Source: ICE

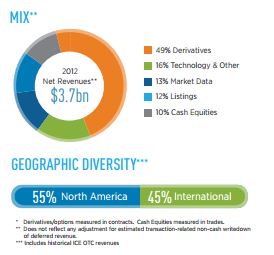

Dually headquartered in Atlanta and New York- IntercontinentalExchange Group, Inc. (NYSE: ICE), a leading global network of exchanges and clearing houses, today announced the successful completion of its previously announced acquisition of NYSE Euronext (NYSE: NYX). The value of the cash/stock transaction was estimated to be $11 billion and resulting in a combined market captilization of $23 billion for the group. The group operates exchanges and clearing houses across a diversified range of asset classes spanning interest rates, equities and equity derivatives, credit derivatives, bonds, foreign exchange, energy, metals and agricultural commodities.

ICE NYSE Euronext

With a combined market cap of $19 trillion of NYSE and Euronext listed shares, the acquisition of NYSE Euronext by IntercontinentalExchange was structured as a cash merger of listed companies that were successfully completed today, as shares of ICE (the parent company) began trading on the NYSE today, and thus reflecting the new ownership as wholly-owned subsidiaries under IntercontinentalExchange Group Inc. and the publicly-traded entity under the fitting ticker symbol "ICE".

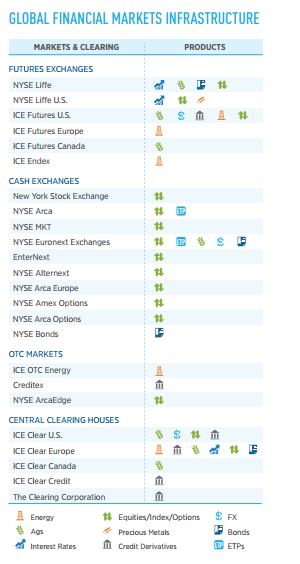

According to the official press release, the combined company (group) operates 16 global exchanges and five central clearing houses, and is on track to be the leader in global capital raising for the second consecutive year. ICE and NYSE Euronext businesses will continue to operate under their respective brand names.

Game-Changing Transactions

Jeffrey C. Sprecher, ICE Chairman and CEO

Commenting in the official corporate statement regarding the deal, ICE Chairman and CEO Jeffrey C. Sprecher said, "This is a game-changing transaction."

Mr. Sprecher further added in the statement, "ICE now leads in terms of the breadth and depth of services, best-in-class technology, and access to markets and capital. We have significant opportunities ahead both to grow and to make the business more efficient and competitive. Our team will continue to keep our customers front and center on everything we do, while bringing new products to market in real time. We look forward to unlocking value together both for customers and shareholders."

As the consolidation of these two major exchanges came together, following regulatory and anti-trust approval, the combined effect produces one of the largest operators of financial market centers globally.

Rise of Multi-Asset Trading as Exchanges Converge

When viewed comparatively, the transaction can also be symbolic of the convergence of commodity derivatives with equities and securities, in their proportion of investors' portfolios or market-related collective awareness, as multi-asset investing and multi-platform trading continue to consolidate asset classes into one place. Although both brands will continues to operate respectively (NYSE & ICE) as subsidiaries under the new group structure, it will be interesting to follow developments of any future cross-selling or cross-integrating products from the commodity futures and derivatives space to that of securities and exchange-traded equities.

Duncan L. Niederauer, ICE President and NYSE Group CEO

ICE President and NYSE Group CEO Duncan L. Niederauer, stated in the official press release regarding the transaction, "This is a great strategic fit for both companies. We now have a stronger and more diversified business model, which leverages the iconic NYSE Euronext brand, our leadership in listings, equity options and interest rate markets with ICE's attractive portfolio of markets, clearing houses and technology for the global derivatives markets."

As per the official announcement today, ICE intends to pursue an initial public offering of Euronext in 2014 to create a Continental Europe-based entity subject to market conditions and regulatory approvals. Together, Liffe and ICE's existing London-based exchange and clearing operations, ICE Futures Europe and ICE Clear Europe, will create the U.K.'s leading multi-asset class derivatives market, spanning interest rates, bonds, equity derivatives, energy, emissions and agricultural commodities.

With regards to its trade execution capabilities, and according to information on its corporate website, ICE transacts one-third of global cash trading, more than any exchange group globally, and host to more than 50% of the world’s traded crude and refined oil futures contract volumes and provides global benchmarks in interest rates, energy, agricultral, FX & equity indexes.

Foreign Exchange Segments

One of its many segments, foreign exchange offered through ICE Futures U.S., includes nearly 60 currency futures contracts offering cash-settled and delivery of foreign currencies for select pairs, according to information on its corporate website. Home to the U.S. Dollar Index, the most widely recognized benchmark for the value of the U.S. dollar, ICE U.S. Dollar Index (USDX) futures and options are the only publicly available, exchange-traded derivatives based on this index, offering traders Liquidity , multiple professional Market Makers , and substantial open interest. ICE Futures is the second largest futures exchange in the US, after the CME.

According to the press release, the new management team will be:

Source: ICE

IntercontinentalExchange Group

- Jeffrey C. Sprecher will serve as Chairman and CEO, IntercontinentalExchange Group, Inc. (ICE).

- Chuck Vice will serve as President and COO, ICE.

- Scott Hill will serve as CFO, ICE.

- David Goone will serve as Chief Strategy Officer, ICE.

- Jonathan Short will serve as General Counsel & Corporate Secretary, ICE.

- Edwin Marcial will serve as Chief Technology Officer, ICE.

- Mark Wassersug will serve as SVP, Operations, ICE.

- Kelly Loeffler will serve as SVP, Corporate Communications, Marketing, and Investor Relations, ICE.

- Mayur Kapani will serve as SVP, Derivatives Trading Systems Technology, ICE.

- Sunil Seshardi will serve as Chief Information Security Officer, ICE.

- Doug Foley will serve as SVP, HR & Administration, ICE.

- Martin Hunter will serve as SVP, Tax & Treasurer, ICE.

- Andrew Surdykowski will serve as SVP, Associate General Counsel & Assistant Corporate Secretary, ICE.

- Dean Mathison will serve as Chief Accounting Officer, ICE.

Source: Excerpt from "ICE at a Glance"

Exchanges

- Duncan L. Niederauer will be President, ICE and CEO, NYSE.

- Thomas W. Farley, currently SVP, Financial Markets at ICE, will become COO, NYSE.

- Scott Cutler will serve as EVP and Head of Global Listings, NYSE.

- Joseph Mecane will serve as EVP and Head of U.S. Equities, NYSE.

- David Peniket, currently President and COO, ICE Futures Europe, will continue in that position and will additionally serve as President and COO, NYSE Liffe subject to regulatory approval.

- Benjamin R. Jackson , currently President and COO, ICE Futures U.S., will continue in that position and will additionally serve as President, NYSE Technologies.

- Dominique Cerutti , currently Deputy CEO, NYSE Euronext, will serve as CEO of Euronext.

- Brad Vannan will serve as President and COO, ICE Futures Canada.

Clearing

- Chris Edmonds, currently President, ICE Clear Credit & TCC, will become Senior Vice President, Financial Markets, ICE.

- Stan Ivanov, currently Chief Risk Officer, ICE Clear Credit, will become President, ICE Clear Credit & TCC.

- Paul Swann will serve as President and Managing Director, ICE Clear Europe.

- Thomas Hammond will serve as President and COO, ICE Clear U.S.

ICE Benchmark Administration

- Finbarr Hutcheson will be President, ICE Benchmark Administration Limited.

- NYSE Euronext Rate Administration Limited (which will become the new administrator for LIBOR subject to FCA authorisation) will be renamed ICE Benchmark Administration Limited.

4 Board Members from NYSE Join Group Board, Now 14 Members Strong

The following four members of the NYSE Euronext Board of Directors have joined the Board of Directors of IntercontinentalExchange Group, Inc., which now has 14 members:

Sylvain Hefes, Jan-Michiel Hessels, James J. McNulty and Robert G. Scott.

Shares of ICE are up nearly seven-tenths of a percent as of around the time of publication, and trading just under $200 per share.