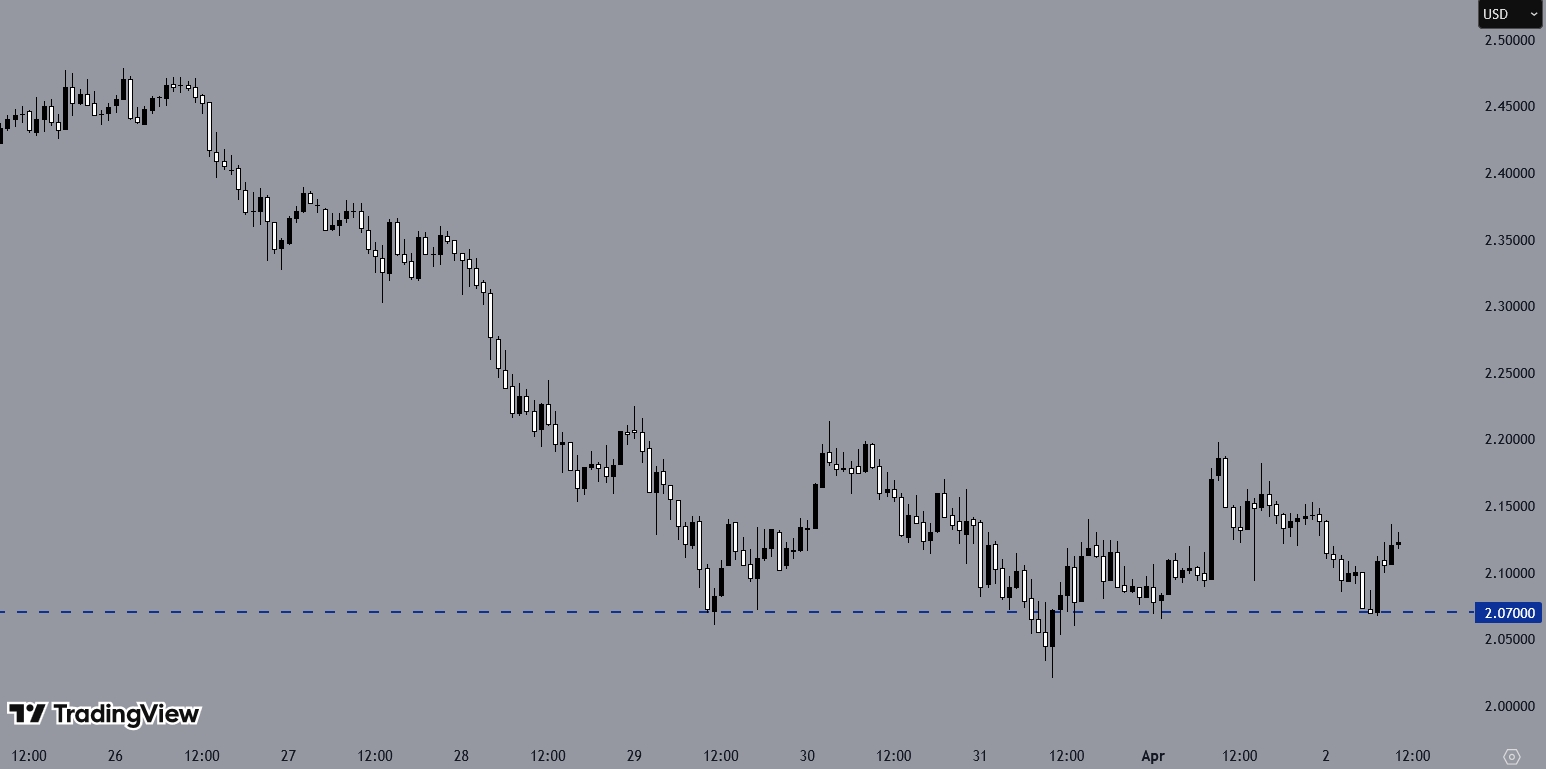

XRP has been trading near an important support level, showing multiple rebounds in recent sessions. On the hourly chart, XRPUSD made a bearish move after facing rejection around 2.20000. If the support at 2.07000 holds, the price may attempt an upward move. However, a breakdown below the support could push the price lower.

The broader market remains uncertain as the Trump administration prepares to announce its tariff strategy. The policy, set for release today at 10 PM CET, will introduce reciprocal tariffs on 15 countries, including China, Canada, and Mexico. These measures target nations that have imposed duties on US goods.

Tariff Volatility Continues to Impact Risk Assets

“The well publicised implementation of tariffs and volatility we have seen in the wake of their announcements will continue to impact risk assets. Our strategy has always to maintain a market neutral position and nowhere is this more appropriate than in such a volatile environment,” Paul Howard, Senior Director at Wincent, commented.

Wall Street is concerned about the economic impact of the tariffs. Meanwhile, the cryptocurrency market faces uncertainty. Analysts have differing views on how digital assets will react, given the volatility seen earlier this year.

“The correlation between risk assets such as cryptocurrencies and macro markets is more pronounced than ever,” Howard continued.

“If we focus on the fundamental changes that have happened in support of the industry the last 3 months then it is likely once the markets become more settled with the new economic paradigm,” he added. “Once again, we should see the majors start to trade a more positive trajectory in the mid/longer term.”

You can read more on this topic at FinanceMagnates.com: How Donald Trump’s Tariffs Will Impact Bitcoin? Expert Predicts BTC Price Jump to $150K.

Trade Policy Uncertainty Sparks Recession Fears Among Economists

The intellectual architect behind the “common good capitalism” movement remains cautiously supportive of the administration’s trade policies, particularly the focus on reciprocity, strengthening supply chains, and addressing bad actors. However, concerns arise about the clarity and execution of these policies. Critics argue that the tariffs will disrupt rather than balance the economy, pointing to similar issues from previous trade policies.

Economists have raised alarms about the risk of a recession, with rising tariffs potentially harming consumer confidence and business investment. The broader economic implications of escalating trade tensions could destabilize global supply chains and provoke retaliatory actions, especially in key sectors like tech, agriculture, and automotive.