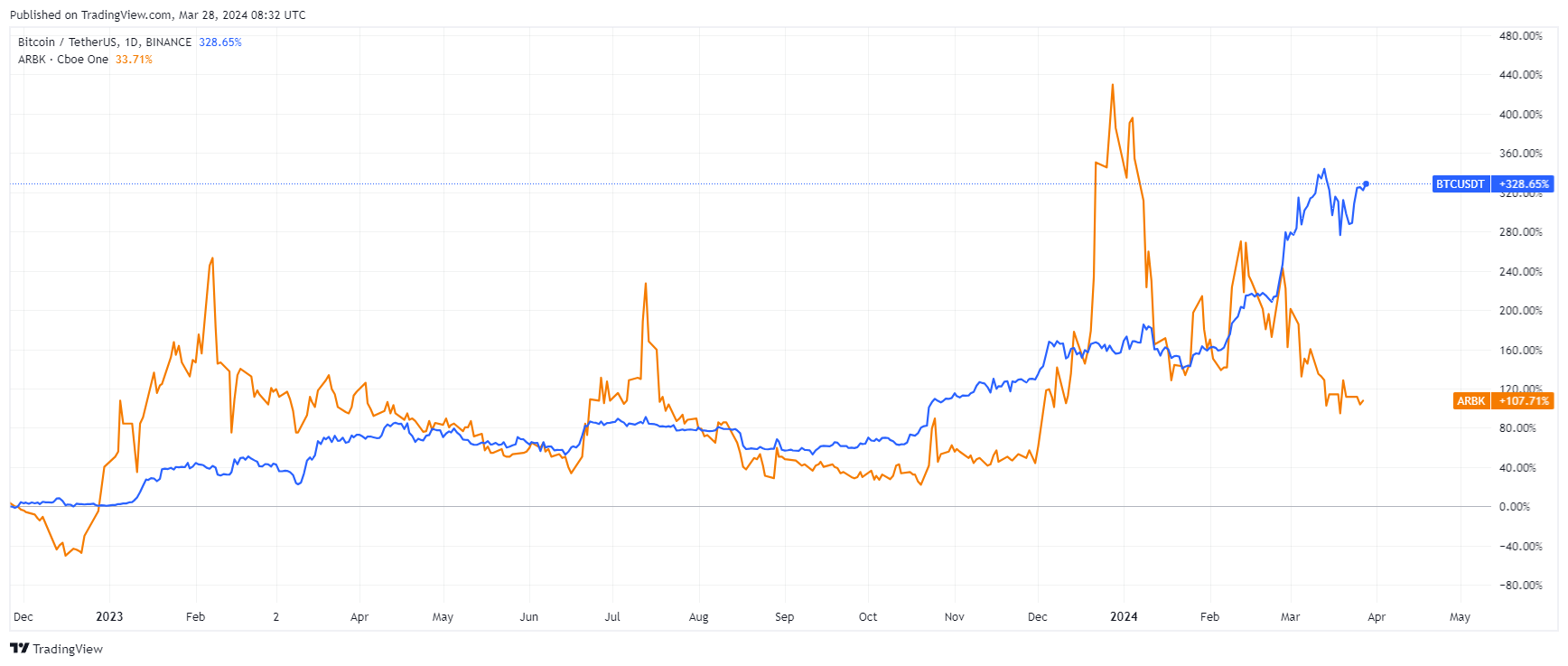

Although Bitcoin (BTC) has already gained nearly 70% in 2024, shares of Argo Blockchain, a cryptocurrency mining company publicly listed in London and the USA, are scraping the bottom, falling 55%.

The company's solution to some of its problems and shareholder discontent is selling its data center in Mirabel, Canada. The company's London branch (LSE: ARB) announced the finalization of this move on Thursday. At the same time, the miner issued over 460,000 new ordinary shares.

Argo Blockchain Closes Sale of Mirabel Data Center, Reduces Debt by $12.4M

The plan to sell a data center in the Quebec region was first announced almost two months ago. The transaction, which yielded a total consideration of $6.1 million, has enabled the company to reduce its debt and streamline its operations significantly.

The net proceeds from the sale were used to repay the Mirabel Facility's outstanding mortgage of $1.4 million, with the remainder being allocated to repay debt owed to Galaxy Digital Holdings, Ltd.

As of 28 March 2024, Argo's debt balance with Galaxy is $12.8 million, representing a reduction of 63% from the original balance of $35 million.

"The Company continues to execute on its strategy of strengthening the balance sheet and reducing non-mining operating expenses. The Company reduced its debt by $12.4 million in Q1 2024,” Thomas Chippas, the Chief Executive Officer at Argo, commented on the transaction.

In addition to the debt reduction, Argo has relocated and deployed mining machines from the Mirabel Facility to its facility in Baie Comeau, Quebec. This consolidation is expected to reduce the company's non-mining operating expenses by $0.7 million per year, allowing for more efficient use of the facility and onsite team. Argo Blockchain also announced the issuance of 460,477 new ordinary shares.

Bitcoin Winter Hits Argo

As mentioned at the very beginning, the price of Bitcoin is dynamically growing in 2024. Initially, Argo Blockchain's shares rose along with it, but weaker-than-expected BTC production in the first months of the year caused shareholders to lose confidence in the company. As a result, the cryptocurrency spring in the broad market turned into an extended winter for the digital asset miner.

In the meantime, Argo Blockchain underwent significant changes in its management ranks. Seif El-Bakly stepped down as Chief Operating Officer after serving as interim Chief Executive Officer from February to November 2023.

Whether we look at Argo's shares listed in London or the USA, the charts show the same picture: a decline of about 55% since the beginning of the year.

At the same time, Marathon Digital Holdings, the largest publicly traded cryptocurrency miner, is losing only 6%, and Phoenix Group is gaining around 2%.