Believe it or not, the lottery is one of the oldest and most popular games in human history. The contemporary version of the lottery, which most of you are acquainted with, can be traced back to the 15th century when it was used to collect funds for town fortifications and to assist the poor.

However, given its humble beginnings, not much has really been done to innovate the industry and bring it up to 21st century standards.

Yes, while we have managed to digitize some state lotteries, most products remain offline and rather rudimentary since consumers must still purchase a physical paper ticket from their local store to participate.

Recognizing the need for change, Sulim Malook took matters into his own hands and created the Crypto Millions Lotto, which is now acknowledged as the world's largest digital lottery site.

What are the benefits of the Bitcoin lottery?

Sulim Malook is unlike many crypto founders as he arrived into the industry with an already proven track record in the financial markets and experience as a successful app developer.

He picked up a knack for spotting opportunities during his twenty-year career trading options on Government Bonds Futures at the London International Financial Futures Exchange (LIFFE). And according to Sulim, the lottery industry was a low-hanging fruit primed for disruption.

Using his experience, his innovative ideas for the lottery have proven to be an instant success.

Even though the company has only been in operation since 2020, Crypto Millions Lotto is already offering enormous prizes ranging from $10 million to over $200 million in cashouts.

So, what differentiates Sulim's lottery from the rest of the pack? Well, while the principles are largely the same, Crypto Millions Lotto is the only lottery that uses bitcoin as its currency.

Surprisingly, opting for bitcoin as the primary currency has a slew of advantages for both the user and the provider, addressing a number of long-standing difficulties that have plagued the industry for a long time.

In doing so, Sulim has made the lottery safer, more secure, and more accessible for individuals all around the world. With that in mind, let's take a look at what makes the bitcoin lottery better than its more traditional counterparts.

Transparency and security

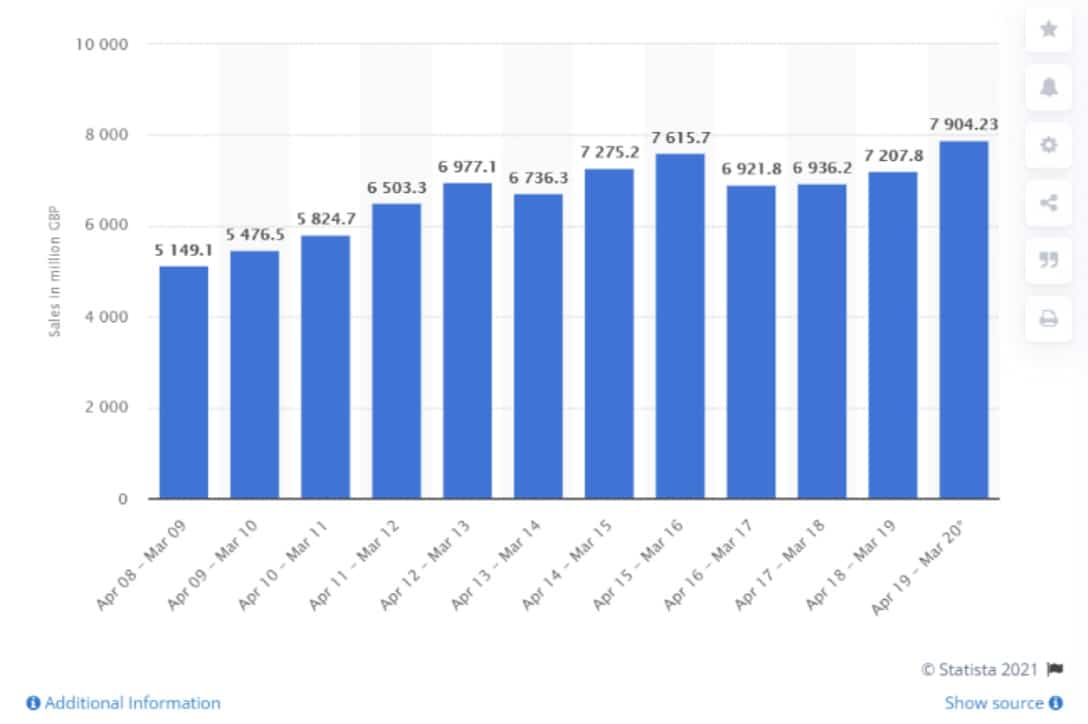

In most countries, lotteries are big business. Take the UK, for example, which saw the National Lottery generate over £7.9 billion in sales from April 2019 to March 2020.

For lotteries like this to gain such broad appeal, one crucial aspect needs to be established between the provider and the consumer: trust.

With this in mind, Crypto Millions Lotto takes a three-pronged approach to its security strategy in order to ensure the safety of all of its participants.

To begin with, they ensure data security by separating their lottery platform and payment processor. All client data is kept in a fully resilient data center in Switzerland that is Tier 3 certified and meets all ISO and IEC accreditation requirements.

Second, all customer funds are held in Cold Storage , which keeps them safe from hackers since only the user has access to them. Importantly, all transactions are encrypted with the HMACSHA-512 algorithm, further ensuring the safety of funds.

Finally, Crypto Millions Lotto insures all of its jackpots with the world's largest and most widely used prize indemnity insurance provider, ensuring that all winnings are protected and distributed to the winners accordingly.

In terms of transparency, Sulim's Crypto Millions Lotto does not base its jackpot prizes on the number of tickets sold. Instead, all players are fully aware of the prizes in advance.

"To make prizes transparent, we don't base them on the number of tickets sold. The amounts of our prizes are all fixed in advance, and our payouts are based on established, televised National Lottery draws, which we have no control over. To give our players complete peace of mind, we insure our jackpots with the world's leading prize indemnity specialist. So, we guarantee that winners will get paid."

No more lost tickets

Every year, billions of dollars in lottery prizes go unclaimed in the United States alone due to lost lottery tickets.

While this is a sickening thought to even contemplate, there have been instances where people have thrown out millions of dollars worth of tickets, only never to find them again.

Crypto Millions Lotto gets rid of this concern, as all of your tickets are logged online. All of your entries are logged online, which means there is no way you can lose your ticket or somehow throw away your winnings.

Winnings are credited to your account in bitcoin as soon as you win, which makes the service even more attractive to the player.

Seeing as you can play from anywhere in the world, users may even be able to limit the amount of tax they have to pay on winnings too, which is a unique advantage over traditional lottery models.

Anonymity

With Crypto Millions Lotto, you don't need to reveal your identity or pass any KYC checks upfront.

You are free to play immediately without the need to jump through excessive regulatory hoops; however, KYC (photo ID and proof of address) is required once a player wins a jackpot or makes a large withdrawal.

This is so the company can maintain compliance with their worldwide e-gaming license, as they must follow stringent anti-fraud procedures and ensure all jackpots with the largest prize indemnity insurance provider.

As a result, as long as the user is who they say they are, living in the nation they claim, and is above the age of 18, they will get any wins they are entitled to.

On the whole, crypto lottery sites like Crypto Millions Lotto pose fewer trust issues than fiat-based lottery sites, especially because you don't have to worry about your credit card information being abused or exploited.

Furthermore, since its inception in 2020, there have been no reports of data breaches on Crypto Millions Lotto.

What does the future hold for Crypto Millions Lotto?

Thanks to the rising popularity in the crypto industry, Sulim's Crypto Millions Lotto looks on course to continue dominating the online lottery scene while posing a genuine threat to some of the more established state lotteries that have monopolized the industry for the past several decades.

"We have lots of exciting things in our pipeline. We've recently added six new lotteries, and we're planning to add more. We also plan to add more games, as well as offering players the ability to get bitcoin using their credit cards directly on our site. As our user base expands into more countries, we want to offer Crypto Millions Lotto in multiple languages. We have also just launched an affiliate program, which we believe offers a more attractive proposition than other affiliate programs already out there," said Sulim.

With the adoption of bitcoin and the foresight to innovate the lottery aligned with consumer demands, the future certainly looks bright from Sulim Malook and his exciting new crypto-based lottery.