For all the hype that surrounded Bitcoin, there’s one use case that has eluded it to be truly considered a currency – Payments . Bitcoin has been highly volatile so merchants have had difficulty assigning prices to goods and services in the currency.

For businesses, managing cash flow while supporting such a volatile tender could be a quite the challenge. Bitcoin also suffers from slow confirmation times. In a retail setting, waiting a minimum of 10 minutes for confirmation is just impractical.

These issues, however, haven’t stopped other Blockchain and crypto projects from bringing the technology into the payments space. Ventures like TenX offer means for crypto asset holders to spend in currently available physical and online points-of-sale through mobile wallets and physical cards.

Stellar and Ripple’s networks aim to be the transactional backbone for financial institutions, promising the speed and scale that Bitcoin isn’t able to provide.

Still, the key issue surrounding payments today is friction. Stakeholders demand hassle-free ways to transact. As such, modern payments solutions must be able to create a superior customer experience that provides features and mechanisms beyond simply transferring value from one person to another or making cryptocurrencies readily spendable through existing mechanisms.

It is in this regard that new crypto payments venture COTI plans to make a difference. COTI, short for “Currency of the Internet,” is a new digital currency that seeks to solve the payments needs of modern commerce.

The platform bridges the familiarity of traditional methods with the strengths of crypto payments. It promises lower fees and speedy transactions. In addition, core to the service is its Trustchain protocol which rewards participants’ good behavior.

Here are four ways COTI can provide a better frictionless payments experience:

Trust

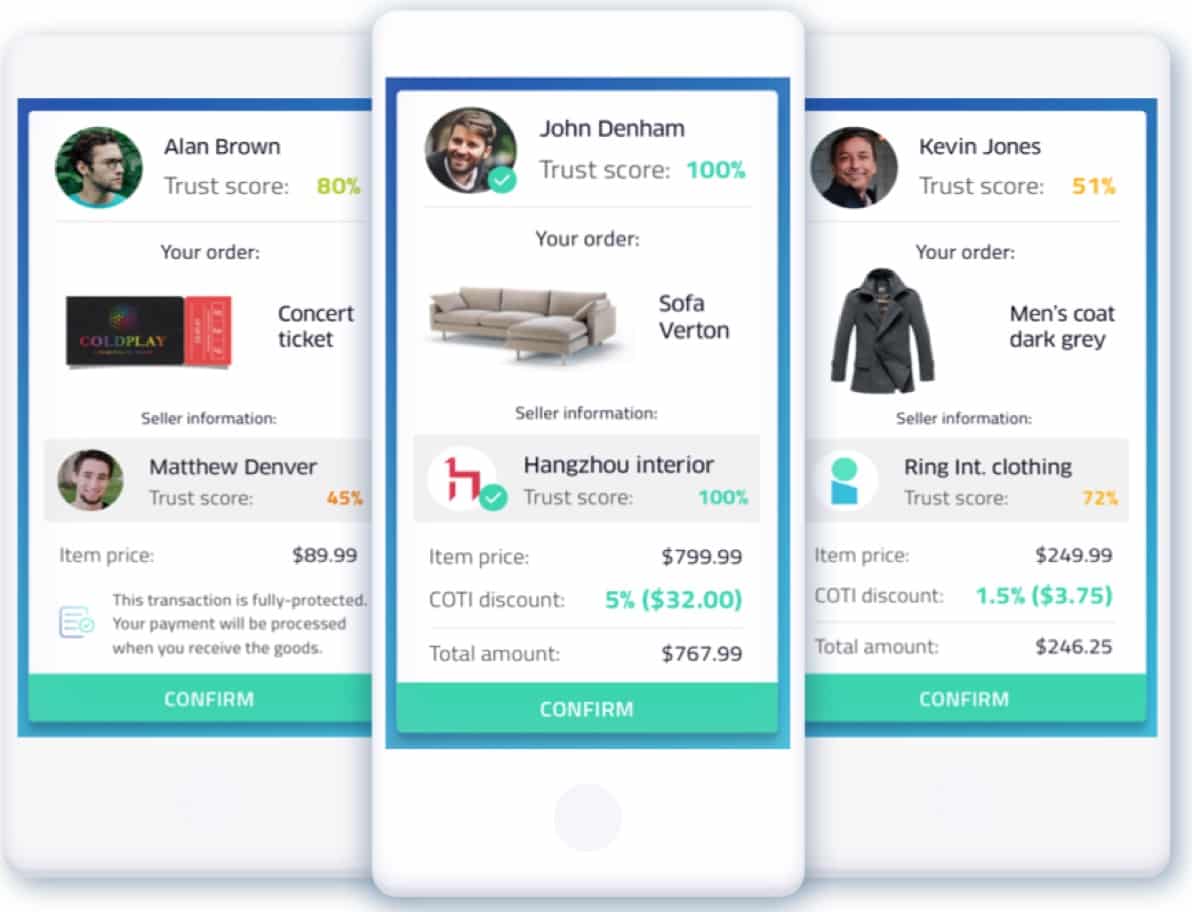

Aside from featuring a currency token to facilitate transactions, COTI offers various features that enhance the payments experience. A key part of its proposition is how it has placed trust at its center. It features a trust scoring engine that evaluates users’ activities, assigning each one a trust score after every transaction.

Those who consistently engage in smooth and issue-free transactions can gain an ideal trust score. Those who don’t are scored unfavorably. The protocol then uses this trust score to determine how much fees users need to pay for using the system. Those with impeccable records pay zero fees.

In addition, COTI has mediation and arbitration mechanisms that help resolve issues among users. This is done in a decentralized manner, using a pool of peers to help decide on cases. This can provide an equitable way to settle disputes unlike with traditional payment methods that are typically decided upon by the payment company’s agent.

Biases may come into pay too. Merchants, for instance, stand to lose much to card and chargeback fraud since most card companies decide in favor of card owners. Most cryptocurrencies also do not have such dispute resolution mechanisms in place.

Speed

The problem of scalability hampers even established cryptocurrencies like Bitcoin. Slow confirmation times and its network’s limited ability to process more transactions per second make Bitcoin highly inefficient for payments.

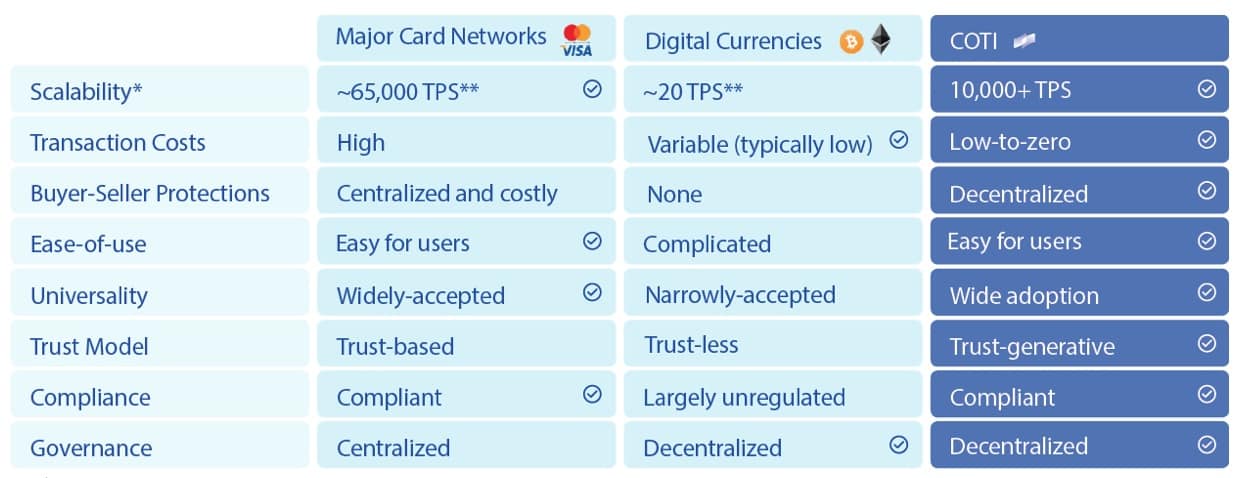

Bitcoin only processes an average of slightly above 2 transactions per second (tps). In comparison, card network Visa easily handles 2,000 tps and can accommodate up to more than 50,000 tps at its peak.

To solve this scalability issue, COTI uses a directed acyclic graph (DAG) architecture. DAG networks are essentially designed to be able to handle more transactions the more it is being used. COTI can handle 10,000 tps.

This allows the network to provide quick confirmations. Transactions also don’t have to be routed to various intermediaries and be subject to clearing processes allowing for virtually real-time crediting of funds to the other party’s wallet.

Costs

Traditional payment methods typically involve middlemen such as the point-of-sale processor, the payment network, and the bank. The involvement of each of these intermediaries add to the time it takes for transactions to complete.

Each of them can also charge fees which leads to higher prices just to use the service. Card networks, for instance, earn from both users and merchants through currency conversion fees (especially for cross-border transactions) and processing fees.

Crypto payments are supposedly cheaper since all the processes take place on the blockchain. It takes away the need for intermediaries. However, some cryptocurrencies like Bitcoin require mining fees for transactions to be processed.

Depending on the prevailing rate, these fees could be significant. At its peak, Bitcoin fees even reached over $30 to have a transaction processed. COTI’s use of DAG eliminates the need for miners which allow for cheaper usage. It’s then left to the Trustchain protocol to determine the fees to be levied upon users.

Relevance

Today’s business environment now involves new forms of commerce. Peer-to-peer (P2P) selling has become huge. Thanks to improvements in logistics and low barriers to putting up online shopping carts, cross-border ecommerce is also gaining steam. In China alone, cross-border sales was expected to reach over $100 billion last year. The rise of cryptocurrency prices have also empowered the new “crypto rich” from all over the globe.

These new activities and circumstances have also created several complications for payments. P2P commerce requires secure but affordable payment methods. Cross-border payments also need to be able to support multiple currencies including both fiat and crypto. COTI, through its mechanisms, could readily address these specific commercial use cases.

As a crypto-based service, it can provide the security needed to facilitate payments between peers. The platform also features currency exchange integration as a means to seamlessly support various currencies.

Minimizing friction

COTI essentially bridges the strengths of both traditional methods and crypto payments. It minimizes friction by delivering the convenience that has been made familiar by conventional payments such as speed and liquidity through multi-currency support. However, it further enhances the experience by minimizing costs and eliminating fees even for cross-border transactions.

Perhaps best of all, by putting trust as core to the platform’s own economy, COTI encourages good behavior among participants. This contributes greatly to creating a frictionless experience that many current crypto payment services still struggle to provide.