Bitcoin Cash (BCH) rose more than 5% on Thursday, reaching $487 after a surge in trading volume helped lift the asset past key resistance levels. The rally occurred despite broad losses across the crypto market and growing macroeconomic concerns.

Ranked #12 with a market capitalization of more than $9 billion, BCH gained 5% over 24 hours, rebounding sharply from an intraday low of $432, according to CoinMarketCap. The recovery gathered pace during the U.S. morning session as multiple volume spikes signaled renewed buying interest.

The coin advanced steadily throughout the day, breaking past $465 before a final-hour push sent it to $480.10. Strong continuation followed a breakout from $462.75 to $468.77, driven by concentrated buying flows.

BCH Outperforms Broader Market

While the broader crypto market faced headwinds, including a 3.5% decline in total capitalization and continued U.S.-China trade tensions, BCH stood out for its relative strength. It reclaimed ground lost earlier in the week and established a fresh support base.

Technical indicators showed a clear uptrend forming with higher lows and rising volume. The early decline to $454 came on elevated activity but was quickly reversed, with buyers entering between $455 and $458 to establish a floor.

You may also find interesting: Kiyosaki Predicts Bitcoin at $1 Million by 2030 as Economic Crisis Looms. How High Can BTC Price Go?

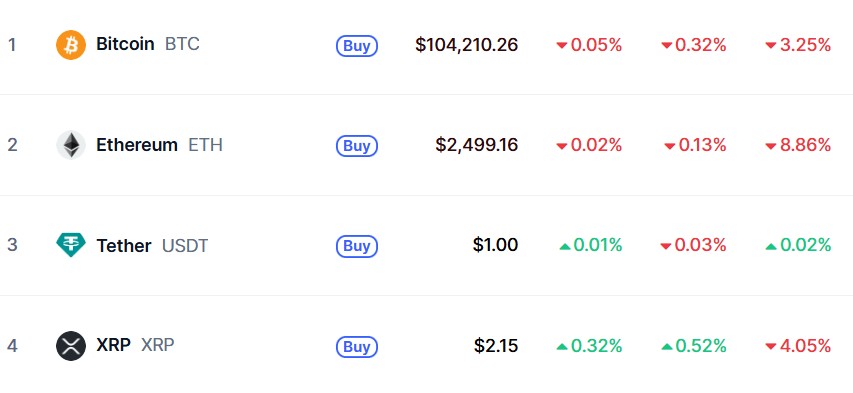

The session’s strongest gains occurred during the final hour, as aggressive buying helped clear resistance at $468. Volume increased sharply, confirming participants' commitment. At the time of this publication, Bitcoin was trading at $104k, representing a 3% decline in the past week, following a market-wide volatility.

Ending the Day Near High

Despite continued macro uncertainty, Bitcoin Cash ended the day near its high, signaling renewed momentum heading into the next session. Traders will monitor whether volume remains elevated as the market digests external pressure.

BCH’s performance on Tuesday highlighted its resilience in a cautious environment. Price action was supported by decisive intraday flows and a strong technical structure.

Meanwhile, Robert Kiyosaki is bullish about Bitcoin. The author of Rich Dad Poor Dad informed his followers on Wednesday that the top cryptocurrency could reach $1 million per coin by 2030, highlighting that wealthy investors should focus on accumulating crypto rather than tracking daily price movements.