Cardano founder Charles Hoskinson recently shared a post on X by well-known trader Peter Brandt. In the post, Brandt extended an olive branch to the XRP community, signaling a potential end to current disputes.

Hoskinson Highlights Peace Offer to XRP

Brandt addressed the XRP army, offering peace and a farewell message regarding the XRP token. He included an image of an olive branch, symbolizing his gesture.

Hoskinson, who has had previous confrontations with the XRP community, commented on the post. He stated: “Peter's coming around to XRP Nation,” indicating acknowledgment of Brandt’s gesture. The response from the XRP community remains to be seen.

Brandt Analyzes XRP Breakout, No Holdings

Recently, Brandt acknowledged XRP's notable 10% surge, a shift from his earlier critical stance on the token in 2020. He now highlights a symmetrical triangle pattern in the XRP/USD pair, suggesting a potential breakout.

Despite this analysis, Brandt clarified that he does not hold XRP, preferring BTC and Solana. This shift underscores how quickly opinions can change in the crypto space. While XRP is gaining attention, the outlook remains mixed.

XRPUSD Shows Bullish Momentum After Intraday Support

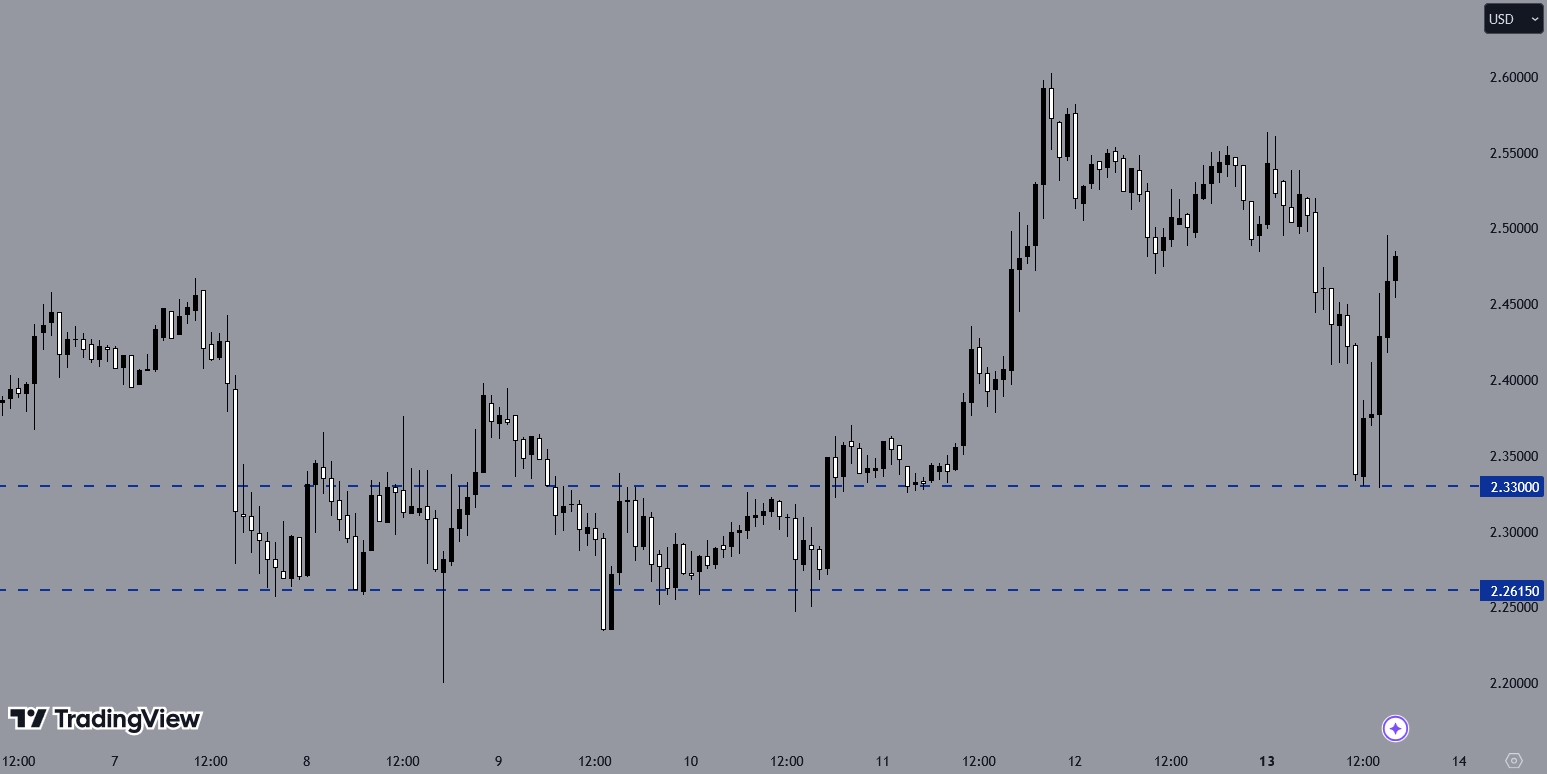

Meanwhile, XRPUSD has experienced a mixed day. It made a bearish move earlier but appears to have found intraday support at 2.33000. The H1 chart shows a bullish inside bar followed by a bullish engulfing candle, and since then, the price has been moving north with good momentum. Earlier, the price saw several bounces on the H1 chart around the 2.26150 level.

Ripple Gains Attention with Key Developments in 2025

Ripple, the company behind XRP, has recently attracted attention due to several significant developments. CEO Garlinghouse and Chief Legal Officer Stuart Alderoty attended a private dinner with President-elect Donald Trump on January 6. Garlinghouse described the meeting on social media as a positive start to 2025.

The meeting has fuelled speculation about Ripple's ongoing legal dispute with the US Securities and Exchange Commission (SEC), which filed a lawsuit against the company in December 2020. The SEC alleges that Ripple sold XRP tokens as unregistered securities. The outcome of this case could have major implications for the regulation of digital assets in the United States.

In another development, all banks in Japan are set to adopt Ripple’s XRP Ledger in 2025. This integration, announced by SBI CEO Yoshitaka Kitao, aims to enhance cross-border payments and currency conversions, offering a more efficient and cost-effective solution for international remittances.

Ripple has also made advancements in decentralized finance (DeFi) through its partnership with Chainlink. This collaboration, launched on the Ethereum blockchain , integrates Ripple's RLUSD stablecoin with DeFi applications, such as trading and lending. The RLUSD, pegged to the US dollar, was introduced on both the Ethereum and XRP Ledger networks last month, with a market capitalization of $72 million, according to CoinGecko.