There’s a common saying in the crypto world: “Not your wallet, not your crypto.” People are regularly warned not to store their cryptocurrency on exchanges, but if one wants to trade crypto, one must by necessity keep some of their tokens on an exchange.

As such, it becomes important to choose the best, safest exchange out there. But how do you find the best cryptocurrency exchange? I looked around in 2018 and I couldn’t find anyone offering a comprehensive, impartial rating system for exchanges.

The ratings that I found were largely based on just a single factor, such as security or volume, or blog posts comparing a few of the major players. There was clearly a need for something more thorough and far-reaching.

I already had experience with this sort of thing -- my company Cointelligence had established an impartial rating system for ICOs and STOs, in an effort to help investors avoid scams.

It seemed just as important to avoid unsafe and scammy exchanges, so we decided to establish a cryptocurrency exchange rating system as well.

How do you rate an exchange?

What are the important factors in rating an exchange? Some exchange lists are simply sorted by volume, but recent reports have shown how much of this volume may be faked and inflated.

And while liquidity is an important part of trading, it really doesn’t matter how liquid an exchange is if you don’t feel safe trusting them with your cryptocurrency.

Currently, we’re looking at the following factors when we rate an exchange:

- Accessibility and Usability -- How hard is it to navigate the site, set up an account, and trade your crypto on the exchange? We also factor in customer support and other aspects of the consumer experience.

- Financial Benefit -- While this includes liquidity, it’s only one part of the metric. We also take into consideration things like the amount of crypto pairs available, fee structure, fiat currency support, and how the assets are insured.

- Team -- Just as with ICOs and STOs, an exchange’s team is so important in establishing how trustworthy it is. Red flags would include an anonymous team, an inexperienced team, or a team previously associated with a bad exchange. On the other hand, if we see a team with a good amount of skills and experience related to cryptocurrency and financial services, we feel more confident about the exchange.

- Risk -- Security is one of the most important aspects of a crypto exchange, which is why we look closely at whether the exchange has experienced hacks or other attacks in the past. We also take into consideration their regulatory compliance, security protocols, insurance, and the withdrawal process.

Over time, we hope to add more metrics to give an even more complete picture of an exchange’s quality.

How does the rating process play out?

Let me show you how these metrics play out with a couple of real examples of exchanges we’ve rated.

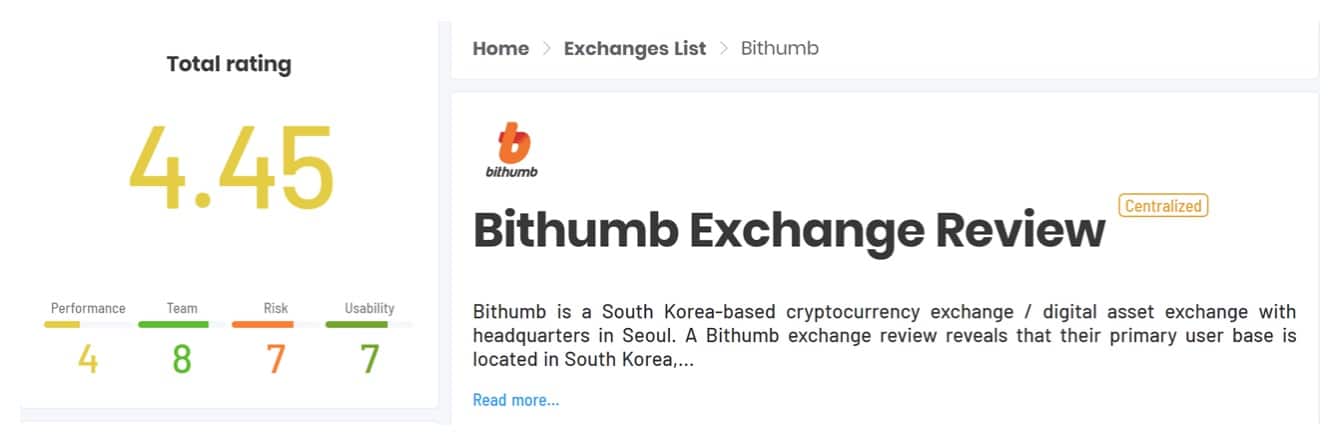

Bithumb

Bithumb has been in the news recently due to a hack that saw them lose approximately $13M in EOS and $6M in Ripple in what may have been an inside job.

We rated Bithumb before this most recent hack and gave them a risk score of 7 due to two previous hacks. This third hack should give anyone pause when they consider whether or not to trade on this exchange. To see the full review of Bithumb click here.

OKEx

After reading the above example of Bithumb, you may think that it’s just enough to search on whether an exchange has experienced hacks before. But sometimes, a hack isn’t actually what it seems.

We originally gave OKEx a lower rating than their current 7.6/10. There had been reports of users having their accounts compromised and their funds stolen.

However, our research team dug deeper and found that this wasn’t due to any fault on the exchange’s side, and instead appeared to have happened because those users hadn’t enabled two-factor authentication to better protect their accounts. To read the full review of OKEx click here.

Why it’s important to rate on multiple metrics

If you look at both Bithumb and OKEx, you’ll see that each team has received a rating of 8. We believe that both of these exchanges have good people behind them who have the capabilities to run a reliable exchange -- but so far, OKEx has done a better job in terms of usability and risk management.

An exchange can’t be judged on only one factor. It’s not enough to simply look at volume, or the team, or how easy the site is to navigate. Because you’re trusting an exchange with your cryptocurrency funds, you need to look at them from every angle before deciding to open an account.

That’s why I believe an exchange system is important. If you agree, I invite you to check out Cointeligence’s crypto exchange list and rating here.

Author Bio:

On Yavin is the founder and CEO at Cointelligence, the data layer of the crypto economy. He has extensive experience as a serial entrepreneur and an angel investor, as well as more than 20 years of experience in the tech industry. On uses his deep hands-on experience and knowledge of online marketing to create winning strategies for ICOs, crypto, and Blockchain companies.

Having earned the reputation of a crypto expert, On continues to contribute to this industry in ways that advance Cryptocurrencies and blockchain technologies. On has a law degree (LLB) and is also a certified Advocate by the Israeli Bar Association.

Disclaimer: The content of this article is sponsored and does not represent the opinions of Finance Magnates.