Believe it or not, this year was Bitcoin’s 10th birthday. (Feel old yet?)

For some, this anniversary was an important indicator of Bitcoin’s stability. “Bitcoin having made it 10 years, even as it significantly declined from a late 2017 peak, stands out as a remarkable achievement where a piece of code that is not governed by any central authority or government has been able to create so much value,” said Steve Eliscu, Executive Vice President of DMG Blockchain , in an email to Finance Magnates. “Having survived for 10 years makes it much more than a fly-by-night.”

For others, however, Bitcoin’s tenth anniversary is a reminder of how little has been accomplished. “The most significant event of 2018 is what did not happen,” said Alex Mashinsky, CEO of Celsius, to Finance Magnates. “We did not get the biggest wave of adoption which was supposed to take us to new highs. After 10 years during which Bitcoin overpowered every downturn to new highs, we are facing the abyss with more naysayers than ever betting big against BTC.”

One year ago... never forget ?? #bitcoin #bitcoincrash #crash #3000 #crypto #cryptocurrency #blockchain #altcoin #altcoin #cryptogazing #investing #bitcoininvestment #trading #bitcointrading #cryptocurrencytrading #binance #bittrex #cryptoexchange #exchange #bitcoinexchange pic.twitter.com/UzqomrHRYA

— Cryptogazing (@cryptogazing) December 18, 2018

The Evolution of Bitcoin from Anarcho-Capitalist Dreams to Institutional Ambiguity

How did we get to this point? “One has to think of Bitcoin as a 4 leg relay race in which we had the first slow round 2008-2011 represented by the Anarchists who wanted to blow up the world, and now count less than 5% of total wallets that dominated the demand and were true HODLers,” Mashinsky said.

Alex Mashinsky.

“They passed the baton to the Libertarians who wanted to save the world with BTC and now amount to about 30% of all wallets. They supercharged the growth of BTC between 2012-2016 and successfully passed the Baton to the Speculators who came from the FiAT (sic) land to the Crypto land seeking riches. They now count for over 60% of all wallets and are responsible for getting us to all-time highs in 2018.”

I think it's called market cleansing... #bitcoincrash started 2013, riding the hype with not enough plans for the drop. Completly understandable. Who could have known? Except someone being in the market since 2013... https://t.co/t6lZbi4XuQ

— Markus Zancolò (@mkuegi) December 9, 2018

These three groups have led us to where we are today: “they tried to pass the baton to the fourth and largest “professional” racer, the global institutions, who were supposed to take us from here to infinity and beyond,” Mashinsky said. However, “The institutions dropped the Baton and refused to complete the rally which caused the market for BTC to drop by over 70%.”

2018: The Year of the Crash

Darius Eghdami.

“You can’t read a story over the last month without it becoming painfully obvious that 2018 wasn’t a great year for the cryptocurrency market,” said Darius Eghdami, CEO of FansUnite.com, in an email to Finance Magnates. “And it’s hard to look at the marketplace without seeing the crash as the most defining moment of the year.”

But one has to beg the question--which crash?

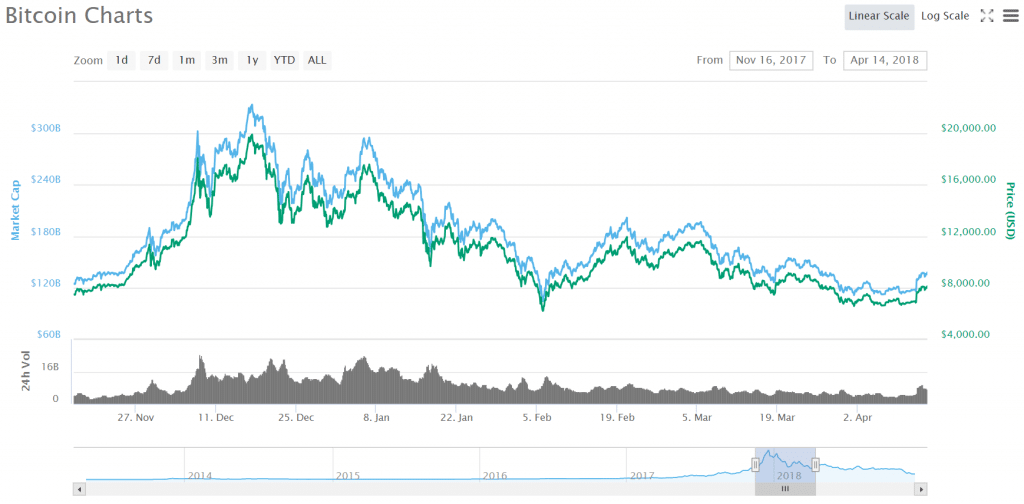

The first (and perhaps most significant) crash came at the beginning of the year. At the end of 2018, the markets were higher than they had ever been; the world watched as Bitcoin climbed from $5,000 to $15,000 to $20,000.

Then, just as soon as it had risen, the price of BTC came crashing down. By early February, the price of Bitcoin sank as low as $6,200.

While the exact cause of the year’s first big crash is unknown, there is some indication that rumors of an exchange ban in South Korea may have triggered a massive sell-off wave. Once the rumors caused a small initial drop in the price, the hundreds of thousands of speculative investors that had just entered the market jumped ship, causing the price to drop further. The further the price dropped, the more people sold off, and so on and so forth.

Thus, the year started with a thud. And while a number of analysts thought that this was nothing more than a bump in the road, the crash that brought in the year set the tone for what would be a grueling 12 months of crashes and slides for BTC.

The Denial of the Winklevoss’ Second Proposal for a Bitcoin ETF Brought Forth Another Mini-Bubble... and a Mini-Pop

As Bitcoin’s price faded throughout the first six months of the year, so did its media presence. David Jones, Chief Market Strategist at Capital.com, told Finance Magnates that this was actually one of the factors driving the price of Bitcoin down. “This year has not seen anywhere near the level of news flow [as 2017], and just as importantly the take-up of Cryptocurrencies as a form of payment by the mainstream just hasn't happened. The urgency to jump in based off [sic] developing news just hasn't been there.”

David Jones

Indeed, BTC was all the rage at the end of 2017, but the public once again began to view it as nothing more than a hobby for tech and finance nerds.

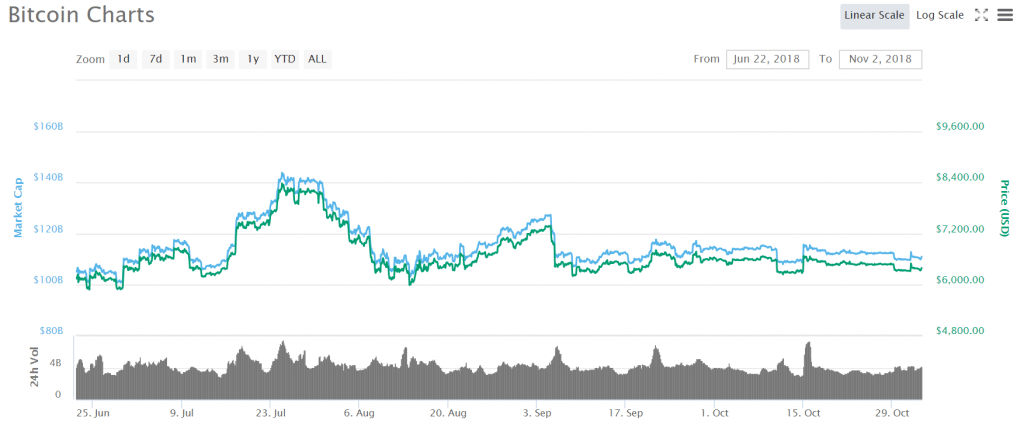

In July, however, Bitcoin came crashing back into headlines with the news that a decision on what would have been the first-ever Bitcoin ETF (exchange-traded fund) was imminent. Cameron and Tyler Winklevoss, Bitcoin billionaires and creators of the Gemini cryptocurrency exchange, had submitted a second attempt at an application to establish a Bitcoin ETF.

Upward movement in the price of BTC during the weeks preceding the scheduled decision on the ETF seemed to indicate that the public believed that the application had a good chance of getting approved. However, the denial of the application sunk the price right back to where it had been several weeks before, and the decline that would ensue over the remainder of the year began.

David Siemer

While the price movements around the ETF decision were certainly significant from an investment point of view, the denial of the application also had important implications for the perception of Bitcoin in the eyes of the public and the eyes of the law.

Much of this has to do with the reasons behind the denial. “Speaking at Consensus: Invest, SEC chairman Jay Clayton cited market manipulation as one of the key factors that has stymied progress on a Bitcoin ETF,” David Siemer, CEO of Genesis, told Finance Magnates.

Kyle Asman, partner at BX3 Capital.

But the possibility of a Bitcoin ETF isn’t completely out of the cards in the future. Siemer also pointed out that the possibility of a Bitcoin ETF in the future may also be influencing the price of Bitcoin. “As the old adage goes: Buy the rumor, sell the news…” Rumor of an ETF has certainly been priced into Bitcoin, and as efforts from key players like the CBOE and VanEck continue to face headwinds, the market price has likely incorporated a lower probability of a Bitcoin ETF in the short-term.”

?SEC: “All ETF proposals are denied until further notice.”

?Crypto Twitter: “I notice you didn’t deny the VanEck one...” ?SEC: “Price manipulation is a major concern and exchanges need to do more.” ?Crypto Twitter: “So you’re saying there’s a chance!”#Bitcoin #BTC $BTC pic.twitter.com/gOAp0flEq0 — Jacob Canfield ?I Love Crypto YouTube Channel (@ILoveCrypt0) August 23, 2018

Kyle Asman, co-founder of BX3 Capital, echoed Siemer in a statement to Finance Magnates: “the initial denial of an ETF had a downward effect on the price. After the initial denial I think it has been priced into the market that we wouldn’t see an approval in 2018.”

The decision on the VanEck ETF application is scheduled for early 2019, but some doubts have been cast that the SEC will have made any decision by then.

In essentially every BTC ETF denial, the SEC has specifically cited risk of "fraudulent and manipulative acts and practices". The SEC's mandate is to protect investors from these risks

Given the below, what are the chances we're actually getting a BTC ETF approval in February? pic.twitter.com/A2hlkwuXRs — Travis Kling (@Travis_Kling) November 15, 2018

The Bitcoin Cash Crash

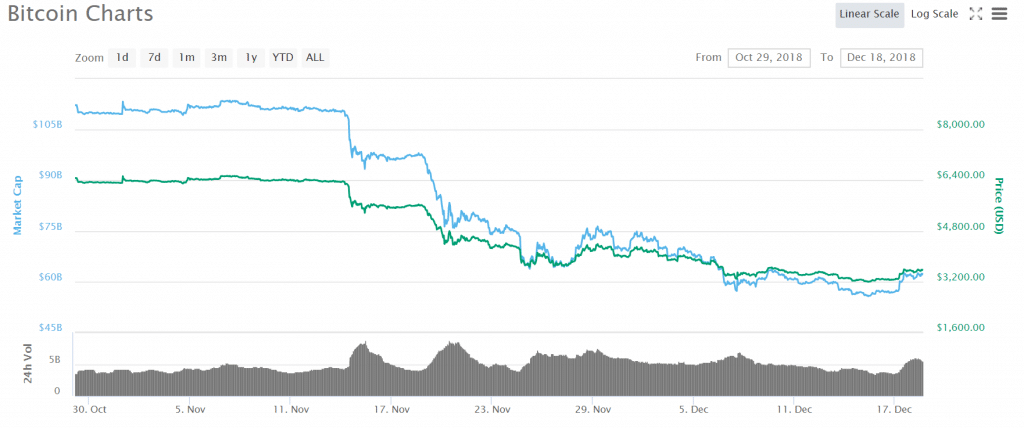

The battle between which protocol would be the “real” Bitcoin Cash took the cryptosphere by storm in late November. A hot battle of egos led to a raging “hash war” that some analysts argue led to the final big crash in the price of Bitcoin this year (unless--God forbid--another one happens in the next two weeks.)

It went something like this: two protocols to update the Bitcoin Cash network were proposed by two opposing parties, led respectively by Bitcoin ABC (the group of developers responsible for the creation of Bitcoin Cash in the first place and Craig S. Wright (the self-proclaimed creator of Bitcoin).

More like #bitcoincrash amirite? #BSV #BitcoinSV. pic.twitter.com/jZIGQdTABv

— stiffed.biz (@StiffedB) December 10, 2018

As each side pushed to make their protocol dominant, both reportedly “rented” hash power to make their protocol more powerful. Hash power is the computing power that’s used to power a blockchain network.

Where did this rented hash power come from? You guessed it--the Bitcoin network. As more and more hash power was taken away from the Bitcoin network, the network became slower and slower, and more difficult to use. Naturally, it was used less--and the decreased transactional volume led to a significant price crash. For the first time in over a year, Bitcoin sunk below $4000.

What kind of social repercussions did this latest crash have on the way that Bitcoin is used? If nothing else, it was a reminder of the nature of the beast. “The Bitcoin Cash Crash came after a period of remarkable stability for Bitcoin,” said Steve Eliscu. “It points out that even as the technology has matured, the value that people place on cryptocurrency is still highly unpredictable.”

What Does the Future Hodl?

After such a hard year, does Bitcoin stand a chance? Does any cryptocurrency stand a chance?

Darius Eghdami said that the massive price decline of 2018 was nothing more than a natural part of a new industry: the “firm believers in cryptocurrencies, including such luminaries as Mark Cuban and Steve Wozniak, and are certain that when there is a true value or utility of the coin, a strong development team behind the project and applications of blockchain technology that actually make sense, cryptocurrencies are going to play a huge role in the future of commerce.”

“As we saw during the .com bubble, the strong currencies will survive as the world continues to move towards a digital world."