Ripple, a San Francisco-based blockchain company, recently transferred $682 million worth of XRP to an unknown wallet, according to data from Whale Alert, a service that tracks large cryptocurrency transactions.

Meanwhile, XRPUSD has been moving upward on the intraday charts following a decline yesterday (Thursday).

XRP Transfer Marks First Major Move Since December

This marks the company's first major transfer since December 21, when it sent over $200 million XRP in two transactions. The latest transfer surpasses the total amount Ripple sent in December.

Ripple's CEO Brad Garlinghouse has confirmed the company holds more than $100 billion worth of XRP tokens, which he suggests should be considered when valuing the company, as reported by U.Today.

XRPUSD Holds Support, Eyes Bullish Rebound

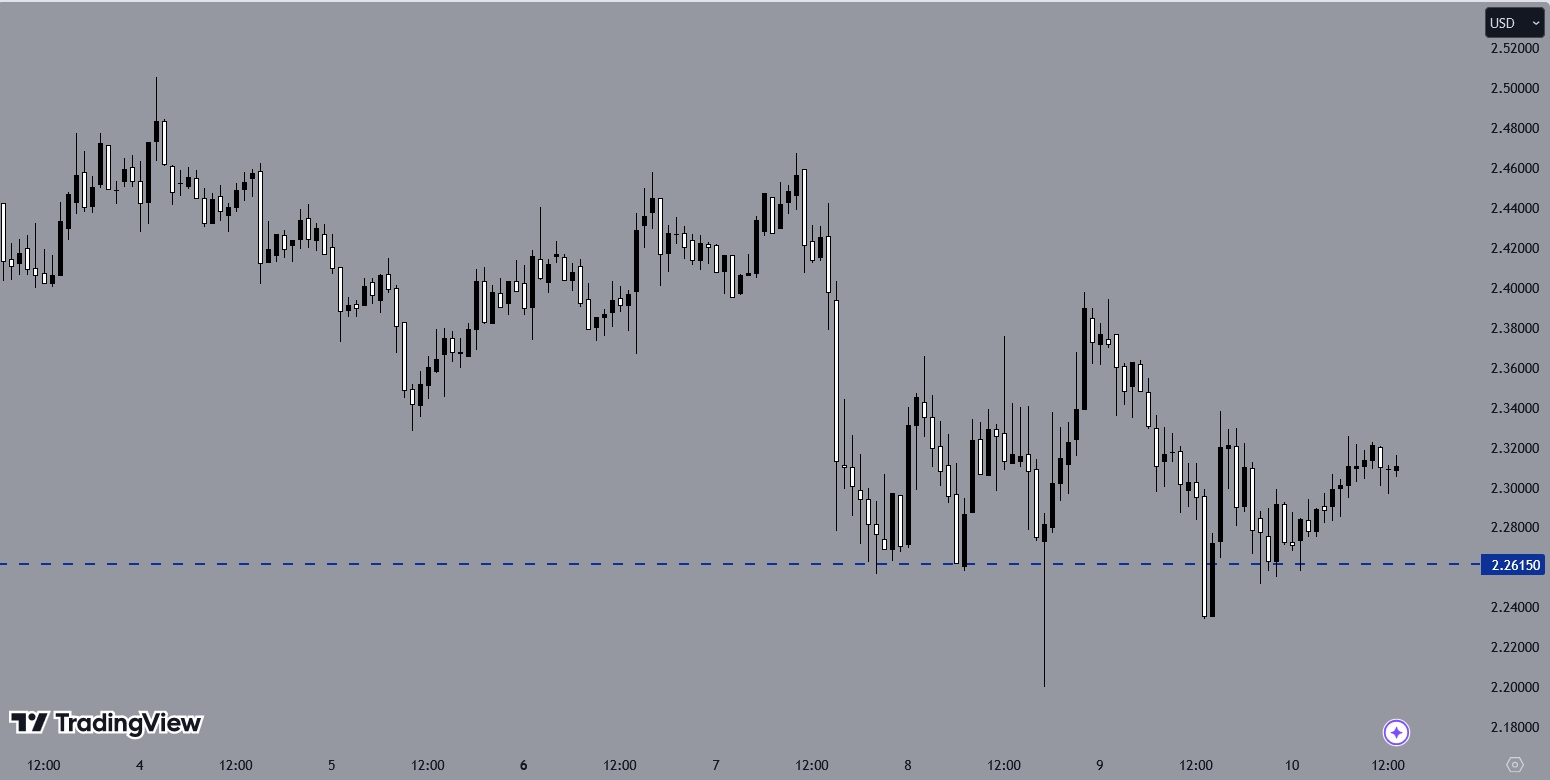

XRPUSD experienced a bearish session yesterday. On the H1 chart, the price attempted to breach the 2.26150 level but retreated to the support level. Currently, the price is moving upward at a moderate pace. A bearish breakout below 2.26150 could push the price lower. However, if the support holds, XRPUSD may end up having a bullish day.

Ripple's Developments: High-Profile Meetings and Strategic Partnerships

Recently, Ripple has garnered attention due to a series of notable developments. CEO Garlinghouse and Chief Legal Officer Stuart Alderoty attended a private dinner with President-elect Donald Trump on January 6, which Garlinghouse described on social media as a positive start to 2025.

This high-profile meeting has sparked further speculation about Ripple’s ongoing legal battle with the US Securities and Exchange Commission (SEC), which filed a lawsuit against the company in December 2020. The lawsuit accuses Ripple of selling XRP tokens as unregistered securities, and the case’s outcome could have significant implications for the regulation of digital assets in the US.

In another major development, all banks in Japan are set to adopt Ripple’s XRP Ledger in 2025. The integration with the Interledger Protocol (ILP), announced by SBI CEO Yoshitaka Kitao, aims to streamline cross-border payments and currency conversions, offering a more efficient and cost-effective solution for international remittances.

Ripple has also made strides in the decentralized finance (DeFi) space through its partnership with Chainlink. This collaboration, launched on the Ethereum blockchain, integrates Ripple's RLUSD stablecoin with DeFi applications such as trading and lending. The RLUSD stablecoin, pegged to the US dollar, was introduced on both the Ethereum and XRP Ledger networks last month, with a market capitalization of $72 million, according to CoinGecko.