After years of speculation, Ripple has confirmed that it will not go public in 2025. The company behind XRP has opted for a different path. In an interview with CNBC, Ripple’s President, Monica Long, explained that an IPO is not part of the company’s plans. She noted that Ripple is financially strong, holding billions in cash.

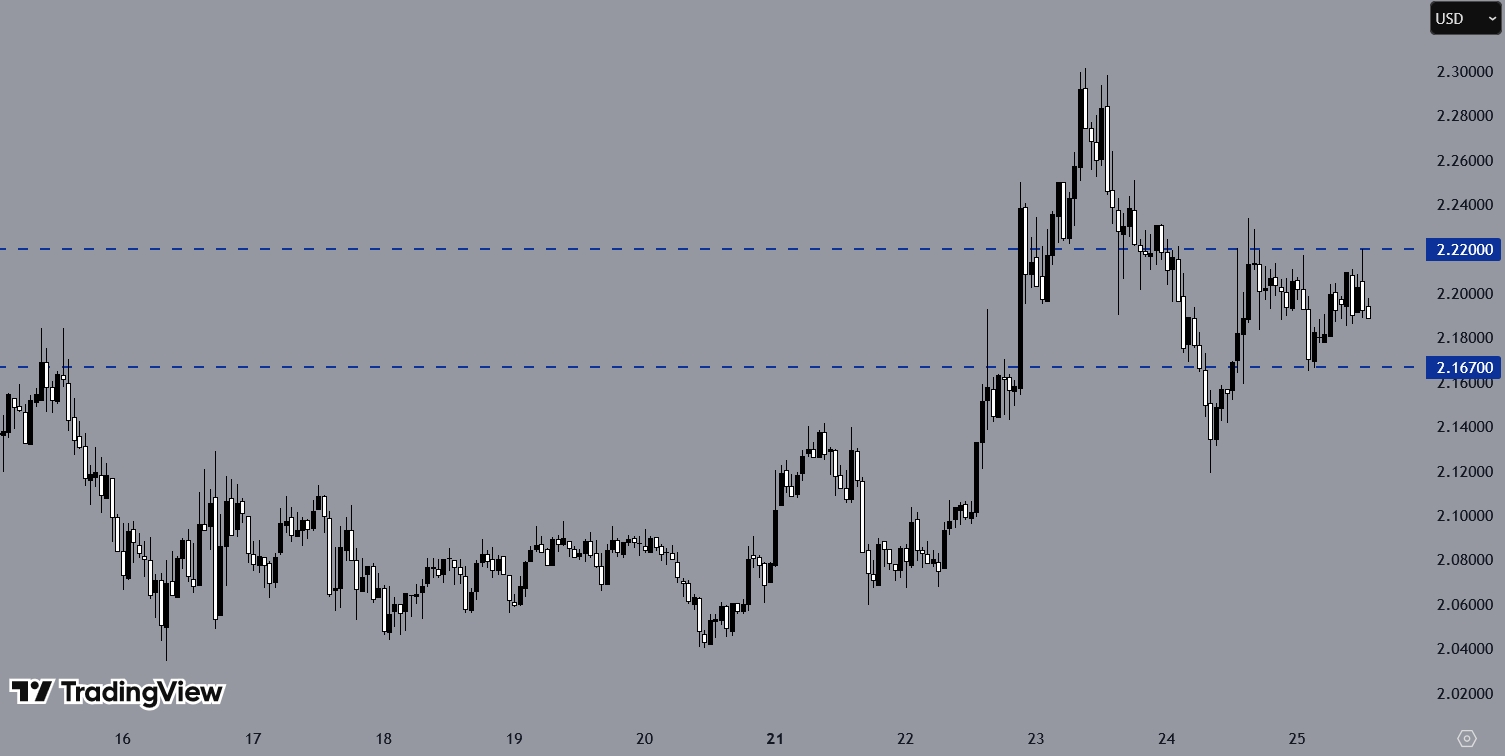

Meanwhile, the XRPUSD H1 chart indicates that the price is stuck within a horizontal range. Traders should wait for a breakout to determine the next direction.

The IPO Talk Has Been Around for Years

Long stated that companies typically go public to raise capital or increase visibility, but Ripple does not need either at this stage, as reported by Coinpedia. CEO Brad Garlinghouse supported this view, confirming that Ripple does not seek outside funding or plan to become a publicly traded company in the near future.

The possibility of Ripple going public has been discussed for several years. In 2022, Garlinghouse indicated that an IPO would be considered once Ripple’s legal issues with the SEC were resolved. Following the legal resolution in late 2023, Garlinghouse reiterated that going public is not a priority for Ripple.

Trades Within Narrow Intraday Range

The XRPUSD H1 chart shows that the cryptocurrency faced rejection near 2.22000 and found support around 2.16700. At the time of writing, the price is moving back toward the lower boundary of the range. However, without a clear breakout above resistance or below support, intraday traders may find it difficult to identify setups with favourable risk-to-reward ratios.

You may find it interesting at FinanceMagnates.com: Ripple Secures First DFSA Blockchain Payments License in Dubai Push.

Ripple’s Valuation Has Shifted

Earlier this year, Ripple repurchased shares at a valuation of $11.3 billion, down from $15 billion in 2022. The share buyback raised $285 million, increasing Ripple’s total funding to $318.5 million.

Ripple’s investors include high-profile names such as Andreessen Horowitz, Google Ventures, and Founders Fund, signalling ongoing confidence in the company.

Ripple Grows Global Presence via Partnerships

Ripple recently announced the acquisition of Hidden Road for $1.25 billion. The deal is among the largest in the digital asset sector. With this move, Ripple becomes the first crypto firm to own and operate a global, multi-asset prime broker. Hidden Road provides services in clearing, prime brokerage, and financing across asset classes, including foreign exchange, digital assets, derivatives, swaps, and fixed income.

Ripple has also expanded its network through new partnerships. The company is working with Revolut and Zero Hash to strengthen its position in the stablecoin space alongside USDT and USDC. In Portugal, it has partnered with Unicâmbio to enable real-time payments between Portugal and Brazil using digital assets.

In South Korea, BDACS will use Ripple Custody to store XRP and RLUSD. Ripple expects Japanese banks to begin using the XRP Ledger for cross-border transactions by 2025. The company is also collaborating with Chainlink to integrate RLUSD into Ethereum-based DeFi platforms.