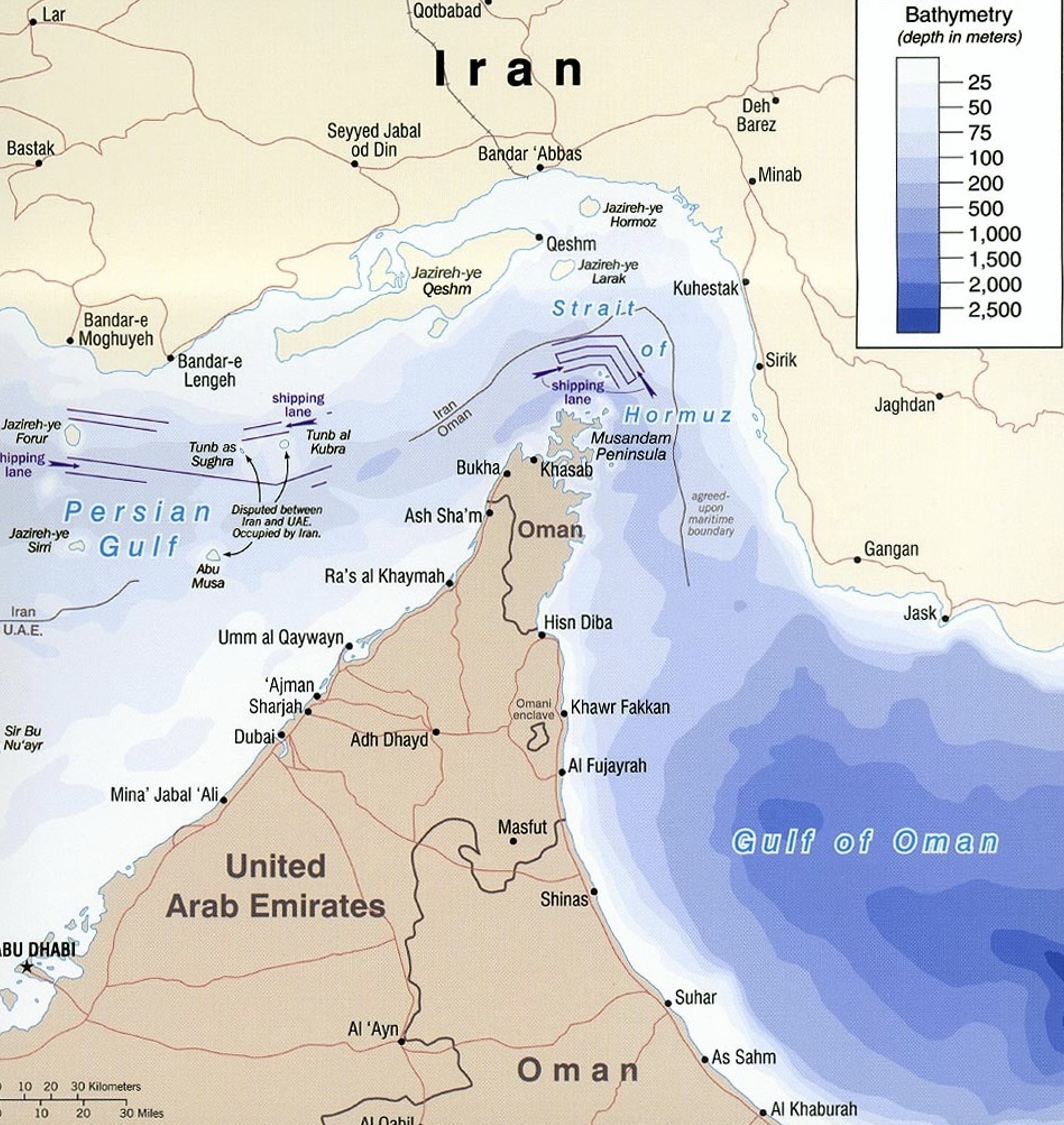

This narrow sea lane in the Gulf region is a route through which a fifth of the world's oil and liquefied natural gas (LNG) flows, feeding a large part of the global economy. The northern side is controlled by Iran.

As of 2023, 20% of the world's liquefied natural gas and 25% of seaborne oil trade passes through the Strait, making it a highly important location for trade. It has been so for centuries; its vast hinterlands were rich in luxury trade goods with no easy access to lucrative trading ports. After the US struck Iran's nuclear facilities and uranium enrichment facilities on June 22, 2025, the Islamic Consultative Assembly officially closed the strait with a decision.

What does it mean for global oil prices?

The Strait of Hormuz is of vital importance to gas and oil exporters in the Gulf region, as it is the only route through which large volumes of oil and gas produced by the region's oil-rich countries can be exported by sea. Located between Oman and Iran, this narrow passage connects the Persian Gulf to the Gulf of Oman and the Sea of Oman. Two supertankers with a capacity to carry around 2 million barrels of crude oil have turned back in the Strait of Hormuz after the US airstrikes on Iran, as well as the risk of retaliation that could affect commercial shipping in the region, increased. The tankers, Coswisdom Lake and South Loyalty, entered the strait on Sunday and suddenly changed course. Goldman Sachs has drawn attention to the fact that risks to global energy supply have increased due to a possible disruption in the Strait of Hormuz. The bank stated that this situation could lead to serious increases in oil and natural gas prices. The bank predicts that the price of a barrel of Brent crude could rise to $110 for a short time.

Is the Strait of Hormuz completely under Iranian control?

In the 1980s, Iran began to threaten the Strait of Hormuz. The Gulf Cooperation Countries (Saudi Arabia, Bahrain, Qatar, Kuwait, Oman, United Arab Emirates) signed a defense pact against the Iranian threat in 2000. Similar to NATO, the rule of 'an attack on one member state is considered an attack on all' was accepted. The US made various defense agreements with the Gulf countries and established military bases.

So, Iran is actually capable of seriously disrupting or blocking the Strait of Hormuz. Probably yes. Iran could attempt to lay mines across the Strait, which is 34 km (21 miles) wide at its narrowest point. The country's army or the paramilitary Islamic Revolutionary Guard Corps (IRGC) could also try to strike or seize vessels in the Gulf.

Importance for the European Union

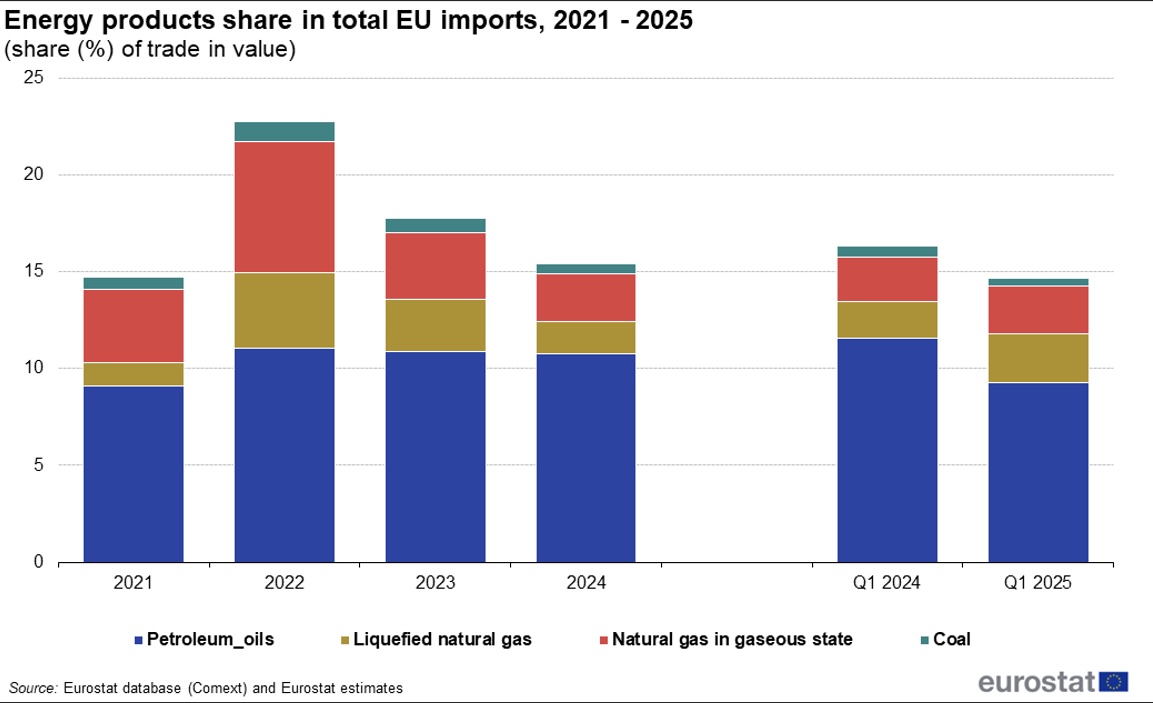

According to Eurostat data, for the energy products analysed in this article, the following figure shows their share in total EU imports in 2021-2024 and in the first quarters of 2024 and 2025. The share of energy products in total EU imports showed significant fluctuations due to strong volatility in their prices and reached 22.8% of total EU imports in 2022. This was followed by a significant decrease to 17.8% in 2023 and again to 15.4% in 2024. In addition, in the first quarter of 2025, there was a decrease of 1.7 percentage points (pp) compared to the same quarter of 2024. The distribution by products shows that the shares of liquefied natural gas (+0.6 pp) and gaseous natural gas (+0.2 pp) increased between the first quarter of 2024 and 2025, while the shares of petroleum oils (-2.3 pp) and coal (-0.2 pp) decreased.

Although Middle Eastern countries are not the largest oil and gas importers to Europe, these countries have a large share. After the closure of the Strait of Hormuz, energy prices pose a great danger not only to the European Union countries but also to the general national economy.

Forex Markets

Oil prices rose to their highest since January after the weekend U.S. attack on Iran’s nuclear facilities raised supply concerns. Brent rose 2.49 percent to $78.93 a barrel, while U.S. crude gained 2.56 percent to $75.73. If the conflict between Iran and Israel were to start again and the Strait of Hormuz were to be closed, oil prices could accelerate their rise again.

In technical analysis, we can see that the price has returned from the resistance level in the weekly time series. Despite this, MACD continues to give bullish signals. In the event that military action does not occur, price declines may continue. Otherwise, strong price increases will only be a matter of time. The target will be 88.30$.

We can see the same effect in natural gas prices. In technical analysis, the price is testing the support level instantly. At this tested level, the Fibonacci 23.6% level maintains its strong support level position. MACD continues to give bullish signals. If the price rises from the support level again, the target will be 4,770.

Conclusion

The Strait of Hormuz is a critical chokepoint in global oil supply, with about 20% of the world’s energy passing through it. The geopolitical tensions between Iran, Israel, and the wider Middle East have the potential to disrupt this vital shipping route, which would have a dramatic effect on global oil prices. Analysts have warned that if the Strait is closed, oil prices could soar above $110 per barrel, exacerbating an already volatile global market.