The US Securities and Exchange Commission has extended its review period for several proposed XRP exchange-traded funds. Notices filed on Monday (yesterday) set new deadlines between October 18 and October 23.

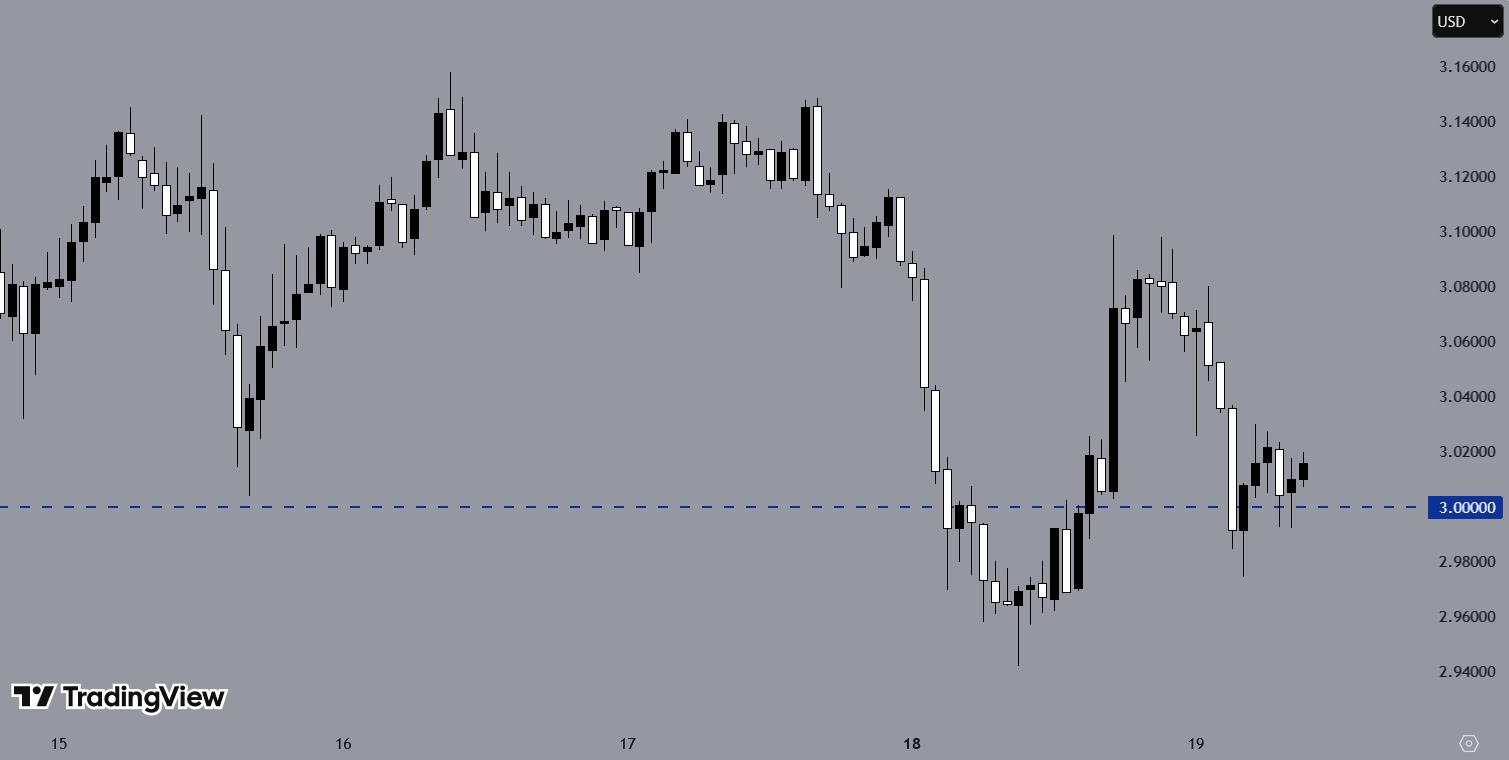

As of writing, XRPUSD is trading near $3, a key psychological level. Traders are closely monitoring price action to gauge the next move.

Applications Under Review

The applications include proposals from CoinShares, 21Shares, Canary Capital, and Grayscale. CoinShares filed in February seeking a Nasdaq listing. Around the same time, 21Shares submitted its Core XRP Trust to the Cboe BZX Exchange . The SEC had already postponed these applications in May, saying it required more time for assessment.

Part of a Broader Pattern

The delay follows a broader pattern of extensions for digital asset funds. Similar postponements were recently made for Solana and Litecoin ETF applications, with no decision expected before late October.

Mixed Market Reactions

Community response has varied. Some traders voiced frustration at the repeated delays. Others described the extensions as part of the normal review process. On social media, one trader suggested the timing was intended to suppress XRP’s price ahead of a possible approval. These claims have not been verified.

You may find it interesting at FinanceMagnates.com: BTC and ETH “Likely to Trade in Ranges,” Analyst Says as Futures Leverage Remains High

Price Movements

XRP traded at $3.06 on Monday, a 1.33% decline from the prior session. Some traders said they intended to increase holdings during the dip, expecting higher valuations if ETFs are launched.

Speculation that BlackRock might enter the XRP ETF market has been denied. The firm stated it has no current plans to submit an application.

Read More: XRP Trades in Range as Analysts Predict $6 by 2025 Amid SWIFT Transaction Decline.

Analyst Assessments

Analysts maintain a more structured view. Bloomberg ETF specialists James Seyffart and Eric Balchunas estimate a 95% chance of approval. They pointed to the conclusion of the SEC’s case against Ripple as a key factor.

Data from prediction market Polymarket also indicated optimism, with odds of approval before year-end at 77%, up six percentage points after the SEC’s latest filing.