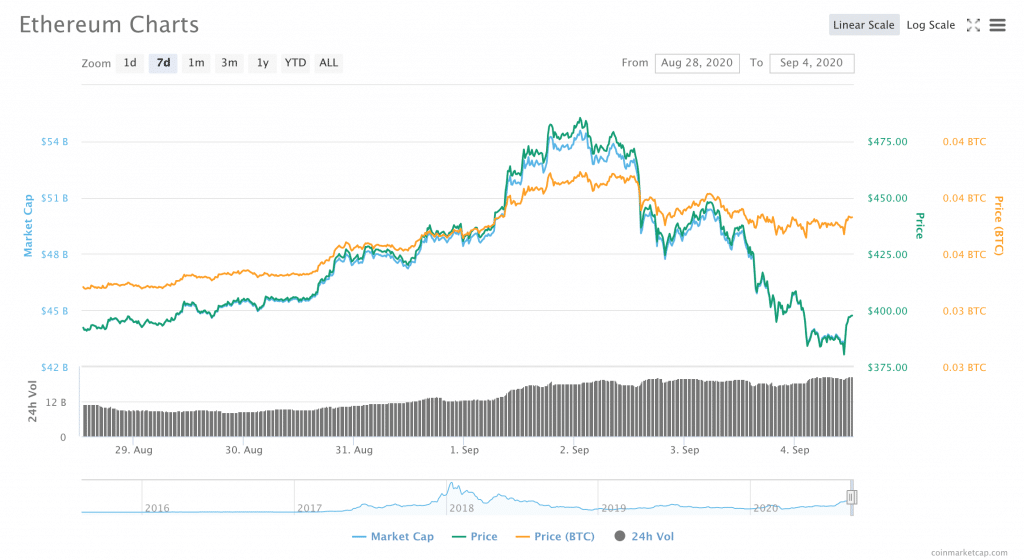

Beyond Bitcoin crypto markets, in general, have also taken a bit of a hit.

For example, the price of Ethereum, which has been riding high for weeks, has finally taken a dive. At press time, the price of ETH was down to $397.73, with a drop of 8.34 percent in the last 24 hours. On Wednesday, ETH reached a yearly high of around $486.

The drop in the price of ETH could partially be happening in correlation to what is going on in BTC markets. However, there are a few theories unique to ETH that analysts are using to explain the price drop.

For one thing, transaction fees on the Ethereum network went through the roof: according to on-chain Analytics firm Glassnode, miners on the network earned over $500,000 in fees in just one hour on September 1st. The rise in fees, coupled with a slowing of transaction speeds, may be contributing to ETH’s price decline.

And indeed, Stuart Popejoy, co-founder and president of blockchain infrastructure firm Kadena, predicted the fall of ETH’s price in an email to Finance Magnates earlier this week.

“ETH 1.0 is clearly on a warpath to bleed millions of dollars in gas fees over the next couple weeks,” Stuart Popejoy said. “Eventually there will be a new equilibrium when enough gas gets emitted to bring prices back to reality.”

Stuart Popejoy

DeFi Tokens Are Dropping, Too

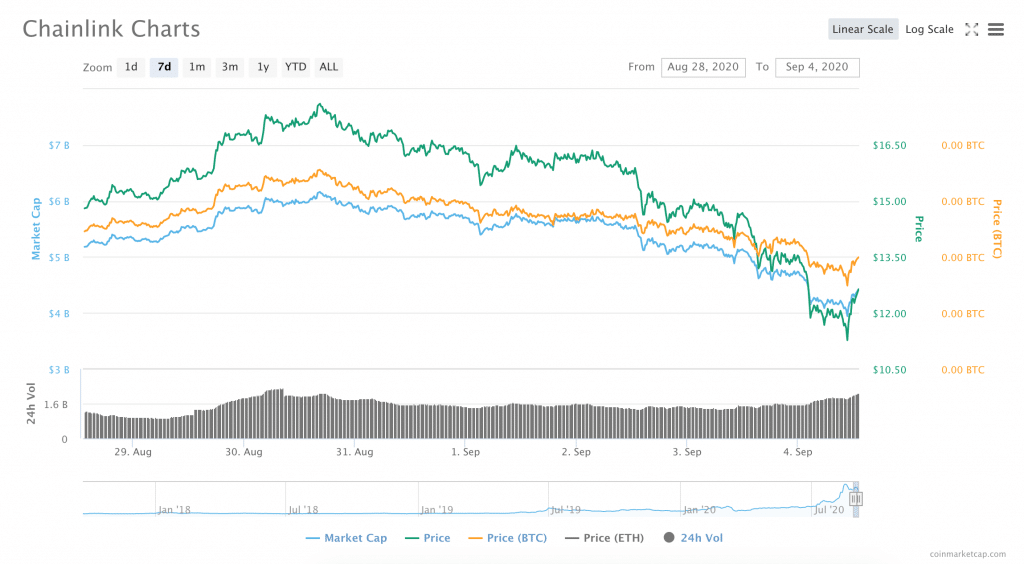

The drop in ETH’s price also seems to have spread to other assets in the DeFi (decentralized finance) ecosystem.

For weeks, months even, a number of assets associated with various DeFi protocols have been making headlines due to their positive price movements. Finance Magnates reported in August that the price of BAND (the asset associated with the Band Protocol) had increased more than 6000% since the beginning of the year. The same month, Chainlink’s LINK had seen a 659.551% increase since January 1st.

As of today, both of these assets, and many other DeFi tokens, are down for the count. LINK had shed nearly 13 percent in the last 24 hours and was down 28 percent since a weekly peak on Sunday; BAND was down 17 percent in the last 24 hours and had fallen 30.4 percent since its weekly peak on Thursday.

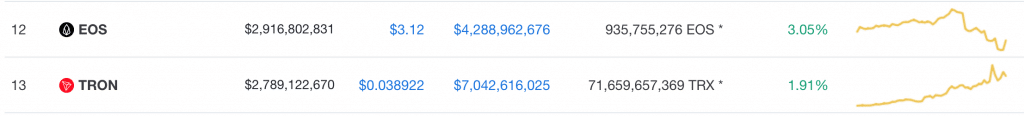

On the other hand, TRON and EOS, two protocols that have also been used to build DeFi applications, were in the green at press time. EOS’s upward movement seems to be the result of a buyback that had taken place over the last 24 hours, while TRON had shown fairly consistent gains throughout the week.

Beyond possible correlation with BTC and ETH, price drops in the DeFi token space seem to be the result of price corrections that have been expected for quite some time.

Is the DeFi Bubble Bursting?

Indeed, in an interview conducted in July, Deniz Omer, head of ecosystem growth at Kyber Network, told Finance Magnates that the price increases in DeFi tokens were somewhat reminiscent of the ICO explosion that took place in late 2017.

“In 2017, if you look at the actual value that existed, I would say that 98 percent of that was speculative value, and only 2 percent was fundamental value,” Omer said. Then, “over 2018 and 2019, as the market deflated,” the ratio began to reverse course: “fundamental value went higher and higher, and speculative value kind of dropped.”

Deniz said that similarly, the ratio of speculative value in the DeFi ecosystem “is increasing compared to the fundamental value.”

Deniz Omer, head of ecosystem growth at Kyber Network.

“It’s not that these products are not amazing – they are super amazing,” he added. At the same time, though, “when I see a several-thousand-dollar valuation for some kind of governance token, I’m not sure the capture mechanism allows for so much value to go up.”

In other words, Deniz believed that the price explosions in some DeFi tokens were “short-term, basically,” and that “[...] there should be a rebalancing and a correction at some point, especially if more people join in.”

And indeed, it seems that DeFi markets may have reached some kind of an inflection point, though more growth and more corrections are certainly expected in the future.