Japan's recent introduction of high-tech banknotes featuring advanced hologram portraits is more than a measure against counterfeiting; it is a strategic move aimed at maintaining public confidence in the yen during a period of economic uncertainty. This initiative, announced by Prime Minister Fumio Kishida, aligns with Japan's broader efforts to navigate economic challenges, including the weakening yen and inflationary pressures.

Why is Japan Introducing High-Tech Banknotes Now?

Japan is introducing high-tech banknotes as part of a comprehensive strategy to enhance currency security, maintain public confidence, and support economic stability. The advanced hologram technology represents a significant leap in anti-counterfeiting measures, ensuring that physical currency remains a trusted and secure medium of exchange. This move also aligns with the government's broader efforts to modernize the economy and navigate the complexities of a digital financial landscape.

Economic Context: The Weakened Yen

The introduction of these high-tech banknotes comes at a critical time for the Japanese economy. Experiencing significant depreciation, there are several factors causing the weak yen:

- Monetary Policy: The Bank of Japan's ultra-loose monetary policy, designed to stimulate economic growth, has kept interest rates exceptionally low. This makes the yen less attractive to investors compared to currencies with higher returns.

- Economic Performance: Japan's economic recovery, though positive, has not kept pace with global peers, affecting investor confidence and the yen's value.

- Global Influences: Geopolitical tensions and shifts in the global economy have led investors to seek safer or higher-yielding assets, further weakening the yen.

The depreciation of the yen impacts Japan's economy by increasing the cost of imports, thereby exacerbating inflation and putting pressure on consumer spending and business costs.

Strengthening Public Confidence

In this context, the new banknotes play a crucial role in maintaining confidence in the yen. While digital transactions are on the rise, cash remains a significant part of the Japanese economy. The high-tech features of the new banknotes ensure that physical currency remains secure and trusted.

Enhancing the security of physical currency helps reassure the public and businesses that the yen remains a reliable store of value. This is particularly important in a time of economic uncertainty, where trust in the financial system can be easily shaken.

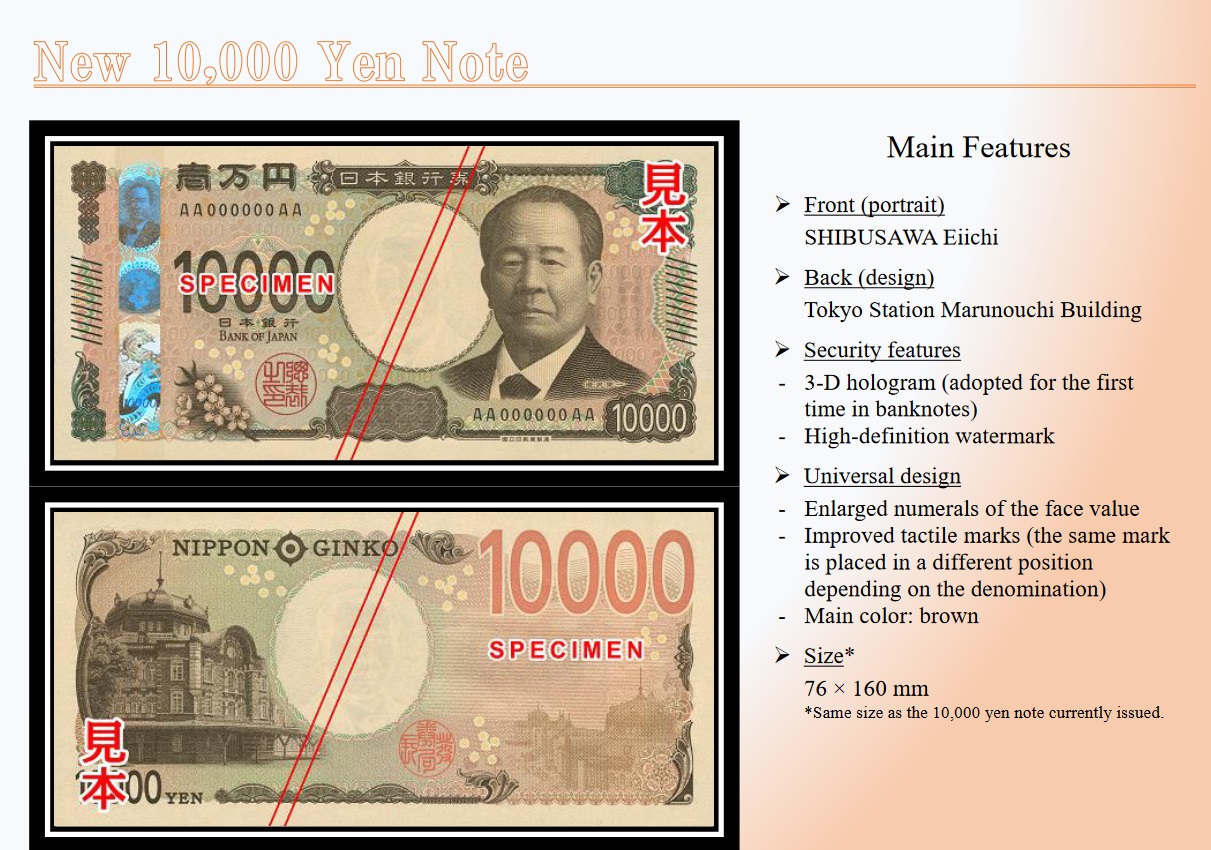

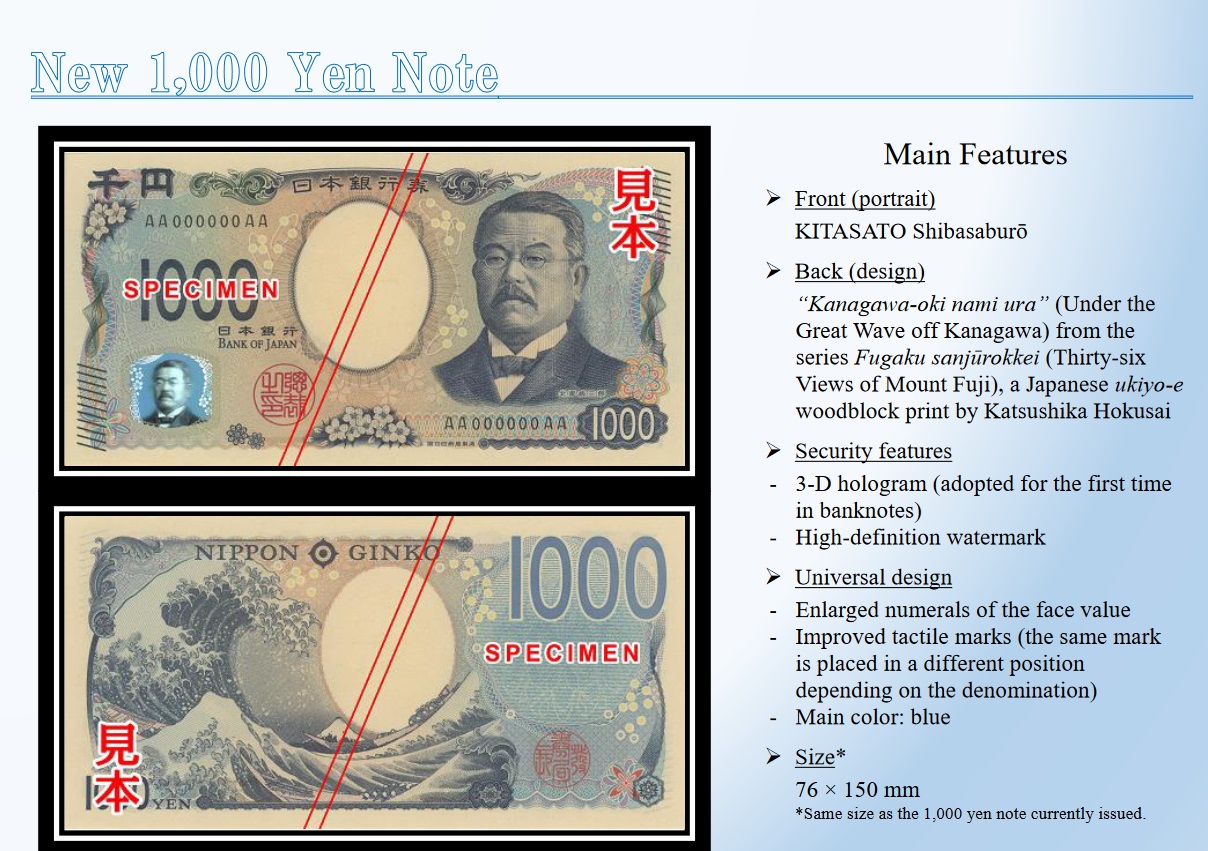

A Technological Leap in Currency Security

The new banknotes, the first redesign in two decades, incorporate three-dimensional hologram portraits of notable historical figures such as Eiichi Shibusawa, Umeko Tsuda, and Shibasaburo Kitasato. These figures symbolize Japan's dedication to capitalism, women's empowerment, and scientific innovation. The advanced security features are intended to make counterfeiting nearly impossible, thus preserving the integrity of Japan's physical currency.

Prime Minister Kishida highlighted the importance of these notes, aligning their release with Japan's economic recovery efforts after decades of stagnation. By enhancing the security of its currency, Japan aims to bolster public trust in the yen, even as it promotes a shift towards digital transactions.

How Do the New Banknotes Help in Combating Counterfeiting?

These new banknotes employ cutting-edge holographic technology to generate three-dimensional portraits that change depending on the viewing angle. They employ technology, described as a world-first for paper money, is designed to thwart counterfeiters by making it extremely difficult to replicate the intricate patterns and holograms.

Japan remains predominantly cash-based due to several cultural and practical reasons such as cultural preference, technological gaps, or an aging population. As such, the National Printing Bureau of Japan has emphasized that these bills' security features will help maintain the integrity of the nation's currency, which is crucial for sustaining public trust and economic stability

Conclusion

Japan's introduction of high-tech bills amid a push towards a cashless society symbolizes a nuanced strategy to reinforce trust in its currency during turbulent economic times. This move should not be viewed in isolation but as part of a broader narrative of how nations adapt to the dual demands of technological advancement and economic stability. By enhancing the physical security of the yen, Japan addresses immediate concerns of counterfeiting and public trust. Simultaneously, the drive towards digital payments represents a forward-looking vision of economic efficiency and global competitiveness.

The juxtaposition of with digital payment initiatives also reflects Japan's unique socio-economic fabric, where traditional practices coexist with cutting-edge innovation. This dual approach can serve as a model for other economies grappling with similar challenges. It underscores a fundamental principle in modern economics: the need to balance innovation with reliability, and technological progress with cultural and practical realities. As Japan navigates its economic recovery, its strategies offer valuable insights into how other nations might fortify their financial systems against both present uncertainties and future disruptions.