Donald Trump has deepened his involvement in the cryptocurrency space ahead of his January 20 inauguration. In an unexpected move, the US President-elect launched his own memecoin, $TRUMP, this weekend causing a wave of speculation and trading activity in the crypto market.

Within hours of its debut, the coin's price skyrocketed from just a few cents to $14, leaving traders and analysts divided over its legitimacy and implications for the crypto industry, CNBC News reported.

Trump Doubles Down on Crypto

Trump announced the launch through his official Truth Social and X accounts, assuring skeptics that the coin is indeed linked to him. The announcement, accompanied by the phrase "WINNING," described the token as a celebration of his ideals and leadership.

The memecoin's sudden rise triggered skepticism among some traders. The coin's official site claims it is a symbolic gesture rather than a financial instrument.

"Trump Memes are intended to function as an expression of support for, and engagement with, the ideals and beliefs embodied by the symbol "$TRUMP" and the associated artwork, and are not intended to be, or to be the subject of, an investment opportunity, investment contract, or security of any type," the announcement noted.

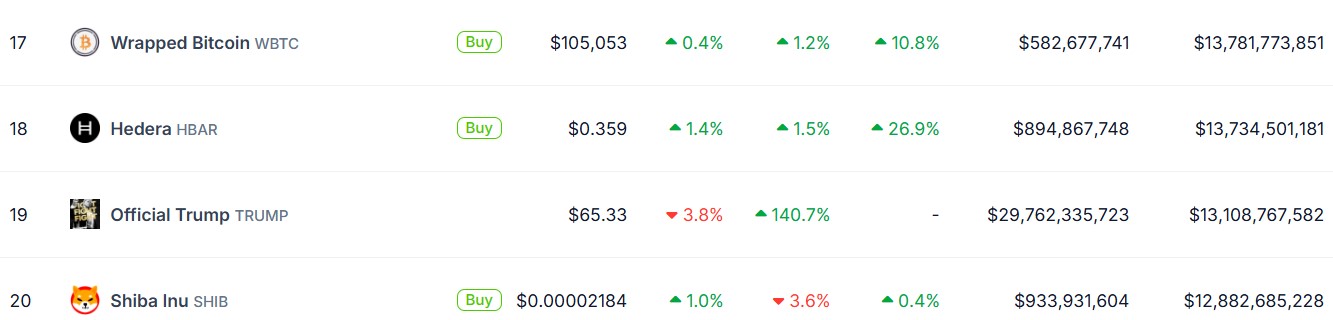

Despite its symbolic intent, $TRUMP quickly gained traction among traders. Data from CoinGecko shows that $TRUMP has amassed a market capitalization of more than $13 billion. At the time of this publication, the memecoin traded at $67, representing a 139% surge in the daily chart.

The crypto community initially approached the coin with caution, questioning its authenticity. However, the use of Trump's verified accounts and his ties to CIC Digital LLC, a firm previously involved in his NFT projects, lent credibility to the launch.

Trump Embraces Memecoins

Trump's embrace of cryptocurrency marks a stark shift from his earlier skepticism. Alongside his sons, he co-founded World Liberty Financial, a platform championing decentralized finance.

He has also previously dabbled in NFTs and pledged to make the US a global hub for crypto innovation. The $TRUMP memecoin launch comes days before Trump assumes office, making him the first US president to lend his likeness to a cryptocurrency.

As $TRUMP surged, other Trump-themed tokens saw their value plummet, with some losing as much as 50% overnight, Coindesk reported. Meanwhile, $ TRUMP's rapid rise has positioned it as one of the most polarizing topics in the crypto space.