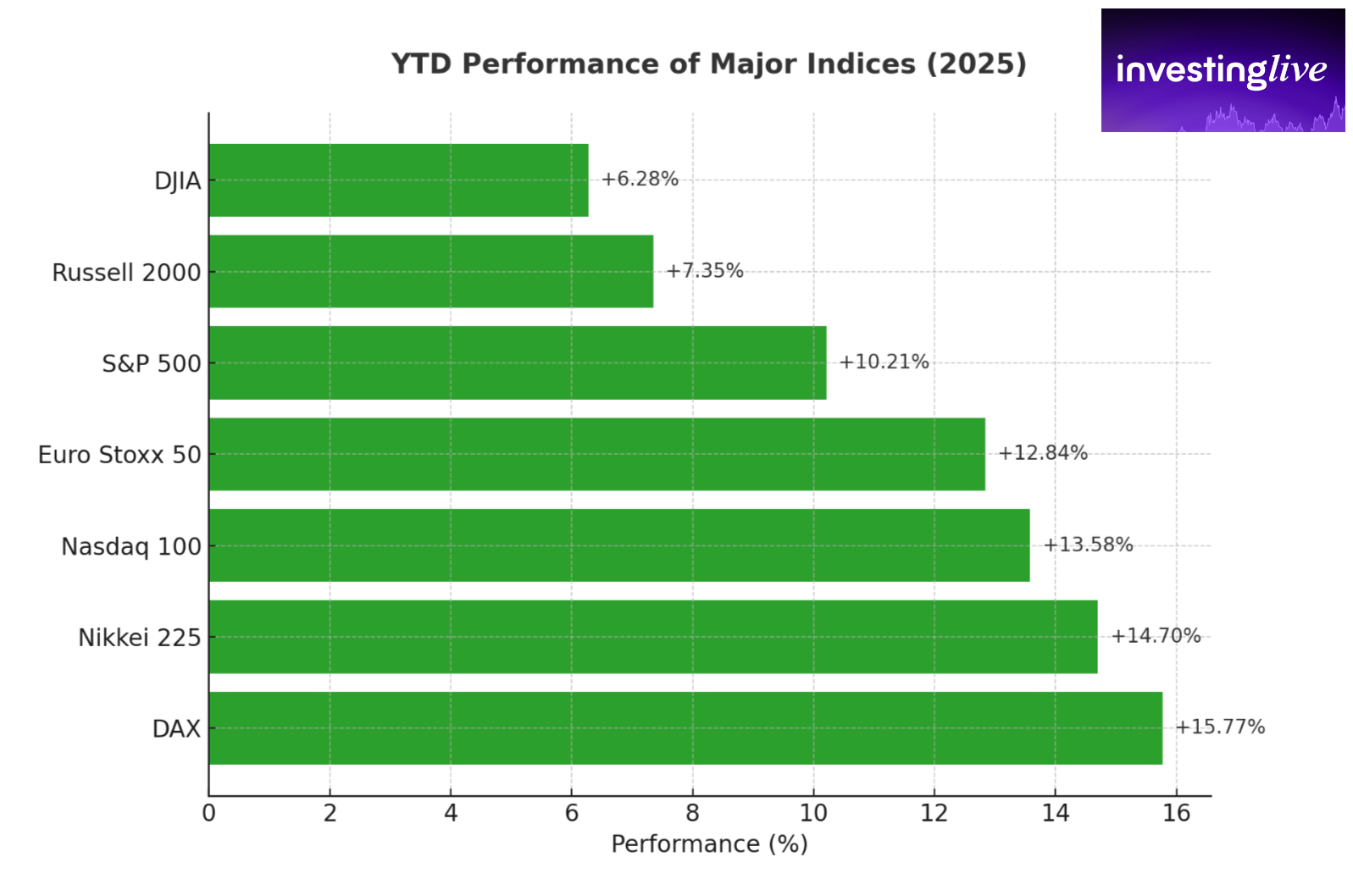

YTD Stock Index Scoreboard: DAX Still Leads the Pack

For long‑term investors tracking indices only, the green bars tell the story. Year to date in USD terms: DAX +15.8%, Nikkei 225 +14.7%, Nasdaq 100 +13.6%, Euro Stoxx 50 +12.8%, S&P 500 +10.2%, Russell 2000 +7.4%, DJIA +6.3%. The winner so far is still the DAX.

So far in 2025, indices have managed steady gains with the DAX still leading, up almost 16%, while the Nikkei 225 and Nasdaq 100 also post double-digit returns. Yet the story beneath the green bars is nuanced. As investingLive, formerly ForexLive notes, many investors are waiting for a pullback before adding risk, creating a “wall of cash” on the sidelines that could cushion any dip but also limit upside. Meanwhile, central banks remain cautious: ECB’s Makhlouf has warned about structural headwinds such as aging populations, while the Swiss National Bank is keeping clear of negative rates, signaling that ultra-loose policy is unlikely to return soon. Together, these factors suggest that while equity indices are in positive territory, long-term drivers and central bank caution may keep rallies more measured than investors might hope.

Why the DAX is ahead in 2025

Currency translation tailwind

For USD‑based investors, a stronger euro has boosted euro‑area equity returns when translated back into dollars. That lift alone helps the DAX screen better than peers in USD terms.Sector mix that fits this phase

The DAX is heavy in global exporters, industrials, autos, capital goods and software. A rebound in global capex, factory automation and AI‑related digital spending has supported names tied to equipment, engineering and enterprise software.Lower starting valuations

Europe, including Germany, entered the year at a discount to U.S. megacaps. Multiple expansion from a cheaper base, plus attractive dividend yields, made total returns more competitive.Earnings resilience and shareholder returns

Several DAX constituents delivered steadier‑than‑feared results, increased buybacks or maintained strong dividends. That combination has kept capital committed.Macro relief compared with 2022–2023

Energy costs stabilized versus the prior shock, supply chains improved, and clearer ECB policy guidance reduced uncertainty. Even modest improvements can go a long way for cyclical exporters.

What long‑term investors should watch next

Currency risk

If the euro reverses lower, USD‑based returns from the DAX can compress. Decide whether to hold exposure hedged or unhedged.Global demand for German exports

The index is sensitive to China, the U.S. and broader manufacturing cycles. A slowdown in any of these can hit earnings quickly.Sector concentration

Strength has leaned on industrials, autos and a few large software and healthcare names. Diversifying within Europe can reduce single‑country or single‑sector risk.

The DAX has earned its lead so far, helped by currency translation, sector composition and a valuation catch‑up. For investors building or rebalancing international exposure, those drivers are worth weighing alongside risk controls. For intraday context and curated signals, visit the LiveBytes stream at the top right of investingLive.com, formerly ForexLive.com. This is information only and not financial advice.