Crypto analyst warns that Bitcoin faces a potential bearish trend after breaking key support levels. While a short-term rebound is possible, the overall outlook remains cautious, and traders are advised to manage risk amid volatile market conditions.

BTC Bounces Before Facing Key Resistance

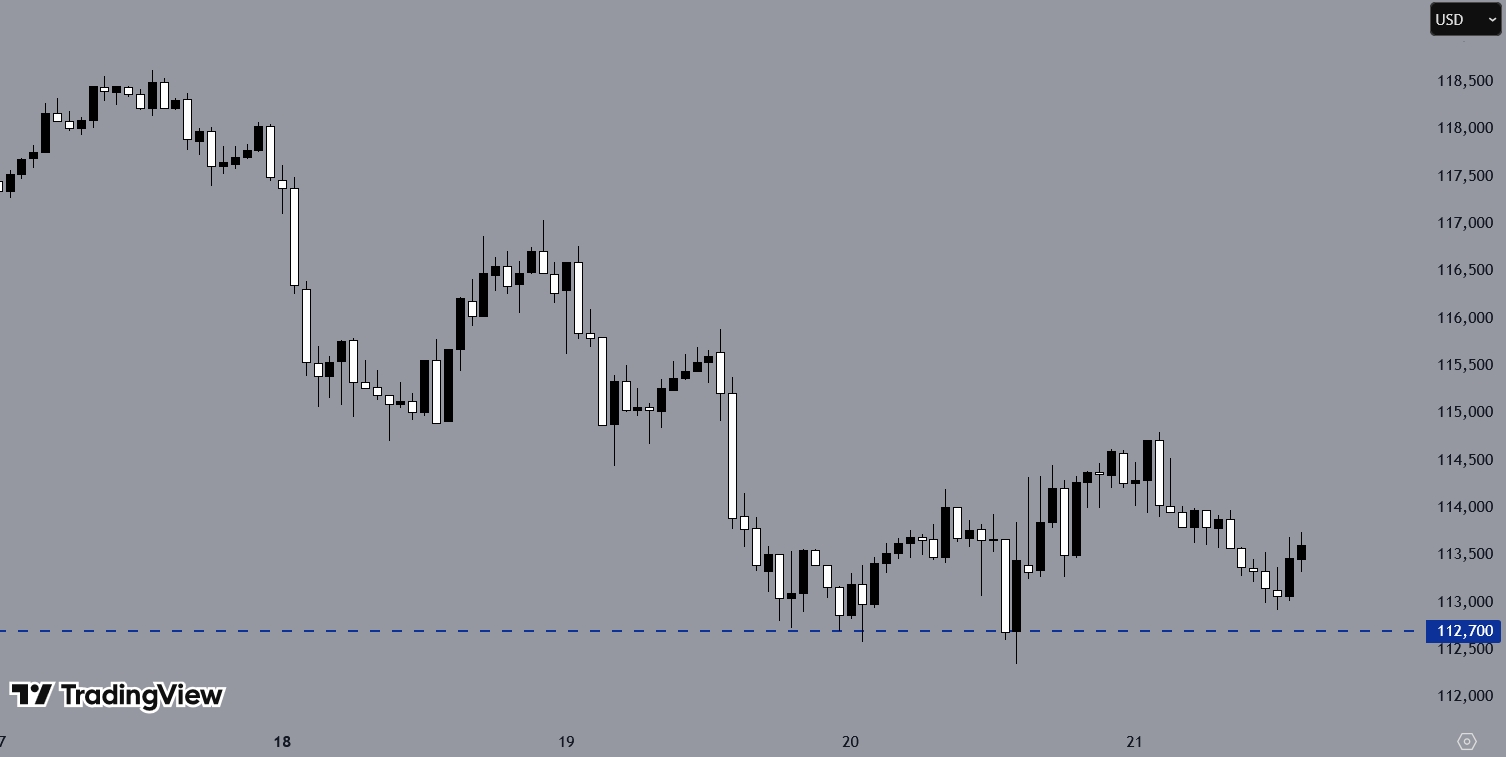

Bitcoin has been undergoing a bearish correction. On the H1 chart, the price bounced several times around 112,700, prompting a brief upward move, while 114,800 acted as a key resistance level.

The cryptocurrency has since pulled back, with intraday support continuing to hold. A bearish breakout below this support could drive the price toward 110,000, whereas a break above 114,800 may push it toward the next resistance near 116,500.

Bitcoin Faces Bearish Risks, Analyst Warns

Crypto analyst BitcoinHyper on social media warned of a significant bearish scenario for Bitcoin, despite a recent 10% drop and a brief bounce from daily support levels.

Bitcoin has broken key weekly and horizontal support levels, confirming a downtrend across 1-hour, 2-hour, and 4-hour charts. The analyst’s “ideal scenario” is a short-term rally to around $119,000—a potential short squeeze that could liquidate traders betting against BTC.

You may find it interesting at FinanceMagnates.com: BTC Remains Under Trendline; North Wales Police Investigate £2.1M Bitcoin Scam.

Following any bounce, Bitcoin could see a deeper correction toward $108,000, with a worst-case scenario near $18,000 if a larger rising wedge pattern develops. Oversold indicators on the Daily RSI and Stochastic oscillator suggest a temporary rebound, but the overall trend remains bearish.

For traders, BitcoinHyper recommends cautious long positions with tight stop-losses, while preparing to sell into strength. The outlook aligns with Bitcoin’s historical tendency for slightly negative returns in September.

Analyst Sees BTC Volatility Amid Leverage

Ryan Lee, Chief Analyst at Bitget, expects Bitcoin to trade within a range of $112K to $118K, as profit-taking and cautious market sentiment continue to influence price action. Increased leverage in futures markets may add volatility, making BTC susceptible to sharp movements.

Lee also highlighted that macroeconomic factors, including Federal Reserve decisions, could impact price direction. The market currently reflects a balance between potential rebound opportunities and the risk of further corrections, shaped by structural demand and elevated speculative activity.