The meaning of the word “trustless” may seem paradoxical to some at first glance, however the meaning of the word may imply a lack of trust or trustworthiness. When we speak about Blockchain technology as “trustless”, we mean that the trustworthiness of blockchain-based systems is absolutely unparalleled, given its attributes as fully automatic, transparent, and immutable.

This is why blockchain technology is taking the world by storm – for the first time ever, financial, governmental, and so many other kinds of systems can be built without reliance on any centralized entity. Hundreds of blockchains that serve meaningful and innovative purposes have appeared on the scene throughout the past year, and more are being developed every day.

While many of these blockchains stand to change the world, there are few things standing in the way. A lack of interoperability in the blockchain sphere has long been one of the major obstacles preventing blockchain technology from widespread adoption.

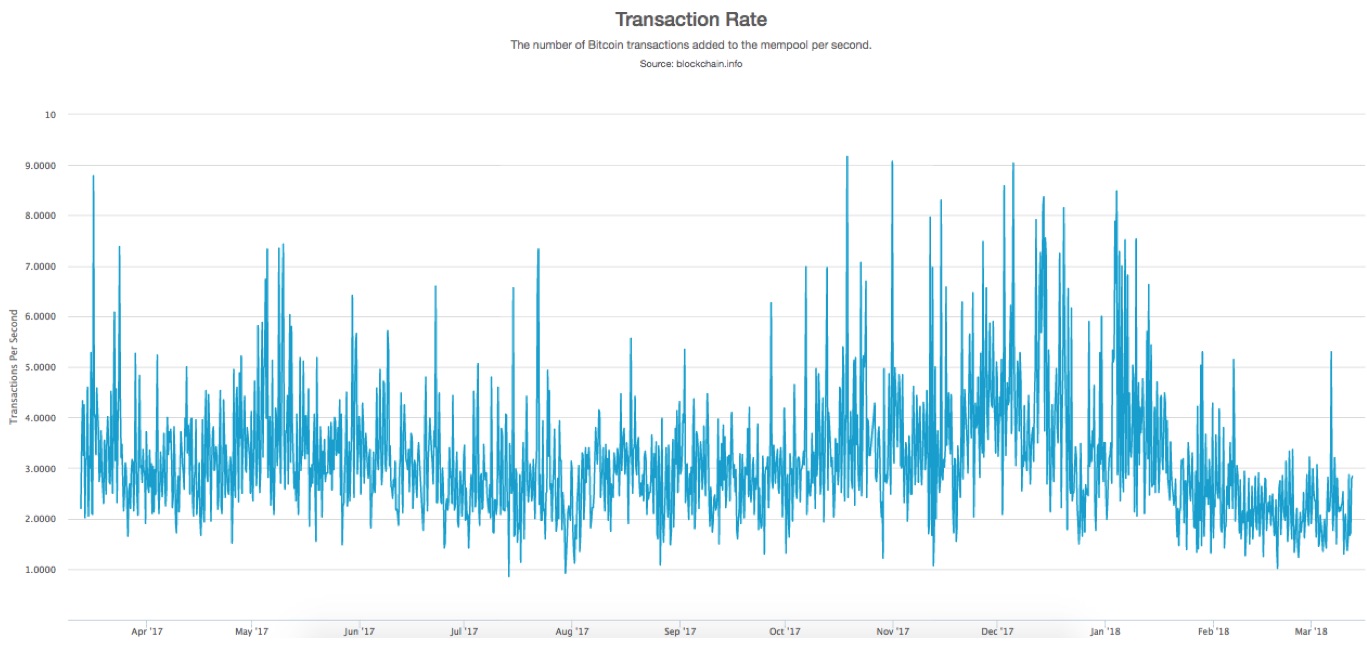

Scalability has also stood as one of the more well-known issues in the blockchain sphere. Perhaps the most well-known set of scalability issues have belonged to the Bitcoin network – at worst, BTC transactions could take hours and hundreds of dollars to process.

A few platforms have been developed specifically to address these issues. These have focused on helping facilitate scalability and interoperability, while also making the blockchain world intercept more closely with the rest of the world.

One of these is Fusion, a blockchain network developed by DJ Qian, who also happens to be the Founder of VeChain and Qtum.

What is Fusion?

Qian’s new project has been described as a ‘blockchain of blockchains’ – a network that allows its users to send and receive value in the form of various kinds of cryptocurrencies. As such, Fusion hopes to act as the basis for what it's creators call the Internet of Values (IoV) – an infrastructure of value transfer based on various crypto tokens.

While a number of blockchain networks and other pieces of technology (including Polkadot, Cosmos, Ripple, and the Lightning Network) have been developed to facilitate cross-chain interactions, Qian’s network is (in many ways) the most versatile and powerful among them.

Interoperable smart contracts, risk free loans, and off-chain data integration

The Fusion network is the first that of its kind that is capable of offering its users the ability to create smart contracts that can accept and dispense Payments in more than one kind of crypto. For example, a user could create a smart contract for a retirement account that could accept payment in the form of Ripple, Ethereum, and Bitcoin, and could disburse payment in the form of these cryptocurrencies as well as Dash and TrueUSD.

Interfaces that will allow Fusion to integrate “off-chain” data sources are being developed along with the network itself. These interfaces will make it possible for smart contracts on the platform to interact in real time with data sources that will allow for the development of smart contracts that can be used to distribute royalties, collect mortgage payments, and create risk-free loan contracts.

Qian has also explained that the network will employ third-party auditors to ensure that loan contracts formed on the network can be trusted.

Fusion also enables the development of what is refers to as a “control and management layer” that can operate across all blockchain-based networks. The network uses its nodes to control the private keys of the cryptocurrencies that are hooked into its platform. This also facilitates the ability to create multi-token wallets on the network.

Scalability, smart Contracts, and off-chain data streams

Scalability on the Fusion network is powered by the use of a hybrid of both a Proof-of-Work and Proof-of-Stake protocols. Proof-of-Work uses mining to create new blocks and provides block rewards to nodes with the most hashing power; Proof-of-Stake distributes block rewards based on token ownership, thus providing an incentive to stabilize the network by holding tokens long-term.

Smart contracts on the network also make use of multiple triggering mechanisms, meaning that they can be ‘plugged in’ to more than one source of data or pay-in in order to execute their functionality.

The Fusion blockchain also happens to be open-source, meaning that the code can be reviewed by anyone at any time.

An ICO mechanism designed for inclusivity, low fees

To prevent centralization of the network, the Fusion ICO was designed so that the token would be distributed among as many participants as possible. This consisted of a mechanism that is a 323-line Smart Contract on the Ethereum network

For one thing, the mechanism ensures the token sale would take place over a period of ten days. This window of time allowed anyone interested in purchasing tokens to have the opportunity to do so--many ICOs are over within hours (or in some cases, minutes) after their beginning.

Additionally, the smart contracts used in the token sale mechanism leveled the playing field in terms of gas fees – often, token sale participants with large amounts of money will pay massive gas fees to be put to the front of the token-purchasing line. The Fusion token sale mechanism ensured that participants were given the chance to buy tokens on a first-come, first-serve basis.

This mechanism can also be used to raise capital for firms seeking to tokenize their value – compared with traditional IPOs, this particular mechanism is far less expensive, much more secure, and incomparably more inclusive towards investors.

The future of cryptofinance

While in the current financial climate cryptocurrencies are often spoken about as a tool for making the rich richer and making financial institutions even more powerful than they already are, Fusion stands as a network that has been created with the intention of allowing any and all interested parties to make use of it.

Ultimately, Qian’s new platform is a network that has been developed as a collaborative tool. “Project Fusion will continuously embrace community,” an executive statement from the project reads--these can include “technical communities, college communities, user communities, investment communities, node participant communities, central organizations, and data source providers.”

The simple truth of the matter is that most of the use cases for blockchain technology have not even been conceptualized. However, if all goes according to plan, Fusion could find itself as the center of the world of cryptofinance.