Perhaps the biggest learning lesson from 2020 has been that the workforce is resilient and can adapt with the right direction and leadership.

From changing business operations to remote work, the global workforce evolved very quickly to keep their organisations not just afloat but competitive. Will 2021 be any different?

For one, we still aren’t completely out of the woods regarding the coronavirus pandemic. On the other hand, the biggest events that we had expected to move the markets in 2020, such as Brexit and the US presidential elections, are done and dusted, albeit with some unexpected twists.

Against this background, there are some things entrepreneurs should keep in mind to make the most of 2021.

Continued Digital Transformation

The shift to the virtual world, speeded up by the pandemic, illustrated the benefits of digital transformation. Even without lockdowns and the need for social distancing, these benefits are likely to drive a continued move towards digital service provision.

Fintech emerged from the 2008-09 financial crisis but mass acceptance of fintech came with 2020 as people were forced, not just to work from home, but to access everything they needed without leaving home.

Most businesses responded with agility. For instance, physical events were replaced by webinars and virtual conferences and businesses adopted communication tools that eased their connection with both employees and customers.

The retail and food industries were a classic sink or swim scenario. Many thrived with the adoption of social media marketing, online ordering, apps and deliveries.

The success of these alternatives means that they are likely to remain vital for 2021 and beyond.

Adaptability and Flexibility

We learned that the physical presence of every employee wasn’t essential to business success. With the work-from-home system, not only did employees get greater flexibility in scheduling their work day; geographical boundaries no longer restricted them.

This has been a huge advantage for businesses. Without the need to have employees present in an office, entrepreneurs could tap in to a much larger and more diverse talent pool.

When geography stops limiting the hiring process, we can ensure hyperlocal services, run by remote teams across different regions of the world.

In fact, at Deriv, we’ve always taken pride in our hugely diverse workforce, consisting of employees from over 45 different nationalities, working through unified teams in different parts of the world.

The key to remaining competitive was to quickly adapt to remote work, with time-shifted schedules that allowed us to continue to provide localised support to our clients.

Empowering the Workforce

Work-from-home requires greater attention on employee morale, engagement and motivation. So, investing in the biggest asset of your company, your workforce, should be a key focus and not just in 2021.

Staying connected with your employees via video conferencing tools helps you stay updated on how they are doing, the challenges they are facing and what support can be provided to make life easier for them.

In fact, a McKinsey survey in 2020 revealed that employers who remained engaged with their workforce and learned about their needs saw better business outcomes than those that didn’t connect with employees.

Employers need to be mindful of the wellbeing and mental health of their employees. This requires additional vigilance and compassion in comparison to everyone being physically present in an office.

Deriv believes that one of the crucial steps in enhancing employee engagement and motivation is to help them upskill and reskill themselves regularly.

By investing in the growth of employees, businesses stand to gain, not just a much more skilled talent pool but also greater employee retention.

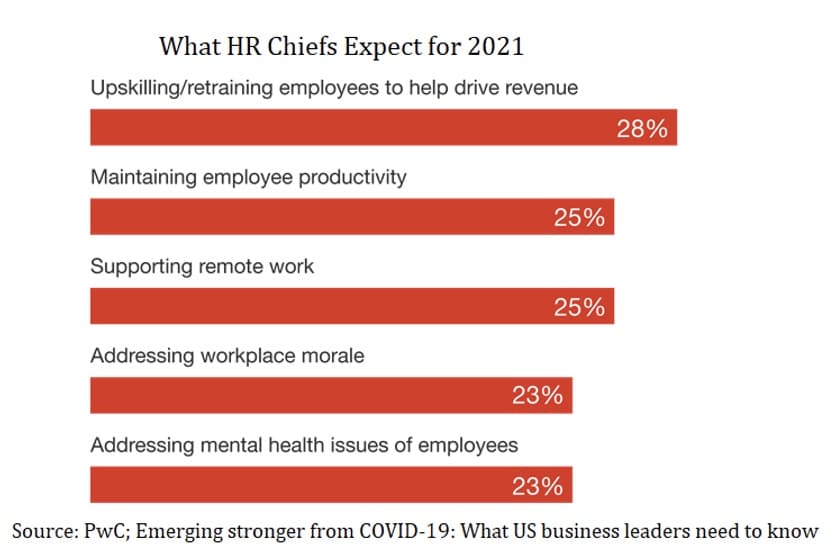

Aside from empowering employees with the right support and skills development; rewarding achievements, contributions or just hard work, can work wonders on remote teams too. A recent PwC report listed areas that Chief HR Officers expect to be a key focus for 2021.

Strong Leadership

To bring a remote team on board with the mission and vision of the company, ensure flexibility and agility; the leadership needs to be strong.

Remote work is especially challenging for the financial services sector, given the need to comply with stringent regulations and security protocols which differ from one region to another, while ensuring seamless service provision.

The way we ensured a smooth transition to work-from-home, while maintaining continuity of services was to ensure that each employee was empowered with the right tools to fulfil their responsibilities.

Our Founder/CEO and senior management at Deriv, stepped up to the plate with a strong leadership ethic, so that employee morale and motivation did not dim, even during the worst times of the pandemic.

We fully utilised remote communication tools to foster strong connections between remote employees and contractors.

The need for strong leadership continues into 2021, as we support our teams across the world to fulfil Deriv’s mission to make trading convenient and accessible for everyone.

Empowering Traders

Supporting traders and offering them robust tools for informed decision making will be of utmost importance in 2021.

Global lockdowns brought thousands of new traders to the financial markets, with brokers across the world reporting a significant rise in the number of new account openings.

These new entrants to the financial world are looking for educational resources and guidance that will enable them to navigate the volatile markets.

Although the biggest events that led to market volatility in 2020 no longer exist, 2021 has its own share of market moving events to contend with.

The world is looking at how Brexit pans out for both the UK and the EU. Obstacles to smooth cross-border trading could raise concerns.

On the other hand, with President Biden in the White House, countries across the world are hoping for bilateral relations between the US and China, as well as several other nations, to be smoothed out. Whether this helps with global economic recovery is still to be seen.

In addition, the success of coronavirus vaccines, the speed of economic recovery and controlling the spread of COVID-19 will all determine how the markets move through the year.

2021 will be a year when financial services providers will need to be agile and ready to provide valuable information, in the form of articles, market analyses, webinars, education and much more to empower traders.

While 2021 might not be marked by the huge uncertainty that characterised 2020, it remains a year of transition.

At Deriv, we continue to expand our international operations with our unique employee/trader centric ethos. We are optimistic for exciting times ahead and ready to embrace challenges. Will entrepreneurs thrive in 2021? Absolutely.

Deriv is expanding its workforce across a number of regions. Visit deriv.hr to learn more.

About Deriv.com

Deriv.com is an Online Trading service provider offering a comprehensive suite of products with flexible pricing, where its customers can trade currencies, indices, commodities, and volatility indices 24/7. Committed to customer satisfaction and high ethical standards, the company delivers quality products and services with integrity.