Exchanges have always been a crucial component of civilised societies. During prehistory and early Antiquity, people used to barter to get what they wanted. Barter was really important in nomadic societies as it allowed people to trade goods they gathered during their travels and exchange them for other goods they could not get because of geographical or technical reasons. However, bartering showed its limits when people started to be sedentary. With the increase of sedentary population, a new way of trading had to be found.

Before the apparition of coins and other forms of money, specific objects were used to trade. These objects took many forms depending on civilisations or even towns but they cannot be considered as a “real currency”. Their problem was that they were not at all convenient as their value was only approximate.

The First Coin

Around 600BC, coins made of gold and silver were introduced in the Kingdom of Lydia. These coins are considered as the first “official” currency ever created. After that, many other civilisations started to use coins as money such as the Greeks and Romans. For instance, Romans used different sorts of coins made of gold, silver, bronze or copper. Each type of coin had more or less value than the other one, just as it is today.

Paper Note

Technological improvements really boosted Forex exchanges as, nowadays, anybody can trade currency

The paper note is not a European invention as many people would think. Indeed, the paper note was created in China under the Tang Dynasty (618AD – 907AD). It was mostly used by merchants and wholesalers as a proof of credit granted to the buyer. Transporting large amounts of coinage was indeed not very convenient for merchants due to its weight and because of thieves, so they had to find another way of doing business. Paper notes were popularized among common folks only during the 11th century though. Thanks to Marco Polo and his travels to Asia, the concept of the bank note was introduced to Europe.

Yet, the first bank note ever printed in Europe came out a few centuries after, in 1661AD, in Sweden. Paper notes were then very common among European countries as they were cheap and easy to produce compared to coins.

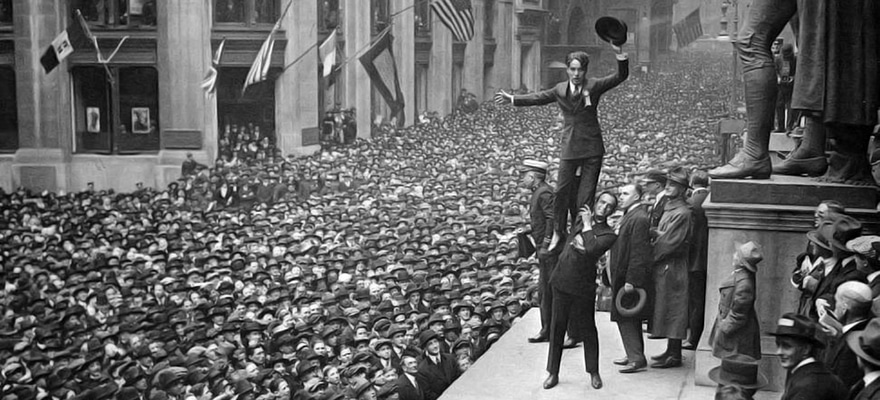

Amsterdam: The First Forex Capital

With the development of currency and the growth of the economy in Europe, the first forex market was created in Amsterdam during the 17th century. This city then became an important hub for traders. Currencies were bought and sold there and rates were set according to the imports and exports of currencies in the Netherlands.

The Gold Standard Monetary System

Investors would rather invest in countries where currency rate was lower – this is one of the reasons China artificially maintains its currency lower

Before the establishment of the Gold Standard Monetary System, currencies used to suffer from gold and silver variations. This means that if a gold mine was discovered or, the opposite, closed, currency value would decrease or increase as gold value would change as well. The Gold Standard System was created to fix this issue by granting a fixed value to gold. The problem was that countries needed a large amount of gold reserve in order to continue to print money. During the First World War, countries’ expenses were way higher than their actual gold reserve. This also happened during the Second World War: another way of regulating currency had to be found.

The Bretton Woods System

In 1946, a conference took place in Brettons Woods, New Hampshire. During this conference the Bretton Woods System was adopted. One of the key elements of this system is the use of the US dollar as reserve currency along gold. Countries could exchange their currency for US dollars. However, as it was more convenient for them, many countries started to exchange currency in US dollars rather than gold which made the US dollar way stronger. Investors would rather invest in countries where the currency rate was lower – this is one of the reasons why today China artificially maintains its currency lower than its actual value. Therefore, investors went to Europe and the United States had to put an end to the Bretton Woods System in 1973.

European Countries then came out with their own system called the European Monetary System (EMS), but the results were not exactly as expected. The EMS was the first step of what would later lead to the creation of a unique currency: the euro.

The Expansion of Forex Exchange and Free Markets

Technological improvements really boosted forex exchanges as, nowadays, anybody can trade currency: the only two things you need are a computer and a good knowledge in forex.

Technology also allowed the creation of Cryptocurrencies , which are basically virtual currencies that are not regulated by any governments. Bitcoin was the first cryptocurrency ever created, in 2009. Free markets attract more and more people nowadays, especially since Bitcoin has gained a lot of value in such a little time. Even if these types of currencies have many advantages, one should always be cautious before trading them.

Indeed, because these currencies are not regulated and vary in accordance with supply and demand, their value can drop on any day.

Throughout history, people have made a lot of progress when it comes to find new ways of trading. Over time, currency took many different forms – from simple coins to Bitcoin – and new ways of payment and trading will certainly be created in the future.