As another week draws to a close, our editors have chosen another selection of stories that have caught their imagination. With a variety of different interests at heart and recommended reading topics that range from the peculiar to the thought-provoking, each editor takes his turn to enlighten us.

The FM London Summit is almost here. Register today!

We start with Avi Mizrahi's recommended read of the week...

Small Enough to Jail

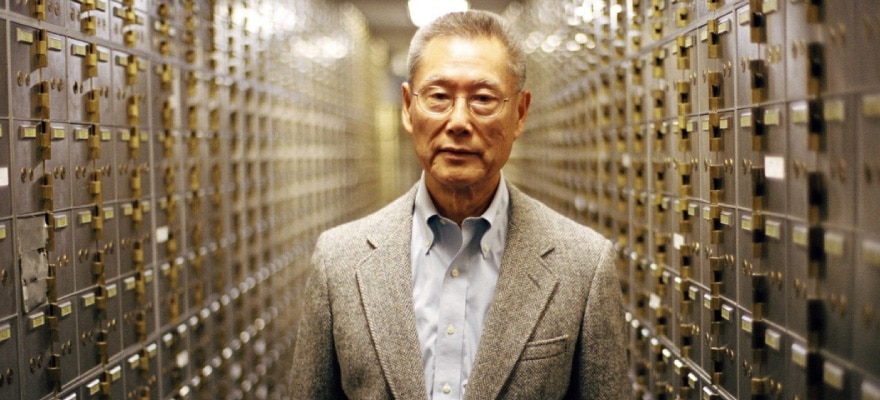

This week I will suggest you read “The Tiny Chinatown Bank That Was Scapegoated After the Financial Crisis” by Brandon Harris over at Vice.

Avi Mizrahi

Editor

These days it seems that Americans are bitterly divided over everything along a strict and binary political line. But one thing that all of them, and also many around the world, seem to agree on is how corrupt the American establishment has become.

This is the driving force behind the strong insurgent campaigns that would have seemed laughable just a few years ago, such as Bernie Sanders, Donald Trump and even Jill Stein.

The main cause of the public’s anger is the idea of ‘too big to fail’ and ‘too big to jail’, with the powers that be on Wall Street and Washington getting away with anything without any accountability.

As a result, the other side of the coin has been almost completely ignored – how the small businesses were forced to bear the brunt of financial regulations written by and for the big banks.

This is where the documentary movie that the article covers - “Abacus: Small Enough to Jail” - comes in. It is about a family bank that American authorities decided to make an example of.

Whether a defendant is guilty or not is up to the courts to decide, but the documentary shows that if you don’t have the right connections, the system will not protect you with the ridiculous arguments used for the big guys.

Where Will the Brexit Bankers Go?

Victor Golovtchenko

Senior Editor

A Bloomberg Markets feature sheds light on the numerous alternatives to London when it comes to big banks. With growing uncertainty over the terms of Brexit, the alternative spots to trade FX (pun intended) have grown in numbers and are now extending far beyond Paris and Dublin.

Cities like Amsterdam, Paris and even Warsaw could benefit from new banking jobs…but the question for them is rather, do they want the industry?

Looking at the prospects for a ‘hard Brexit’, the likelihood that banks will have to enact their fallout contingency plans has increased, however the strategy of the UK government has been put into question by the markets.

The British pound just had its worst week since the immediate post-Brexit fallout, a fall that was accompanied by a Flash Crash . With the purchasing power of middle and lower income families in the UK suffering the most, substantial inflation in the UK is lurking around the corner...

Creepy Clowns Yet to Be Seen in the City

I would like to recommend an article far from the financial or tech world which is funny and creepy. It seems like Britain has not been able to find any respite in any way recently. While we focus on the renewed GBP slump, reminding us of Brexit moment, strange things are happening on the streets.

Sylwester Majewski

Chief Analyst

As UK tabloid The Mirror informs its readers, a worrying series of creepy clown sightings is taking place in the UK. The trend first emerged in the US where such incidents have already been witnessed in more than 20 states. Masked figures lurking in the woods and attempting to lure children were first seen in August in South California.

Now it it has spread across the Atlantic and is gaining traction in the UK. As The Mirror states: "The activities reported range from simple sightings of 'clowns' frightening people in passing cars to more sinister incidents where the fancy dress figures have approached schoolchildren."

Back in the UK, it has not been proven that this phenomenon is in any way related to the Brexit or recent GBP weakness. One can, however, wonder how much time it will take until we will see clowns somewhere in the City.

By the way, did we solve the flash-crash mystery yet?

We conclude another week of stories that our editors are reading. Feel free to share your views in the comment section and any recommendations of your own. We look forward to hearing your opinions!

Check out our previous posts here:

Death and Taxes…and a $10 Billion Scandal

Multiplanetary Species and Climate Change

The Mass-Text Manhunt and Fixing the Blue Screen of Death

The Red Pill and the Encyclopedia Reader

A Less-Cash Society and a $10 Billion Scandal

Coffee, Genes and All The Rest

Taking a Little Trip and Trading’s Resemblence to Poker

The Perils of Low Interest Rates and Subprime Auto Loans

No Gold Medals for Waste, Corruption….or Smog

No Doubt The Most Brutal Fight Yet

Robots, Cyber Motives and a Trader’s Addiction

An Attractive Commodity and the Pyschology Behind the Far Right

Banking on Pokemon and a Philosophical Victory

A New Breed of Plutocrats and China’s New Weapon

Gold Standard After Brexit and a matter of National Identity

Genetically Edited Humans And Electronic Persons

Computerised Storytelling And Quantitative Easing Doldrums

Eyeing Up This Year’s Biggest Tech IPO And The Search For Quantum Questions

Financial Efficiencies And Inefficiencies

The Bank Robber And The Psychologist

Fly Me To The Moon….And Bremain In The EU

Brexit: Ice-Cream Magic Or An Artistic Defeat

Virtual Reality and the Dark Side of Shaming