The United States and China finalized a trade agreement, marking a notable development in their economic relations. The deal focuses on the export of rare earth minerals from China to the U.S. and aims to address supply chain concerns for critical manufacturing components, particularly in microchip production.

Details of the Agreement

According to U.S. Commerce Secretary Howard Lutnick, the agreement was signed earlier this week. It forms part of a broader plan to conclude additional trade agreements with other major trading partners before the July 9 deadline. The deal also includes provisions for the U.S. to ease certain export restrictions on Chinese entities and relax some visa revocation policies.

Market Response

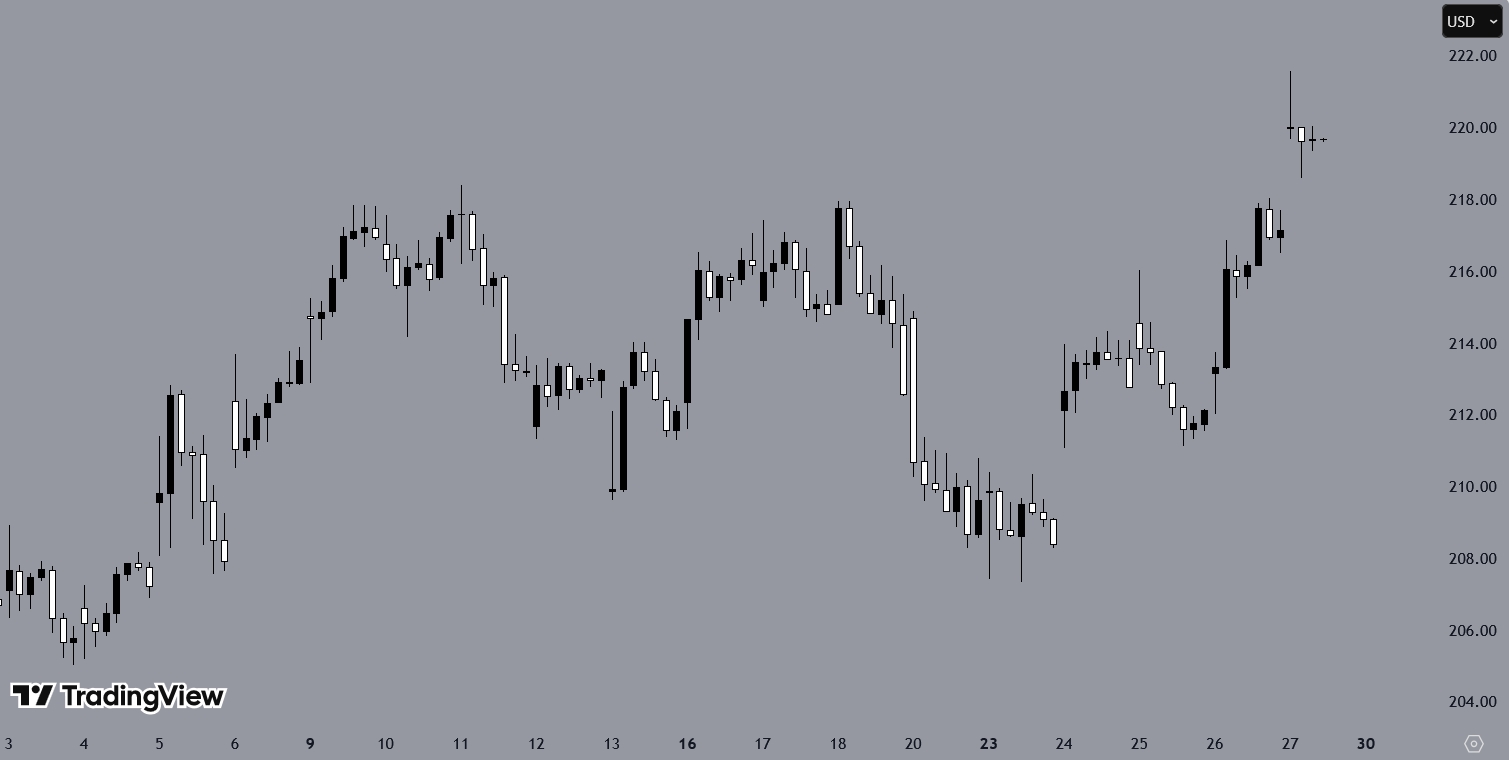

Following the announcement, financial markets responded positively. Major U.S. stock indices, including the S&P 500, Nasdaq Composite, and Dow Jones Industrial Average, moved higher.

Sector-wise, technology companies such as Nvidia, Apple, and Amazon recorded gains, supported by expectations that improved access to rare earth minerals will benefit production.

Retail stocks, including Nike, also experienced positive movements, buoyed by strong earnings reports coinciding with the trade developments. Conversely, some rare earth mining companies saw share price declines amid expectations of increased supply from China.

Global Impact

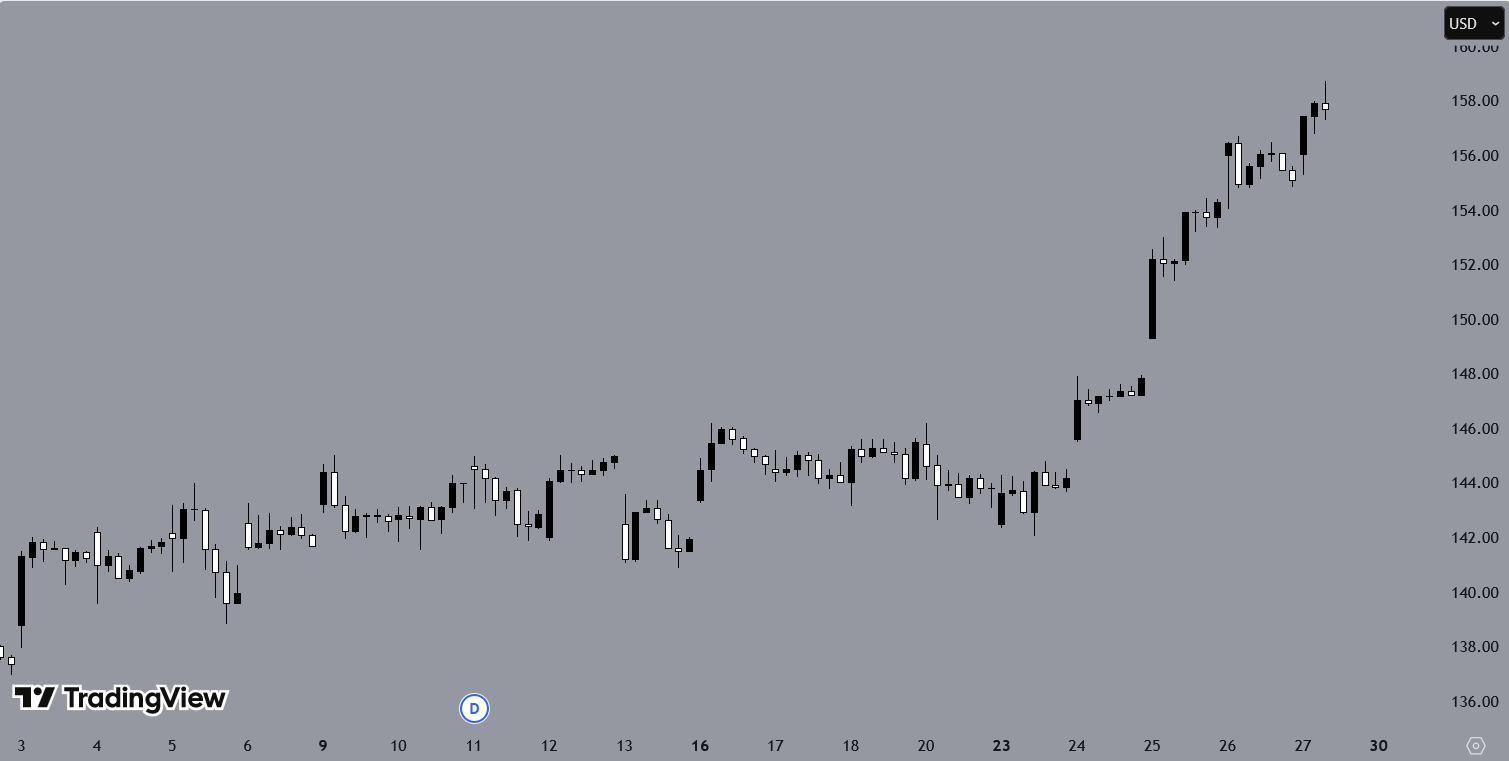

The agreement also influenced broader global markets. Asian-Pacific indices rallied, with several reaching three-year highs, reflecting optimism about improved U.S.-China trade relations.

You may find it interesting at FinanceMagnates.com: Tariff Volatility Pushes FX Trading: Firms See “Strongest Days”.

Outlook and Remaining Challenges

Despite the positive market response, challenges remain. The U.S. administration continues negotiations with other trading partners, and the July 9 deadline for tariff decisions approaches. The full implications of the trade deal will depend on its implementation and further diplomatic developments.

EU Braces for Trump Trade Clash

Meanwhile, Donald Trump has proposed a 50% tariff on all European Union imports starting June 1, 2025, citing stalled negotiations and trade imbalances. Announced on Truth Social, the move triggered declines in U.S. futures and European equities.

The announcement marks a renewed use of tariffs in trade policy and has raised concerns over potential supply chain disruptions.