For a long time, the cryptocurrency market has been surrounded by questions about its volatility and security. But ever since the pandemic, it has drawn more attention from investors of varying risk appetites and tolerance.

Cryptocurrencies are now a popular trend even if they have not fulfilled their promise of a decentralized financial system. There are over 400 million cryptocurrency owners worldwide, led by India, the US, and Vietnam, with 93M, 48M, and 20M, respectively.

Given this, cryptocurrency trading has become part of our daily lives. The market has expanded from individual traders and brokers to business establishments and government agencies. It has become more attractive recently as the market continues to heat up.

In this article, we will discuss why it’s wise to hold cryptocurrencies now.

Cryptocurrencies Have Enticing Upside Potential

In 2021, the price of any type of cryptocurrency rose substantially and set a new all-time high. Bitcoin (BTC), for instance, broke $60,000 during the first quarter. By November, it reached $69,004, the highest value since its inception.

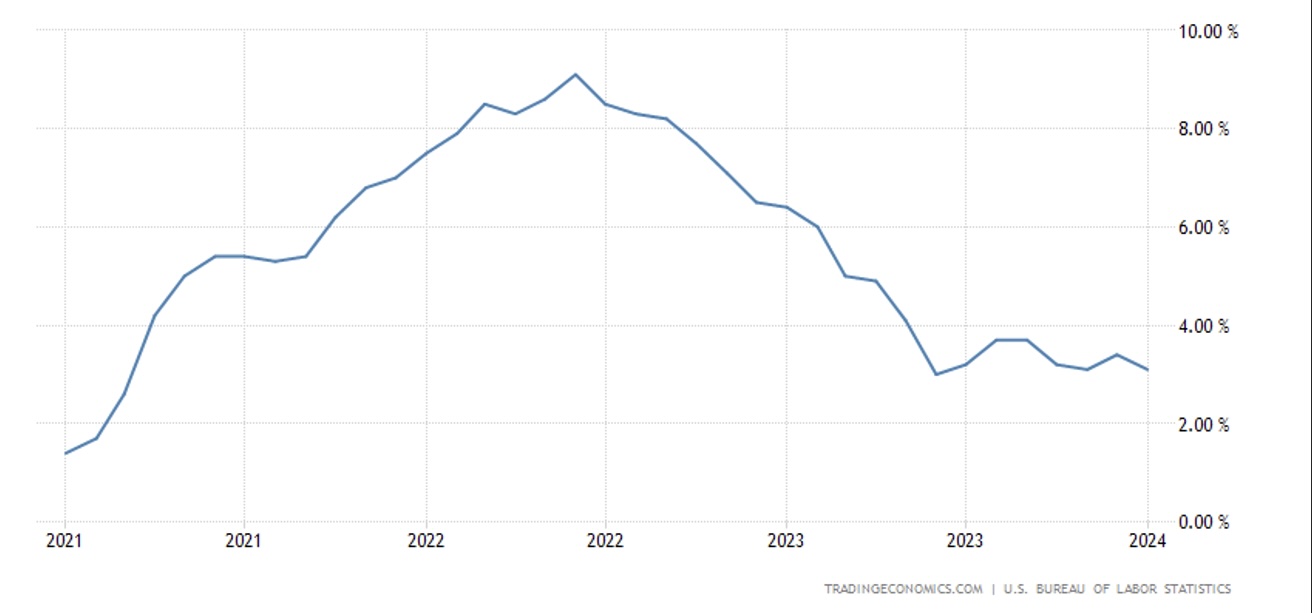

But in only a few months, the celebration turned into panic among investors as crypto prices took a nosedive. It coincided with the skyrocketing global inflation during the first half of 2022. For instance, the US inflation exceeded 8% for the first time in many years before climbing to its 9.1% peak. In response, crypto prices had a steep plunge.

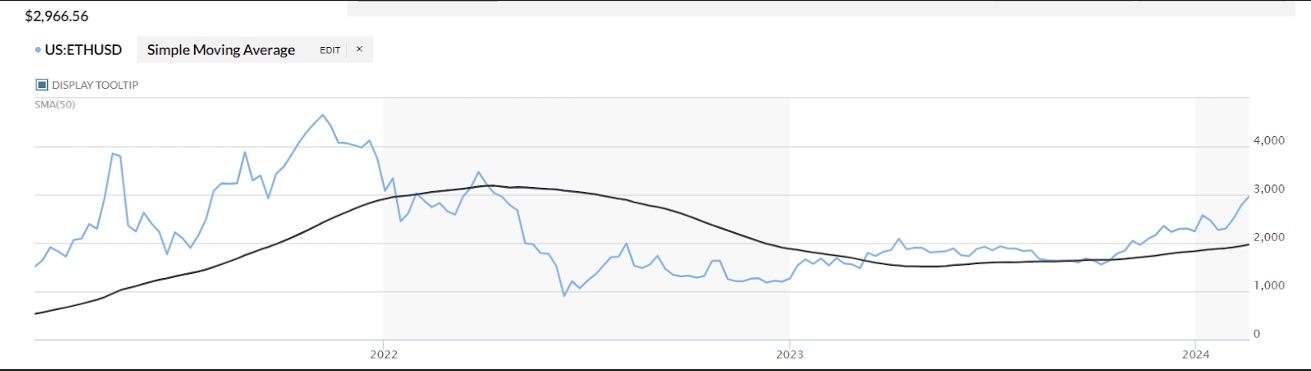

In the following months, prices started to move sideways, mainly due to the contrasting impact of lower inflation and higher interest rates in the US. As such, crypto prices became deeply tied to macroeconomic indicators. This supposition was fortified in 2023 when crypto prices accelerated as inflation decreased and the Fed maintained rate hike pauses.

In 3Q23, the market indicated slowdowns when inflation rebounded, and the Fed expressed its hawkish view. But today, prices have bounced back, showing that the market is heating up.

Given all these, cryptocurrencies are not wise choices for inflation hedges. Yet, their inverse correlation with macroeconomic indicators shows their potential for a sustained price rally this FY. The improving macroeconomic environment will even drive the bullish market. This can be supported by the anticipated Fed rate cuts this year.

Buying cryptocurrencies today is ideal, so investors must take advantage of price dips and pullbacks to buy them at a discount. There may be a double-digit upside potential if inflation keeps decreasing. As such, cryptocurrencies are still cheap today.

To support our views, here are Bitcoin (BTC), Ethereum (ETH), and Litecoin (LTC) charts with a Simple Moving Average (SMA) Line. You can compare their respective trends to inflation.

Cryptocurrencies as Accepted Payment Methods in Many Business Establishments

It is no longer a secret that many business owners have already entered the world of cryptocurrency trading. It has become more apparent in recent years as many online businesses have emerged, especially during the COVID-19 pandemic.

Many businesses are now operational even without brick-and-mortar stores. These are the primary drivers of the e-commerce boom and fintech revolution. And as cashless payment methods take flight, the crypto market is seeing more opportunities to penetrate new niches.

In the US, 41% of Americans no longer use cash for transactions. It substantially increased from 24% in 2015 to 29% in 2018. This contrasts the percentage of Americans with cash transactions, contracting from 24% in 2015 to 18% in 2018 and 14% in 2022.

Credit cards and mobile wallets are the top payment methods today. And since many banks are now into crypto trading, credit cards have started working hand-in-hand with cryptocurrencies. Even mobile wallets like PayPal (PYPL) are used to top up crypto wallets. Given all these, cryptocurrencies will become more common even in small and medium businesses (SMBs).

Moreover, cryptocurrencies have become part of our daily lives. For instance, Amazon (AMZN) and Shopify accept crypto payments to check out orders.

More interestingly, cryptocurrencies are already accepted in many restaurants. Starbucks (SBUX), Burger King (QSR), and KFC (YUM) are just some of the notable brands accepting these payments. SBUX is a famous coffee shop, while the other two are known quick-service restaurants (QSRs). So whether casual dining, fine dining, or quick service, whatever best POS system for restaurants implemented, cryptocurrencies are already accepted.

Government Agencies Are Also Accepting Crypto Payments

Despite being unregulated, government agencies have become more open to crypto as a product of the fintech revolution. Of course, many developed economies, such as the US, are still wary of cryptocurrencies, particularly Bitcoin. Its decentralized nature remains the primary reason behind this.

Policymakers are apprehensive about its capacity to circumvent government-imposed capital controls. While it promises freer financial transactions, governments see risks of unmanageable capital flows across nations. According to Chainalysis, more than $50B of Bitcoin moved from East Asia to other countries in 2020.

On a lighter note, some nations view cryptocurrencies as an opportunity to drive more capital inflows to boost economic activities. These will be pivotal to their rebound as their respective capital markets draw an influx of investors.

In Singapore, government agencies accept Ethereum contracts as payment for their services. This is one of their ways to veer away from siloed centralized payment systems. We can attribute it to Ethereum leading the blockchain technology, making it more secure today.

Note that Singapore is one of the most robust economies in the world. Hence, it will not be surprising if its neighboring countries emulate its economic recovery and development roadmap.

The cryptocurrency market is expanding and thriving today. Given its enticing growth prospects and rising popularity, trading and holding can be practical for individuals and entrepreneurs.