The real estate industry is among those that find themselves in quite the predicament, due to the Coronavirus outbreak. In most regions, real estate companies have been enjoying stability, prior to the pandemic.

However, because of the economic downturn globally, many housing and property markets are now hurting. According to McKinsey, the industry’s value chain has been disrupted with players experiencing reduced operating income and developers experiencing delays.

And these aren't the only things real estate companies have to face these days. The industry now finds itself the subject of lawsuits, concerning their listing websites not complying with the American with Disabilities Act (ADA).

According to web accessibility platform accessiBe, only a small fraction of the 10 million web pages it studied actually meet accessibility guidelines. Real estate websites are likely to have similar results.

Since web development isn't the core business of most real estate companies, working on compliance may prove to be quite the challenge.

In response, many real estate companies have partnered with accessiBe to help their websites meet the necessary accessibility standards for ADA compliance.

The platform leverages Artificial Intelligence (AI) ) to automate the auditing and remediation tasks required to quickly implement accessibility features.

ADA Lawsuits Threaten Real Estate Companies

ADA cases against companies have risen over the past few years. ADA lawsuits involving web accessibility filed in federal courts increased by 177 percent from 2017 to 2018. 2019 saw over 2,200 cases filed.

Real estate companies have found themselves subject to such suits. Compass Real Estate, for example, found itself facing such a lawsuit in 2018.

A blind man filed a case against the company alleging that he had failed to get information on Compass’ location and operating hours on its website.

Recently, Zillow, Zumper, Move Inc., and CityRealty.com were all reported to have been sued by a single plaintiff who claims that these sites were inaccessible to visually impaired users.

The National Association of Realtors (NAR) has discussed the matter among its ranks and promoted ADA compliance a matter of importance for its members.

According to the NAR, other members have already reported receiving letters from law firms claiming that their websites are non-compliant due to the lack of accessibility features.

Perhaps more troubling is that many of these parties are looking to settle for fees rather than promote real accessibility in the industry.

While the merits of individual cases vary, just the threat of facing lawsuits alone should worry companies. Involving lawyers can cost thousands of dollars.

Should their sites actually be found to be noncompliant, they can be fined as much as $55,000 for the first violation.

They may also have to deal with the bad press and its effects which may possibly include losing both existing and potential business.

How accessiBe Makes Real Estate Sites Compliant

accessiBe offers companies the necessary protection against such lawsuits by helping them achieve ADA compliance and making their websites accessible.

Conventionally, making an active site accessible involves checking each website element if it conforms to standards. Fixing these issues manually usually require additional code or development.

Many real estate companies rely on external expertise for their web development needs. Embarking on such a remediation effort to improve accessibility will require significant resources if done through conventional means.

Property listing websites, for example, may have hundreds or even thousands of pages of content. Manually auditing these pages alone including all the text and graphical content they contain will be a tedious task.

Through its AI-powered platform, however, accessiBe is able to trim down the time and effort required to achieve compliance. Users only need to integrate a single line of JavaScript code to the site.

Within 48 hours, accessiBe's AI would have fully scanned and implemented the changes needed for compliance.

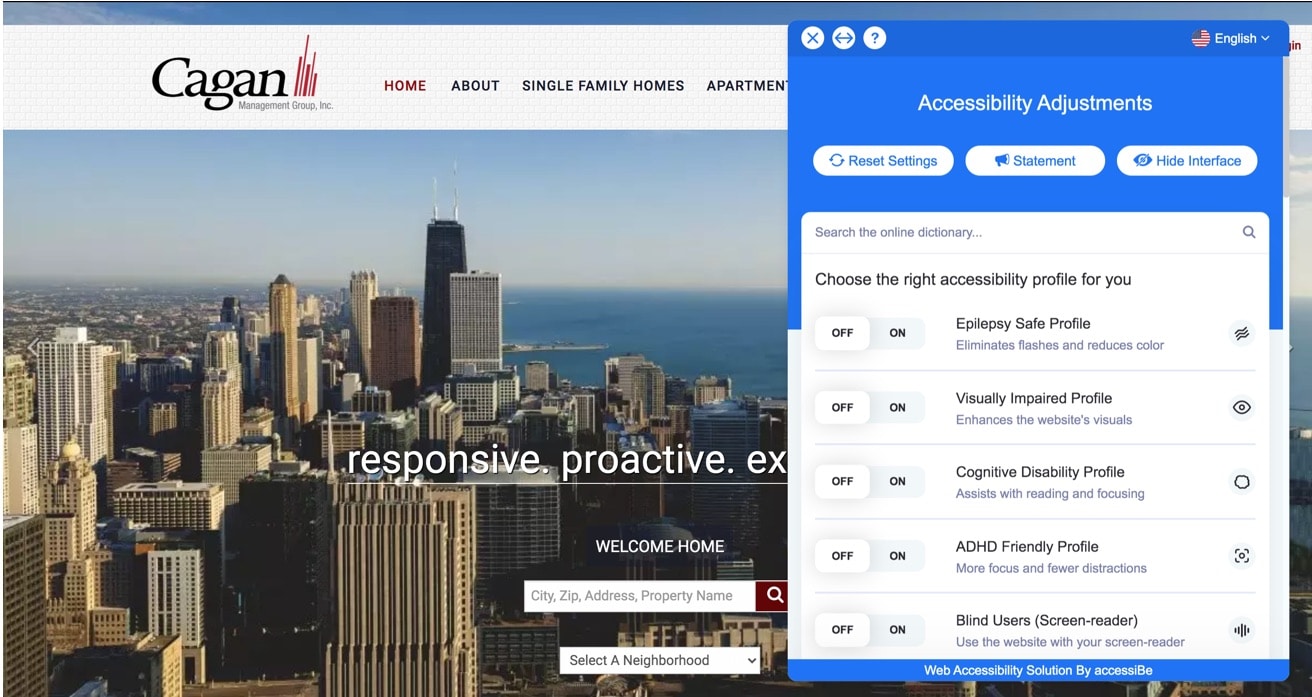

Property management firm Cagan Group was able to quickly make their sites accessible using the platform which the company claims to be much faster than what other remediation services offered and at a more affordable cost.

accessiBe’s interface in action on Cagan Group’s website

Integrating the code enables an accessibility panel which visitors can use to apply visual changes to the site. This includes options to adjust font sizes, text and background colors, and even disable animation.

These help the visually impaired improve the readability of the web content. Disabling animation prevents users with epilepsy from seizing due to flashing visuals.

It uses image recognition to apply the necessary alt tags to pictures. These 'alt-text' tags are used by screen readers to describe what pictures contain, enabling blind people to consume such content.

Remediation also includes making sure that the site is navigable using the TAB key. This allows those with motor impairments to effectively cycle through each page element using special input devices.

The platform also readily gives visitors access to a dictionary to help cognitively impaired users make sense of technical terms and abbreviations.

For continued protection, accessiBe scans websites every 24 hours and applies remediation for any new issues found.

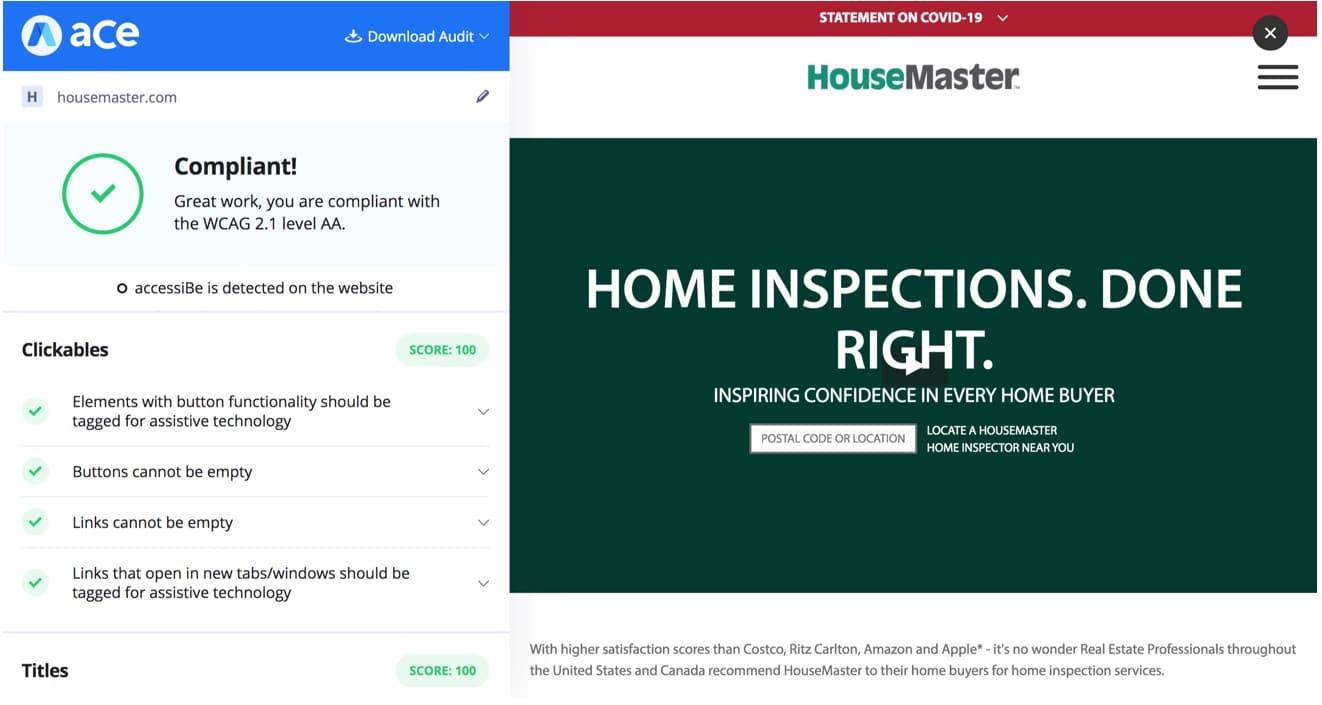

To further help companies, accessiBe also recently launched aCe, a free accessibility compliance checker. Companies can simply type in their website URL to check if their site meets accessibility guidelines.

The results of an ADA audit made by aCe

The tool scans website elements and returns a detailed list of the elements where the site can fall short including buttons, titles, navigation, and menus.

The results provide both numeric scores and explanations about how to fix each issue.

accessiBe is already being used by 44,000 companies including brands such as BMW, Avon, Hilton, and Seiko.

Their real estate clients include HouseMaster, WC Smith, Residential 1 and many others. Earlier this year, the company raised $12 million in its Series A which is earmarked for growth and expansion.

Opening Real Estate Listing Websites For Everyone

Real estate companies deal with the basic of human needs. As such, companies operating today should promote inclusion and accommodate people with disabilities. Web accessibility is important, and remains a struggle for most, real estate companies can look at adopting a solution like accessiBe.

Not only does it enable them to take away the grounds for a party to file a case alleging poor accessibility, it also allows them to do the responsible thing and provide people with disabilities equal access to the valuable services that they provide.