Is there a new offer on the market for clients looking for more intuitive trading? In the last decade, the retail Forex market has expanded to an enormous size with more and more brokers competing against each other.

Since competition among firms is a net positive force for retail traders, we will examine and review one of the industry’s most promising firms, LegacyFX. Altogether, LegacyFX provides traders with five trading platforms – four of which are basedon Leverate’s trading technology: SirixStation, Sirix WebTrader, Atom8, and mobile.

The latter platform is MT4 – a world leader among trading platforms. Our review starts with the Atom8 platform, known as Legacy webtrader. This platform is an intuitively simple one that should be welcomed especially by more novice traders or clients who do not need complex and large desktop software.

While this option is simple in its functionality, the platform has everything a trader would want for trading.

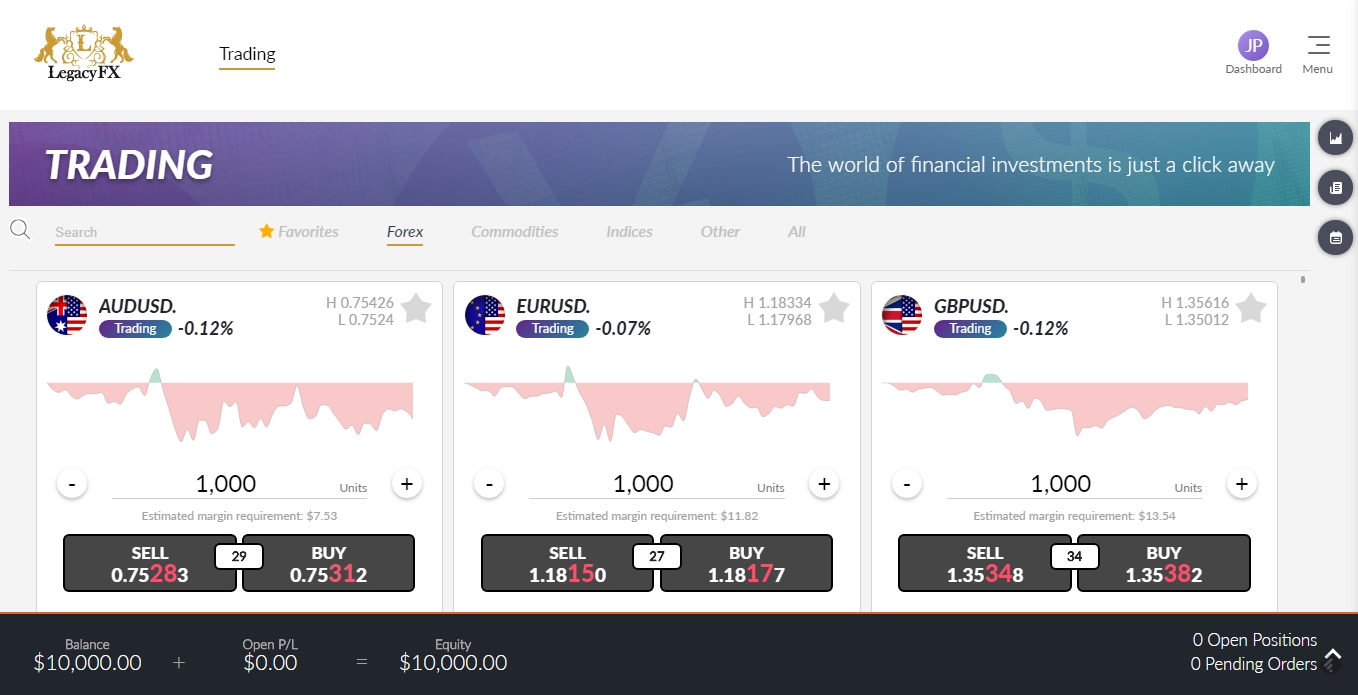

The main dashboard shows us three charts as the leading elements of the screen. We can also see at the bottom of the screen, basic information related to our financial condition, such as Balance, Open P/L and Open positions, along with Pending orders.

On the right, we can also see a robust set of options as well as the menu. Here, traders will be able to effectively tailor their user experience to their own specifications. This also includes changing the language of the platform or to log out. On top of that traders will find market analysis, news, and a calendar. All answers or queries are easy to find.

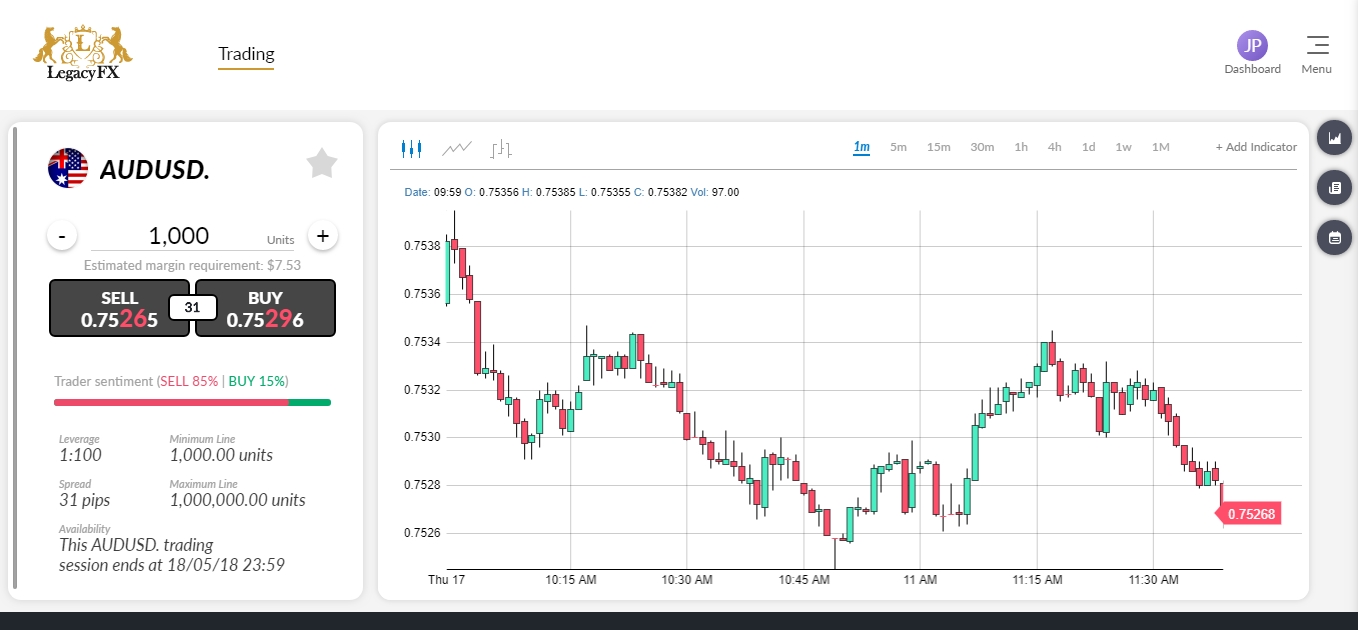

At any moment we can explore one of the charts seen on the main dashboard. A simple click on any chart will lead us to a screen where we have a more detailed chart and trading options on the left.

The chart itself may present the price in one of three modes – Candlesticks, Line, and Bars. The platform also allows adding basic indicators. Although there are only a few of them, thereare enough of such options available to analyze the basic market action.

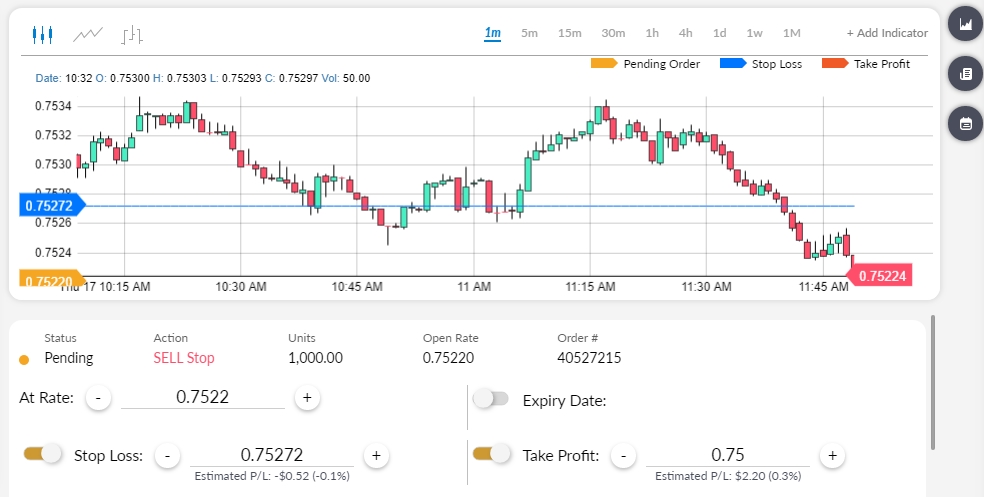

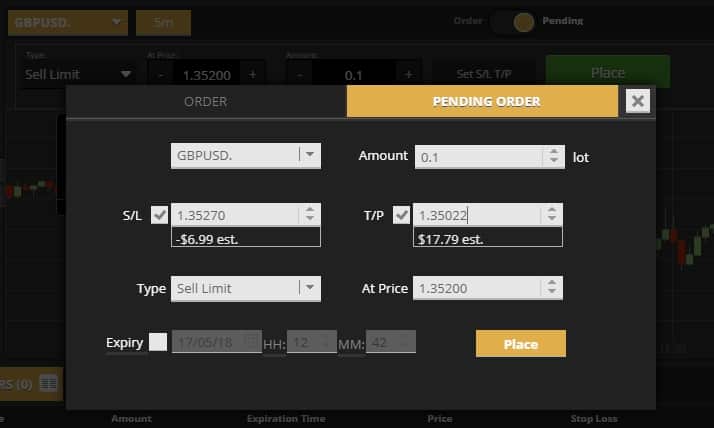

Placing orders on LegacyFX’s platforms are both easy and intuitive. We can do it from the main dashboard screen or from the detailed chart perspective. In both cases, a pending order can be altered very easy.

Traders will also be able to add/change STOP and LIMIT orders. The simplicity of that version of the platform will not create a problem even for beginners. Overall this platform is very easy to navigate and very easy in its design which some traders will find as an advantage while others might see it as a weak point.

More demanding clients may choose the Sirix Desktop platform or SirixWebtrader. Since the Sirix Desktop platform is much more advanced than most other desktop platforms on LegacyFX’s offering, we have decided to test the webtrader version.

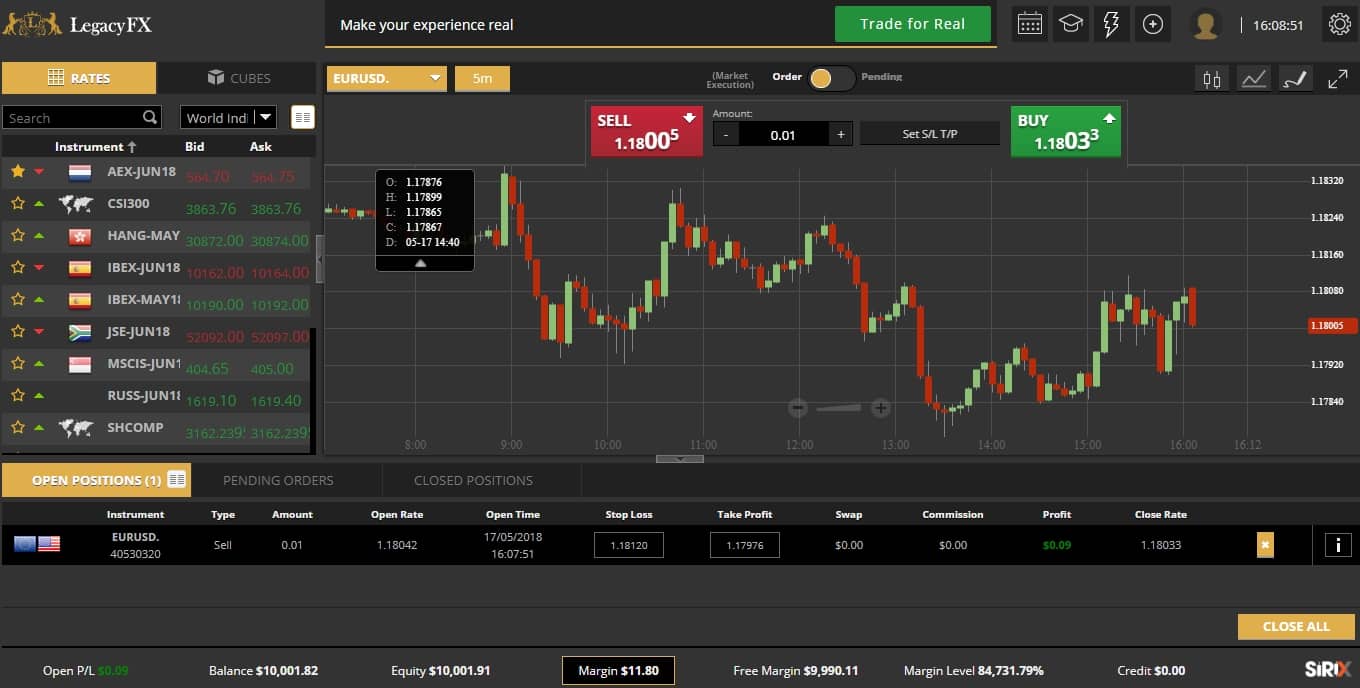

After logging into their account, traders can explore the main dashboard. Even though it is more advanced than that of Atom8 it does not overwhelm the user. Rather, everything seems to be in the right place and flows in an organic way.

Users can find quotes on the left where they can choose from different categories of assets. We also have a large main chart, centralized on the screen, in tandem with the main account information at the bottom. Everything seems streamlined and easy to navigate.

By comparison, the platform offers much more indicators than Atom8. As this is the webtrader version, the range of indicators should be enough even for the most demanding client.

The suite of chart types is the same as in Atom8, allowing users to choose between Candlesticks, Line, and Bars. There are, however, much more drawing tools, ranging from lines to projections.

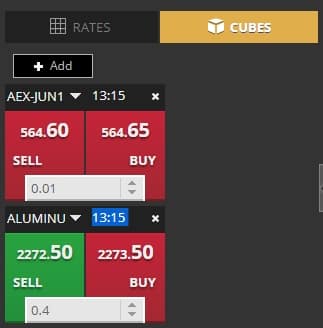

Placing orders isalso a simple process as it was on the Atom8 platform. It can be done from a position above the chart where we see SELL and BUY buttons. However, it can only be done from so-called cubes.

Thisis an interesting solution, especially if the trader has a list of favorite markets in which he or she most often trades and does not need a long list of instruments from which to choose.

When leaving the pending order view, the user can immediately (or later) change the parameters. It is also possible to add STOP and LIMIT orders. Everything in an easy way – either by choosing, +/-, or simply inserting proper values with the keyboard. When a position is finally opened, it can be closed very quickly with Close or Close All buttons which is very convenient.

Lastly, the LegacyFX platform has a special appeal for clients on the go as it offers a mobile platform available for Android, iOS, Windows-Mobile, and HTML 5 based mobile phones and tablets. It can be downloaded from the Apple App Store or Google Play.

The mobile platform allows users to not only view charts but also to open, modify, and/or close existing orders, view the trading history, and more. The layout is very similar to what can be seen in webtrading versions. The interface is also very easy to navigate and to use.

To summarize, LegacyFX’s comprehensive offering is suitable for all traders but especially for beginners who will find all available platforms very intuitive and easy to master. Combined with a good overall Fx/CFD offer that includes ECN accounts and the fact that LegacyFX is a regulated broker licensed by CySEC , traders have access to a truly complete package.

Disclaimer: The content of this article is sponsored and does not represent the opinions of Finance Magnates