Barely a month after launching its app for iOS on iTunes app store, FinanceSwipe is one of the latest to compete for the growing share of the mobile market which is expected to continue to lure new users as Fintech pushes the ease of client use on devices with limited screen space which are becoming increasingly more user-friendly.

The idea behind FinanceSwipe’s design is not something new but rather inspired by the popular dating app Tinder, in which users swipe right to indicate interest in another person, and swipe left to pass to the next prospective match.

"The product is a minimal viable product and we plan on continuing to add new features."

Tinder-Like Theme

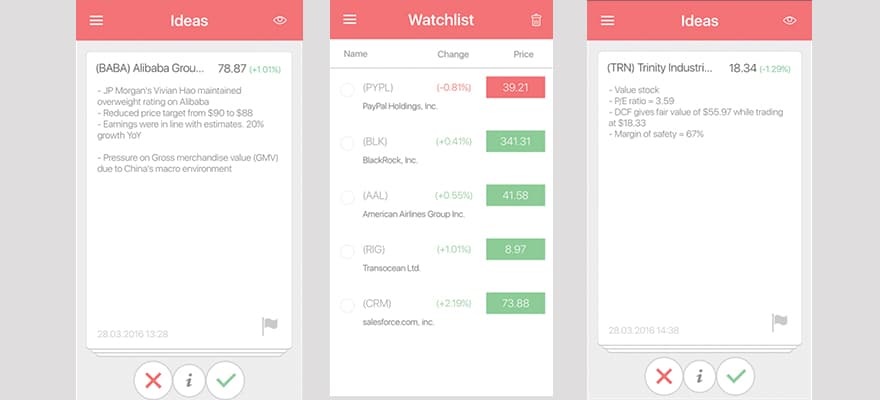

FinanceSwipe uses trading ideas, instead of potential mates, and users of the app are presented with a stream of these ideas, in which each idea must be dealt with – either by swiping left to discard it or swiping right to add it to a watchlist – before the next idea is displayed.

Other companies have applied this approach to various industries, such as retail shopping, and job searches. For example, Switch raised $2 million in seed funding for its app that helps users swipe through different job offerings, and Mallzee raised £2.5 million in funding for its mall themed, shopping inspired app.

Source: FinanceSwipe

Bootstrapped Startup

Finance Magnates spoke with the company’s CEO and founder Aamir Chaudry who is literally running the bootstrapped company single-handedly after taking a loan from his friends, leading to the app's successful addition to the app store at the end of February, and official launch on March 22nd this year, after starting the company last August.

Mr. Chaudry studied accounting and finance and currently holds a position with Deloitte, and after a brief stint as an intern at Barclay’s for barely a week, he also traded stocks and equity index derivatives including options for two years starting in 2011.

When I asked how he did it alone, and what programming skills he had, he explained that his expertise was in Wordpress and not software development per se, and how he was able to create the application by interviewing a large number of freelancers before finding the right people for the job.

Aamir Chaudry

Source: LinkedIn

This type of approach to building a company has become increasingly common in the startup world by digital nomads for many years already and so was applicable to FinTech just as well.

Mr. Chaudry said during the interview: "FinanceSwipe is the perfect tool for discovering new ideas. The swiping feature allows you to quickly view many ideas. The product is a minimal viable product and we plan on continuing to add new features. In the short term, this includes a hashtag search feature and ability to read more information on each idea presented. We have every intention to expand into more asset classes (e.g. Commodities) and devices (e.g. Android), over the short-to-medium term."

App Review

During the call, I was able to install the app on my iPad even though it was the iPhone version of the app, and was impressed with the number of functions available already for such a new company and product, and considering that Aamir is running a one-man operation, not taking into consideration any outside contractors the company uses.

He is, however, looking for a partner and to offer an equity stake, preferably someone with coding expertise in languages like objective C, as it would be hard to scale the company by himself by using only freelancers.

The team will be built out in the future after the company raises capital, while for now, the company is lean and will be continued as is while Mr. Chaudry hopes to set up office at London's Level 39 Technology Accelerator in One Canada Square - in Canary Wharf- just across from the Starbucks 'coffice' where he was sitting as we conducted the interview. For now, his FinTech operation is that of a digital nomad, roaming about within the confines of internet connectivity, as is enjoyed by remote workers which represent a growing number of the digital workforce globally.

Trading Ideas

FinanceSwipe displays a trading idea regarding a specific stock or trading instrument or asset class, and then compiles a list of bullet points regarding the prospects for the security, such as collating analysts' opinions and recent news such as earnings, and technical related chart analysis.

After reviewing the app I was able to ask Mr. Chaudry more about the flow of content within the various parts of the app, after I had already 'liked' a few ideas by swiping right when I was presented with them.

The ideas are created manually by sourcing information from various third parties and adding it in one place for users to swipe through for the next idea. Eventually, Mr. Chaudry hopes to add the capability for clients to trade directly with a broker, such as initiating an order when a user swipes right.

Monetization Pathways

With regard to how the company plans to monetize its business model, Mr. Chaudry explained that a premium subscription could be added in the future, for a monthly fee. He also said that an advertisement model could be added, as well as a potential affiliate marketing agreement with brokers – where any successful client conversions would result in remuneration for FinanceSwipe.

However, considering how new the company is and its recent app launch, Mr. Chaudry explained that he is not looking at the monetization options any time soon, as he focuses on building up the product.

Future plans

Even though the product may be far away from competing with firms like Stocktwits, or other social-network styled trading apps, FinanceSwipe is planning to add a social element to the app. Now, more than ever, FinTech solutions are enabling entrepreneurs to start up businesses from places such as within a Starbucks and with limited resources. Companies can overcome that startup bootstrap phase and attract seed capital, and use funding when the business is ready for commercialization.

FinanceSwipe currently has a pool of nearly 100 trading ideas that it is actively updating and reviewing, with price data from Yahoo Finance, and is planning on launching an Android app within six months.

For now, after launching the app officially at the end of March, the company had 180 users around the time of the interview earlier last week with Finance Magnates, and was expecting a list of changes to be added to the next updates to the app.