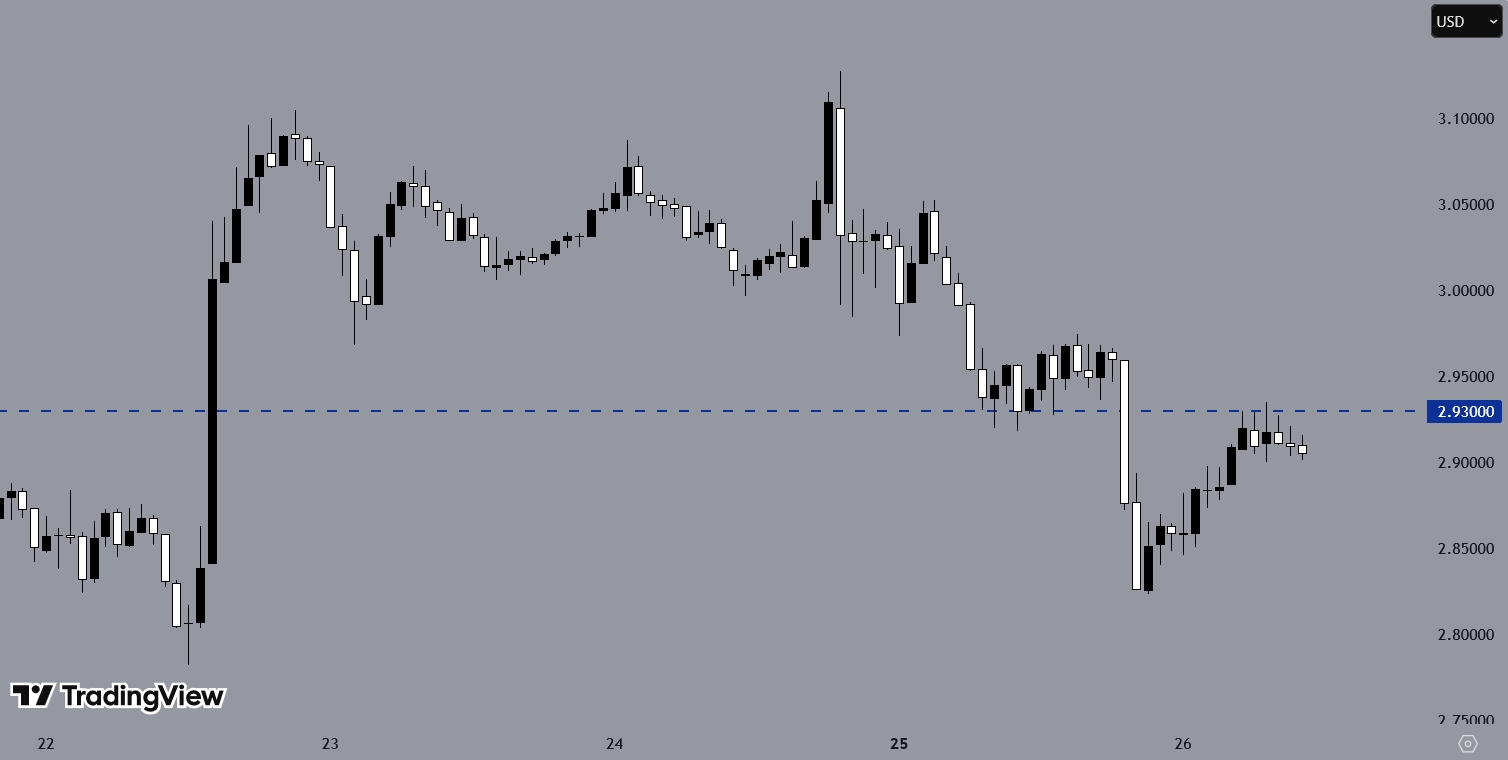

XRPUSD staged a bullish correction on the H1 chart but faces resistance near $2.93. Traders are watching this level closely for clues on the token’s next intraday move.

Crypto analyst warns that XRP could see significant gains or steep losses, depending on key support levels. Sustained support may fuel a rally, while a breakdown could trigger a sharp correction. Toncoin is also flagged for potential upside.

XRP Faces Binary Outlook: Rally or Correction Ahead

In a new technical analysis, CoinsKid outlines a pivotal scenario for XRP, currently trading near $2.90. The analyst’s primary projection is bullish, with a minimum price target of $4.13, described as a potential “fifth wave” in the current market cycle.

Read More: XRP Is Falling, But This Crypto Analyst’s New Price Prediction Suggests 1,000% Surge.

Short-term momentum depends on XRP holding above the Bull Market Support Band around $2.66, while the broader bullish thesis hinges on defending $1.91. A break below that level would likely trigger a “macro correction.”

The report also notes that a surge above $4 could create a “whopping bearish divergence” on weekly charts, potentially leading to a pullback.

XRP Price Forecast: Analysts Outline Key Levels and Risks

DeepSeek AI projects that XRP could trade in a range of roughly $3.50 to $5.00 by the end of 2025, assuming a largely favorable legal outcome for Ripple. The forecast also factors in broader market conditions, including Bitcoin’s performance.

Analyst James Crypto Space notes that if XRP follows a historical fractal pattern from 2017, it could reach around $9 by early September after breaking key resistance levels.

Technical indicators, including a TD Sequential sell signal on the three-day chart, suggest the possibility of short-term consolidation or modest downward movement.

Medium-term projections range between $4.50 and $9.00 by 2026–2027, while long-term estimates extend to $8.00–$15.00 by 2030, influenced by regulatory developments and adoption trends.

Market analyst Zack Rector expects XRP could reach $5 in the near term and potentially up to $15 by September, noting that market volatility may affect outcomes.