Last week, the Wall Street Journal reported that the City of London Police was investigating a case of fraud related to the bankrupt broker, FX World Managed Account Ltd (FXWMA). A London Police spokesman declined to confirm the identity of the firm in question last night, but Finance Magnates' investigation into the case has uncovered details pertaining to the conduct of the man behind the seemingly high-scale business, Clint Canning.

According to various sources, including a string of directorate filings in the UK registrar as well as incriminating social media postings, it seems that Mr. Canning has embezzled millions from clients of his binary option brokerage.

Launched in the beginning of 2014, Base2Trade is based in London and registered in Anguilla, the British West Indies. The website presents a fast-paced trading environment, inviting clients to "take advantage today" of a "crazy June" offer.

However, when trying to open an account a message pops up informing that the company cannot accept UK-based clients. While this same message appears for viewers of several non-UK locations, few others were allowed to proceed with the process.

It would be justifiable to say that Base2Trade has completely ceased operations without notifying its clients

Trader websites such as Forex Peace Army and TradeComplaint are abundant with viewers' warnings against Base2Trade, which has apparently failed to enable withdrawals in several cases. While complaints of this sort are all too common and should be taken with a grain of salt, notwithstanding emanating from legitimate disputes and somewhat challenging to authenticate, according to two sources with substantial facts of the matter, Base2Trade has siphoned several million dollars from clients' funds.

Furthermore, in the last couple of weeks the head of the brokerage has taken flight, leaving both employees and service providers at a loss regarding their funds and salaries. Two industry sources familiar with the inner workings of Base2Trade have confirmed to Finance Magnates that the brokerage has ceased all operations due to its owner having fled the UK to Dubai, perhaps with the missing Client Money that has lead to the investigations.

The social media accounts of Base2Trade (Facebook and Twitter) also appear to have stopped updating with original posts from about December 2014. Except for automatic how-many-new-follower posts on Twitter, the only social media activity around the company are the many unanswered client complaints on its Facebook page, starting from June 11th.

It would seem accurate to say that the company's operations have completely ceased without any prior notification or explanation to its clients. Finance Magnates has tried contacting the team behind the site via phone, email and Skype, but the firm's representatives could not be reached.

FX World's Upcoming Legal Battle

Visitors described posh settings, including Bloomberg terminals

This story is closely linked with the now-dissolved operation of FXWorld.

To recap, the London-based firm has purported to provide an elite managed-accounts service, catering mainly to high net worth individuals. Sources who visited the premises described luxurious settings, including Bloomberg terminals on traders' desks. "1-2 million dollars worth clients were stepping in day in and day out," a person with knowledge of the matter told Finance Magnates.

FX World's air of a respected, high-scale business was reinforced by the recruitment of senior traders. These include former Rabobank's Senior FX Dealer, Gary Andrews and Ross Lawson, who have held various market positions, including a short stint at BGC Partners in 2012 as FX and Fixed Income brokers.

According to at least one individual, the firm offered clients fixed returns on their investments, an ominous sign echoing classic fraud tactics. Soliciting clients with such promises was the trigger of the high profile police raid and arrests of CWM Group's employees in March.

Wearing two hats. CEO Clint Canning.

Finance Magnates has reached out to executives at FX World about the investigation and the location of Clint Canning. However, they were not at liberty to talk about the matter as they are in the midst of their own legal battle with the company. Apparently, at least eleven FX traders have not been paid by the firm for their services.

The Linkage

Ms. Wallace presents herself as being both a Director of Base2Trade and Owner of FX World

Until very recently, Mr. Canning appeared simultaneously on his LinkedIn profile and on FX World's "Meet Our Team" page as the firm's CEO. On top of the confirmation from several sources, a look into Mr. Canning's LinkedIn profile, directorate history and Social Media accounts may shed light in his involvement with the binary option firm.

In April 2011, Mr. Canning was appointed as a Director of Panacea Clean Ltd, a bankrupt company where on his LinkedIn profile he is still listed as a Managing Director. The second listed director from the same time is Eleise Wallace, who according to her LinkedIn profile is the Managing Director at Panacea Inventory. The two were also concurrently directors at another liquidated firm, Invest Connect, until Ms. Wallace resigned in April 2011, possibly in favor of the new role at Panacea.

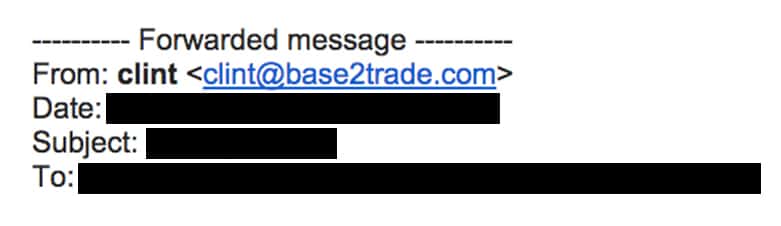

Neither Canning nor Wallace associate themselves with Base2Trade on their professional LinkedIn profiles nor appear as company Directors. However, Finance Magnates has obtained private emails from Mr. Canning, displaying his company's account.

Ms. Wallace's Facebook profile is also rather revealing, as a visitor to her relatively inactive page would discover that she is both a Director on Base2Trade and the owner of FX World.

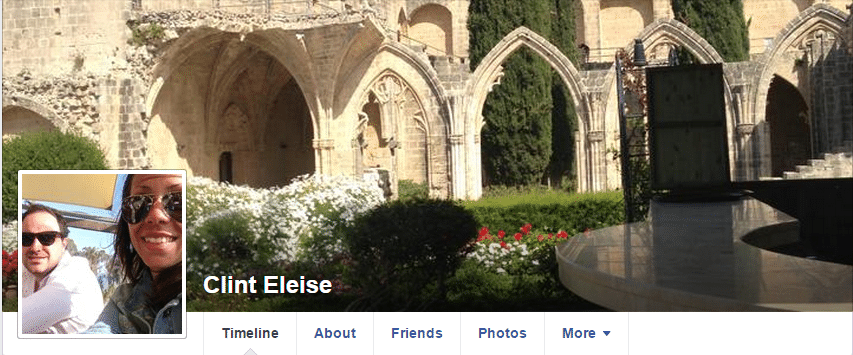

She is also featured in photos with a man remarkably similar to Clint Canning - bearing the name “Clint Eleiese.”

From the images she posted it seems she has just got married to Mr. Canning, a disclosure which may help put the pieces together, reinforcing sources' statements regarding his disappearance.

Finance Magnates has contacted Ms. Wallace, inquiring about the whereabouts of Mr. Canning, and will update if and when she responds.

We also spoke with the City of London Police about the Base2Trade case and the apparent evidence that Mr. Canning is residing in Dubai with his wife. A police officer has confirmed that the City of London Police are investigating a foreign Exchange company in relation to fraud and that no arrests have been made. She declined to discuss the matter further.

During our investigation of the story, we found some initial evidence of additional brokerages which may have been operated by Mr. Canning. Finance Magnates will keep you updated should new information surface.