AliPay+ is creating seamless connections between Asian consumers and European businesses. Pietro Candela, General Manager of Europe at AliPay+, sat down with Finance Magnates and delved on the company's rapid advancements, ambitious future plans, and the overarching vision that drives their initiatives.

During AliPay+’s SME Heroes event in Gelsenkirchen, Germany, Candela reflected on the swift development of a new concept that AliPay+ executed with remarkable speed. This initiative, which targeted both existing and new user bases through promotions linked to soccer events, garnered immediate and significant attention, resulting in a notable increase in transactions. "We produced this concept very fast to be ready for the UEFA Euro 2024. We did a miracle because in a few months, we did what usually takes a year," Candela remarked, highlighting the company's ability to innovate under tight timelines.

The spotlight was also on SM owners based in Cologne and Dusseldorf who were able to share their experience of how inbound global tourism during the UEFA EURO 2024 has benefitted business owners in Germany.

AliPay+ is witnessing a substantial rise in transactions in Germany, driven by the return of Chinese travelers and the surge of international football fans for UEFA EURO 2024.

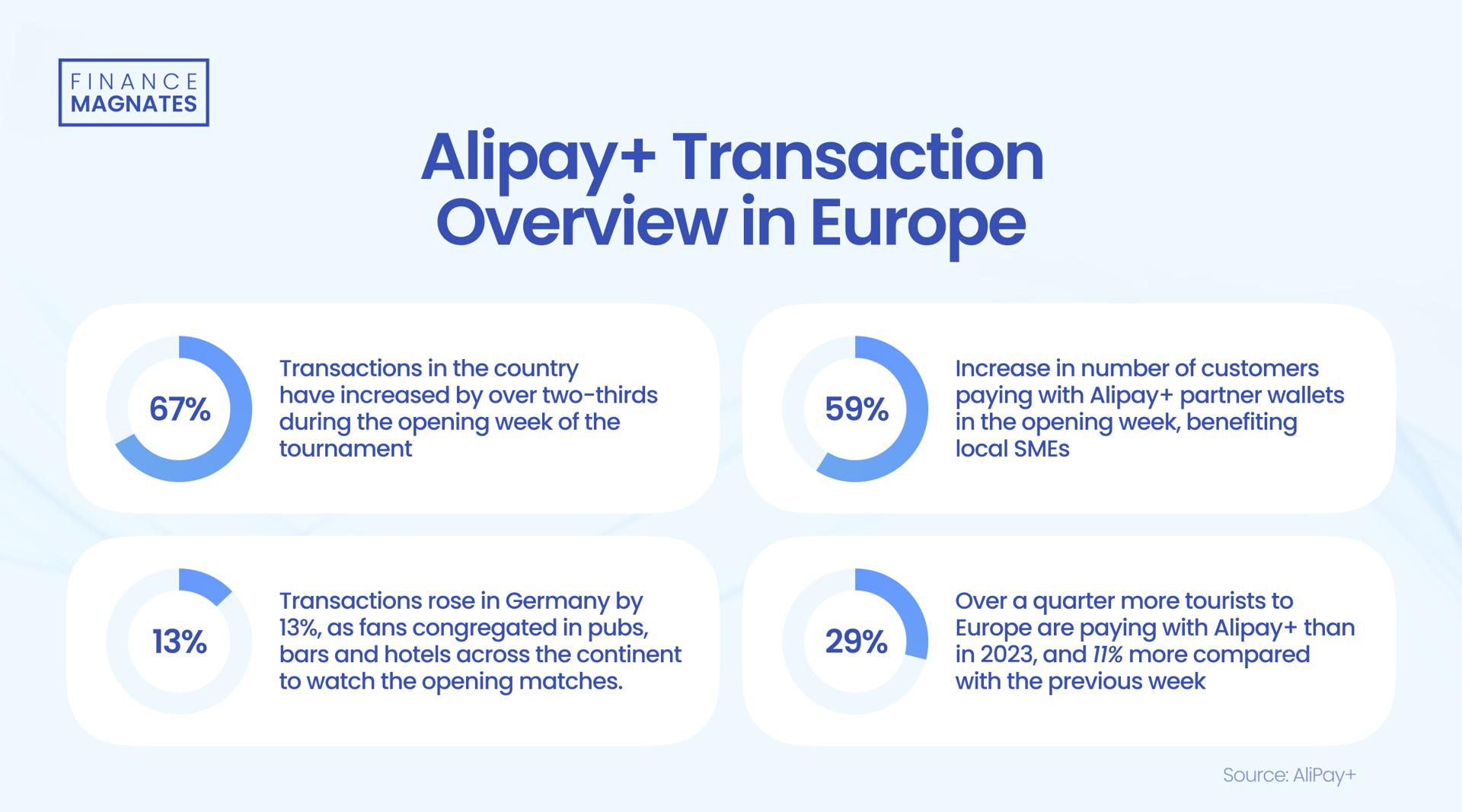

The company's vast user base, encompassing 1.5 billion users globally, underscores its expansive reach. During the opening week of the tournament alone, transactions in Germany increased by over two-thirds (67%), and the number of customers paying with AliPay+ partner wallets rose by 59% WoW.

This spike was reportedly driven by fans congregating across the continent to watch the matches, leading to a 13% increase in overall European AliPay+ transactions (WoW). "The numbers we are seeing in Germany are beautiful, pushed by the return of Chinese travelers and people we invited from our wallet user base," Candela explained. This resurgence is not just about regaining lost ground but forging ahead to new heights of connectivity and service integration.

AliPay+ aims to bridge Asian consumers with European businesses, facilitating global tourism and commerce through their app.

This initiative enhances the travel experience by offering services like booking taxis, paying for transportation, and accessing promotions. The company is advancing its super app concept in Europe, starting with transportation and ticketing services. "We are creating a convenient environment for our partners to grow," Candela noted, signaling the beginning of a new phase in digital convenience and connectivity.

This approach has been well-received by local businesses but it seems that AliPay+ won't stop there. Candela expressed excitement about upcoming launches, emphasizing the potential for AliPay+ to set new benchmarks in digital services. "The babies are finally crying and the mother is not pregnant anymore," he said with a touch of humor, encapsulating the anticipation and readiness for the next big step.

AliPay+ leverages a dual strategy that respects regional specificities.

Candela emphasized AliPay+'s strategy of creating a connected world for mobile app users, offering seamless payment and additional services such as promotions and privileges. This approach is particularly focused on markets with high tourist numbers, notably in Europe and the Middle East. "We want to stay global but also local. Compliance is definitely local, so we have local compliance teams," he elucidated, pointing out the delicate balance between global ambitions and local realities.

The vision of AliPay+ includes leveraging its global brand while tailoring solutions to fit local markets. Compliance and privacy are managed locally, with technology solutions that can be globally deployed but adapted to meet local needs. This strategy is particularly significant in Europe, where market dynamics differ substantially from Asia. "We need to understand how our product can fit locally and adjust it based on local economy requirements," Candela asserted, highlighting the nuanced approach necessary for diverse markets.

This is crucial in a market like Europe, which differs vastly from Asia in terms of population density, economic development, and consumer behavior. "We are enthusiastic about this because after COVID, we concentrated on online due to the lack of travel, and now we are expanding once again," Candela added, reflecting on the resilience and adaptability of the company.

AliPay+'s role in the broader financial ecosystem is not confined to payments alone.

According to Candela, as AliPay+ continues to grow and evolve, it remains committed to creating value for both merchants and consumers. "We try to position in the middle, providing a solution that handles the transaction and the wider shopping experience," he noted, illustrating the company's holistic approach. This commitment is reflected in their strategic partnerships and innovative solutions that cater to a global audience while respecting local nuances. "Our goal is to connect the business from the West to the consumer of the East and vice versa," Candela emphasized, underscoring the company's mission to bridge global commerce through digital innovation.

AliPay+ is redefining global commerce by creating an interconnected world where seamless transactions and enriched experiences are the norm. Candela’s insights reveal a company dedicated to growth, adaptation, and providing unparalleled value to both merchants and consumers in an increasingly interconnected world, reflecting a broader trend in the digital economy: the convergence of global connectivity with local specificity.

And as the world continues to embrace digitalization, AliPay+ seems primed for driving a new era of global commerce that bridges East and West.