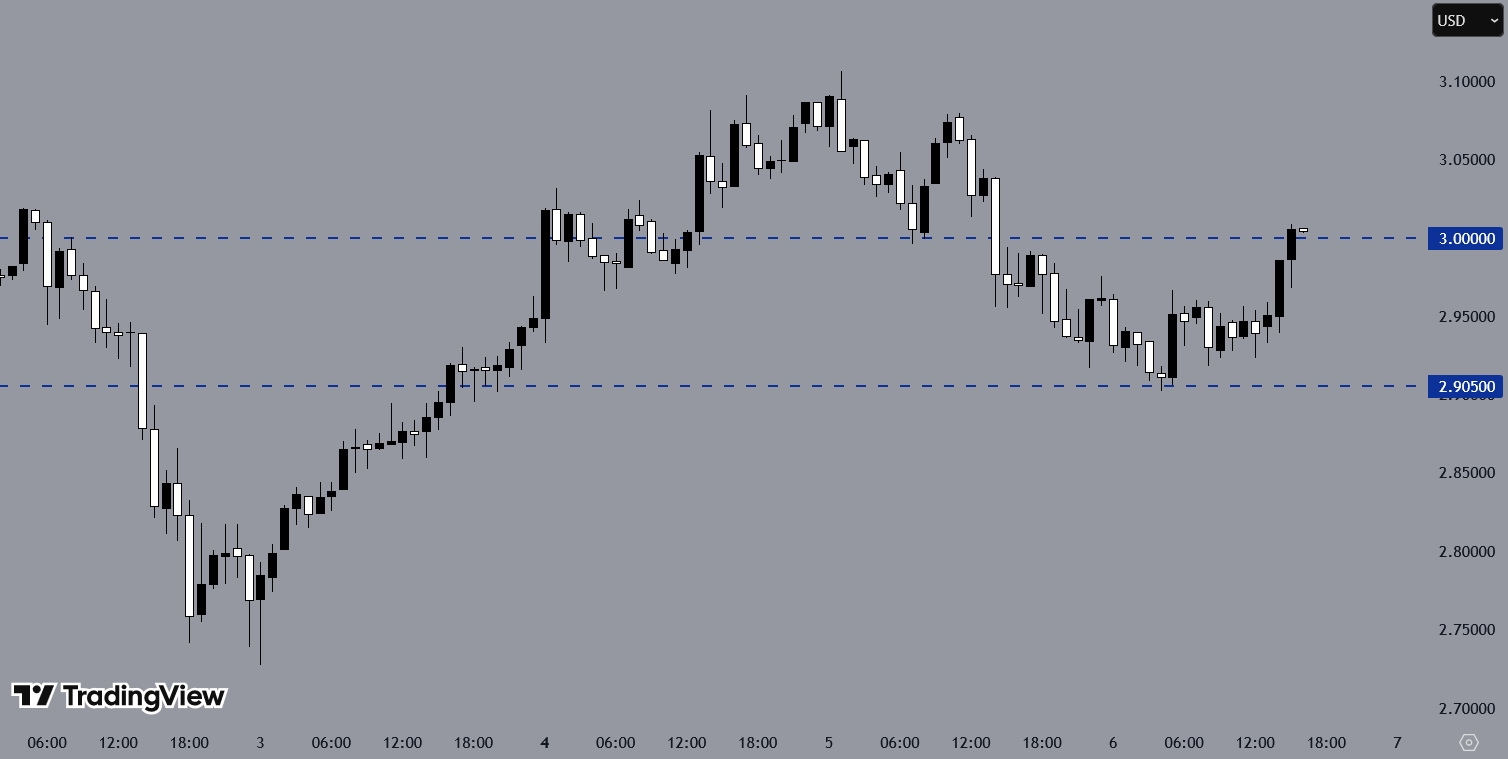

XRPUSD has found intraday support and is again trading around the $3 level. Market participants are watching to see how the price behaves around this point, as it may influence short-term direction.

Meanwhile, SBI Holdings has announced plans to list Japan’s first exchange-traded fund tied to both Bitcoin and XRP. The proposed ETF would trade on the Tokyo Stock Exchange and provide institutional investors with regulated exposure to these digital assets.

Japan Eyes New Crypto ETF Rules

SBI also introduced plans for a second product, the Digital Gold Crypto ETF, which would allocate 51 percent to gold and 49 percent to crypto assets. This structure is designed to reduce investment risk through diversification.

The announcement comes as Japan’s Financial Services Agency is considering changes to how crypto assets are regulated, which could ease the approval and tax processes for such financial products.

Analysts Offer Varied Projections for XRP’s Future Value

Analyst Zack Rector forecasts that XRP could reach $5 in the near term and potentially $15 by September. This would represent an increase of approximately 360% from the current $3 level, a notable but not uncommon movement in cryptocurrency markets. Such projections are approached with caution due to market volatility.

James Crypto Space suggests that if XRP follows a modified version of the 2017 fractal pattern, it could reach $9 by early September. He highlights XRP’s history of sharp price rises within four to five weeks after breaking key resistance levels, based on previous market cycles.

DeepSeek AI estimates that XRP may trade between $3.50 and $5.00 by the end of 2025. This forecast is based on a 70% likelihood of a favorable legal outcome for Ripple, which could support investor confidence and institutional adoption. Broader market conditions, including Bitcoin’s performance, are also considered factors affecting XRP’s price outlook.