After punting a spring listing, the ticket reseller priced at $23.50 for an $8.6 billion valuation, just as CNBC flags a thawing IPO calendar with Klarna, Circle and Gemini waiting in the wings.

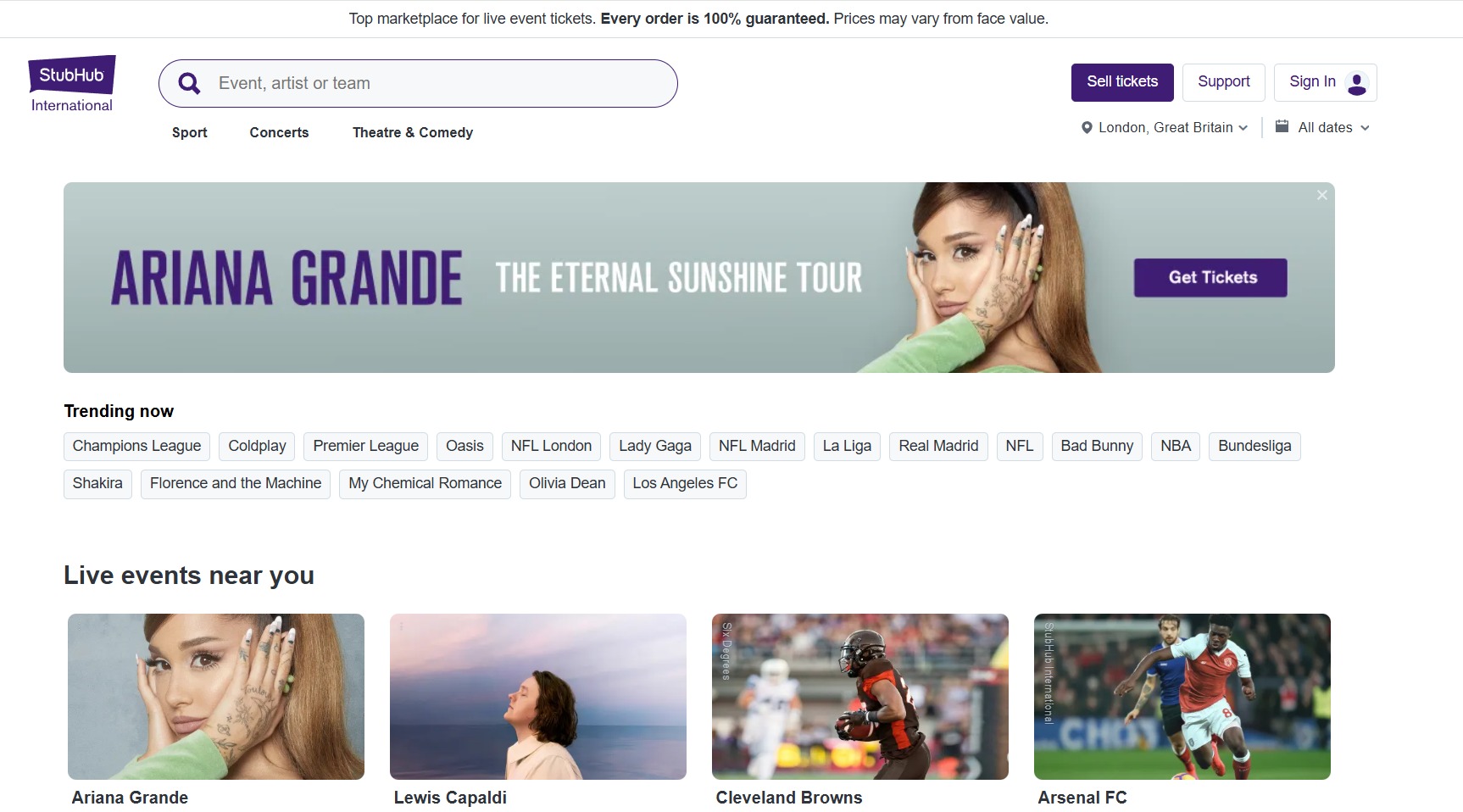

StubHub: The Hot Ticket Actually Showed Up

StubHub has been flirting with public markets for years, but this time it finally rang the bell. The company priced its initial public offering at $23.50 a share, in the middle of the marketed range, for proceeds of roughly $800 million and a valuation near $8.6 billion. Shares list on the New York Stock Exchange under the ticker STUB, with J.P. Morgan and Goldman Sachs leading the deal.

If this all feels overdue, it is. StubHub paused plans in April because of market volatility and had previously considered a direct listing back in 2021. The on-again, off-again roadshow finally found a window, and management took it.

The Business You Love to Hate

The flotation as a bet on the challenging nature of ticket resales. It’s all based around a model that prints fees when demand is rabid and invites political scrutiny when prices spike. The prospectus points to jurisdictions that already restrict resale above face value and warns compliance costs could rise. Investors are not buying a cuddly brand, they are buying a machine that intermediates live-event FOMO.

Under the hood, the recent numbers are not wall posters. StubHub reported a $76 million loss on $827.9 million in revenue in the first half of 2025. Profitability is not a given, even with a total addressable market that management pegs in the hundreds of billions. If you are here for pristine margins, this is not your section.

From False Starts to a Working Window

Why now, after the spring stall? Because the window reopened just enough. There’s been a sudden uptick in IPOs with increasing movement. So, StubHub took its swing. Momentum matters in listings, and there is a psychological premium to getting out while investors are saying yes.

This week has seen a number of marquee debuts, with Klarna (after delaying an IPO in April), stablecoin issuer Circle and Gemini in the conversation. StubHub’s move might signal something simple. The market is willing to fund growth stories again, even ones that come with regulatory footnotes and messy unit economics.

What the Price Says, and What It Doesn’t

A mid-range print can mean two things. Either underwriters calibrated demand with Swiss-watch precision, or nobody wanted to test the top of the range. In either case, $23.50 gets the deal done without creating an instant perception of “overreach,” and it puts a clean marker on a company that has toggled between ambition and anxiety for years. The valuation near $8.6 billion is well shy of the froth that surrounded ticketing a cycle ago, yet it is still a confident bet on post-pandemic experiences and the fee-stack that rides them.

StubHub does have levers. It has distribution deals in primary ticketing, including baseball, that could broaden beyond simple resale. If that push gains traction, the narrative tilts from “middleman” to “platform,” which usually commands a better multiple. If regulators or fans sour, the narrative goes back to markups and heat. Pick your ending.

The Bigger Picture for IPO Watchers

For those seeking deals, the lesson is not about concerts. It is about sequencing. When recognizable names cross the tape in clusters, money moves from watching to bidding. If Klarna, Circle and Gemini clear the bar, bankers will call every CFO who said “maybe next quarter.” If those names wobble, windows slam and we are back to waiting. For now, the vibe is constructive, and StubHub slipped through it.

For stories making the waves in finance and tech, visit our Trending section.