The crypto realm is so much more than just Bitcoin. Bitcoin has been a (sometimes) fun, (sometimes) rewarding speculatory tool for investors and going into the second half of 2021, it is seeing a lot more institutional interest, with the likes of Goldman Sachs creating funds for their wealthy clients.

However, Bitcoin is not fit for purpose as a means of currency exchange, as it is far too spiky, can be moved far too easily by a few Twitter comments, and the Blockchain behind it has no real utility beyond hosting Bitcoin transactions.

There is though a whole world of crypto and blockchain beyond that of Bitcoin, which is disrupting not only the financial industry and getting central bankers and regulatory bodies hot under the collar. Let’s take a look at where the real potential lies.

DeFi

This is a very hot topic. DeFi, short for Decentralized Finance proposes an entirely new way to conduct all of our banking and financial transactions by removing the element of the middleman.

DeFi could soon completely replace the Central Banks that currently monitor and control our monetary systems and it is this that is getting authorities antsy.

DeFi gives users access to platforms based on the blockchain where they can trade, invest, stake, loan and borrow funding.

Because of its nature, all transactions are authenticated and verified automatically over the blockchain. The blockchain is nearly impenetrable and closed to hackers due its model of decentralization.

Data is stored over a huge network of computers (nodes) all over the world, making them nigh-on impossible to hack into. DeFi gives investors access to earning opportunities that are not available in the centralized market places, through for instance staking.

This is a way investors can seek passive yield by staking their digital holdings.

Other utilities of DeFi include prediction markets, AMM (automated market maker), these are algorithms that can automatically look for the best opportunities in the market, while managing risk and maximising returns.

Finally, projects are available for borrowing and lending Cryptocurrencies for interest.

NFTs

NFTs, another hot topic in 2021, are non fungible tokens, where each one is completely unique. They can represent art, music or any kind of digital media and are minted, bought, sold and auctioned off.

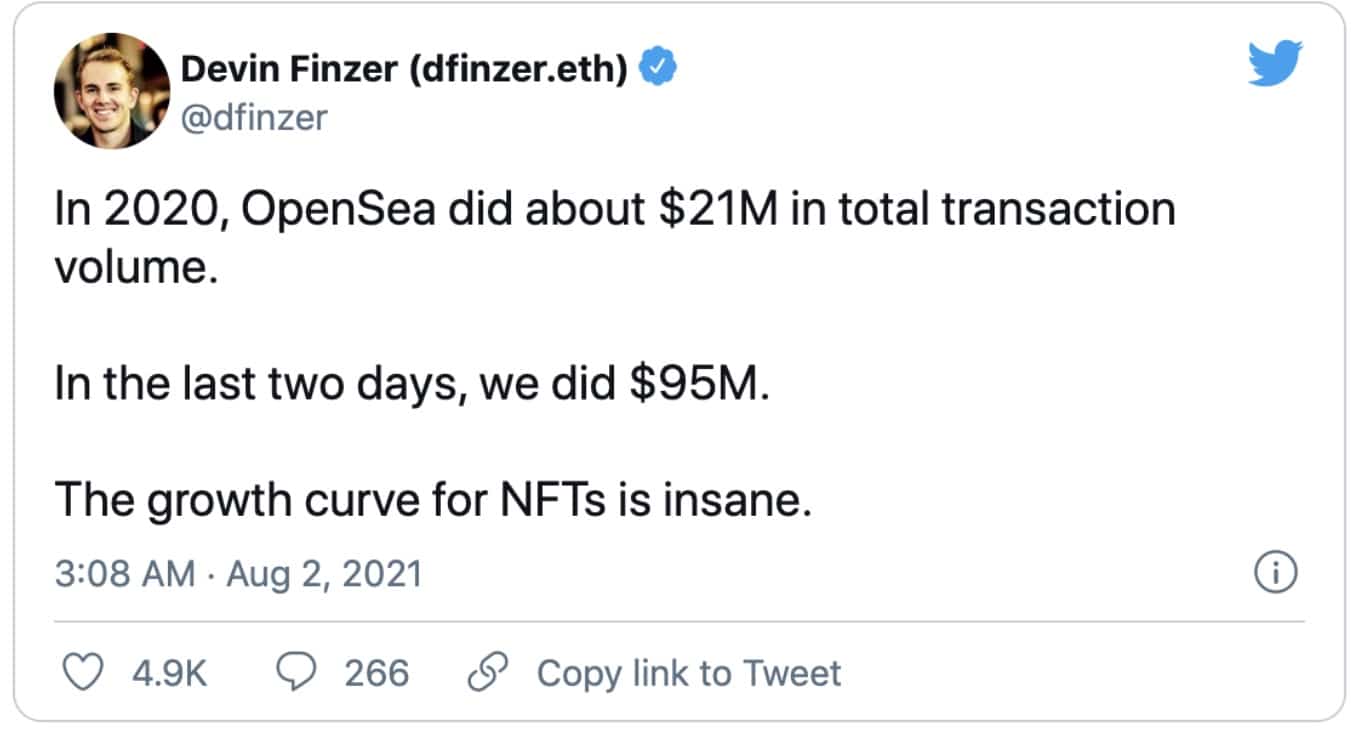

One NFT platform, OpenSea, is seeing remarkable statistics for 2021. They are now processing more transactions each day than in the entire year of 2020.

The co-founder and CEO of OpenSea, tweeted that the platform had processed $95 m worth of transactions in just two days.

This marks an increase in daily transaction value of over 650 times since 2020. No mean feat and a sign that NFTs are very now and are here to stay.

A marketplace like ours at Hoard is a gateway to this fun and lucrative industry. It allows users to trade, buy, sell, loan, or rent non-fungible tokens (NFTs), like in-game items, digital art, and even domain names. For developers they can integrate game items with the Ethereum blockchain.

Cryptopunk NFTs

Cryptopunk NFTs are a collection of 10,000 NFTs which are highly collectible and they have an extremely active resale market. In 2017 their creators distributed them for free and since then they have been sold for 232,000 ETH, ($578 million at today’s value) with each NFT valued at an average of 22 ETH.

One particularly rare cryptopunk has just been put up for sale for $90.5 million which would make this the biggest CryptoPunk sale ever.

Tokenized Assets

In 2021, literally anything can be tokenized from wine, to mortgages, to any physical asset. Sometimes they are backed up by collateral, eg, real bottles of wine, and sometimes they simply represent data.

Once the asset is tokenized it can then be moved, stored and transacted on the blockchain. Tokenization includes fungible assets, like those that can be swapped for another directly eg. Bitcoin and non fungible, eg. those that are unique.

It is worth mentioning stablecoins here because they are a really powerful use of the blockchain. It is a way to take a token and to peg it to a stable asset like an index, gold or even the USD to keep its value in a reasonable range.

Stablecoins can really be a useful tool for currency exchange and it is for this reason that governments have been scrabbling about desperately trying to launch their own CBDCs, Central bank Digital Currencies.

The Bottom Line

2021 was massive for the blockchain industry and with the space moving forwards at warp speed, you can only imagine what 2022 will bring for this fascinating realm. Platforms and projects like ours here at Hoard are pushing the boundaries of what we can achieve on the blockchain and we are excited to see what the future will bring for this arena.

Radosław Zagórowicz, the CEO and co-founder of Hoard, is an expert software developer and blockchain specialist. With ten years of professional experience, Radoslaw is highly skilled in project management, software design, algorithms and blockchain technology.

Radosław Zagórowicz, CEO of Hoard Exchange

With a master’s degree in applied mathematics from the University of Warsaw, Radoslaw has worked as a software developer with prominent brands like Samsung Electronics R&D, and Institute for Structural Research. He is also a founding member of the Golem Network, a board member at imapp.pl, and has been involved with Ethereum ecosystem development since its very beginning.