Ripple has applied for a national trust charter from the U.S. Office of the Comptroller of the Currency (OCC), a move that would allow the crypto firm to expand its services across the country under federal regulation.

The application, confirmed by a company spokesperson, marks a strategic shift toward deeper regulatory engagement at the national level.

“True to our long-standing compliance roots, Ripple is applying for a national bank charter from the OCC. If approved, we would have both state (via NYDFS) and federal oversight, a new (and unique!) benchmark for trust in the stablecoin market,” Brad Garlinghouse, Ripple’s CEO, said.

XRP News: Industry Trend Toward Federal Regulation

The decision aligns Ripple with a growing list of crypto firms seeking national oversight amid evolving U.S. legislation. Stablecoin issuer Circle has submitted a similar application in recent months, highlighting a broader industry trend toward establishing federal licenses to streamline compliance and service delivery.

Ripple currently offers a $470 million stablecoin, RLUSD, which is regulated by the New York Department of Financial Services. The company also provides digital asset custody services. A national banking license would enable it to consolidate and scale these operations across state borders, eliminating the need for multiple state-level approvals.

Related: XRP News: Token Extends Losses Despite Whale Transfers and Easing Geopolitical Tensions

Interestingly, Circle has also applied to establish a national trust bank in the United States, marking its first major regulatory move since going public in an IPO that valued the company at nearly $18 billion. The application was submitted to the Office of the Comptroller of the Currency (OCC), the same regulator approached by Ripple for a similar license.

If approved, the charter would allow Circle to act as a custodian for its own stablecoin reserves and manage digital assets on behalf of institutional clients. The license does not, however, authorize the company to accept traditional cash deposits or extend credit like a conventional bank.

XRP Analysis Market Reacts to Regulatory News

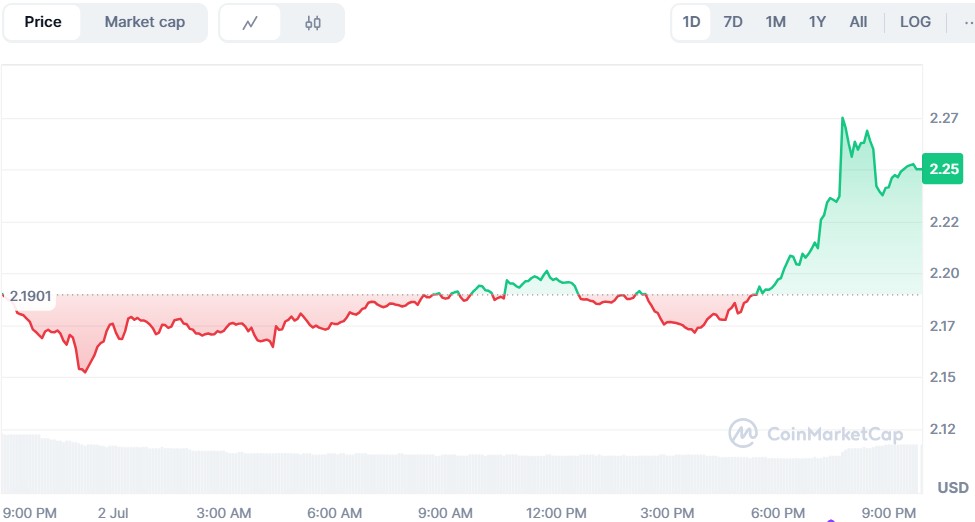

The market responded swiftly to the news, with XRP rising 5% following the report. The price move underscores investor optimism around Ripple’s regulatory progress, especially as lawmakers and agencies in Washington advance discussions on stablecoin and crypto legislation.

Precedent Set by Anchorage Digital

Ripple’s application mirrors the approach taken by Anchorage Digital, which already holds a federal banking charter and provides crypto custody services.

As the regulatory landscape continues to shift, more digital asset firms are expected to seek federal trust charters to gain long-term legal certainty and better access to traditional financial infrastructure.

Ripple has not yet disclosed a timeline for the OCC’s review or approval of its application. However, the move signals a growing acceptance among crypto companies that integration with federal regulators may be key to operating at scale in the U.S. financial system.