Presently, there is an initial coin offering (ICO) frenzy going on in the global market. ICO Alert has listed no less than 200 different coin sales available for the investors in the second half of October alone. This presents a confusing dilemma for investors, many of which are unsure of how to proceed or ultimately decide on what ICO to choose. In essence, investors are given ideas and concepts at a 200 times faster rate than they can realistically process.

At the core of any ICO, the goal of any investor is to earn a positive ROI from his or her investment, period. It’s also worth noting that most of the investors want a project to be both legal and ethical. However, while investing any amount of money, every investor wants to know two things: why the ICO is asking for his or her money, i.e. how do they plan to use the money and how they plan to return a positive ROI.

Sadly, not many of the ICOs have logical answers for these two seemingly simple questions. This is where Covesting is different. Thrown in the ring by former Saxo Bank trader, Dmitrij Pruglo, Covesting answers both the questions in a simplified manner.

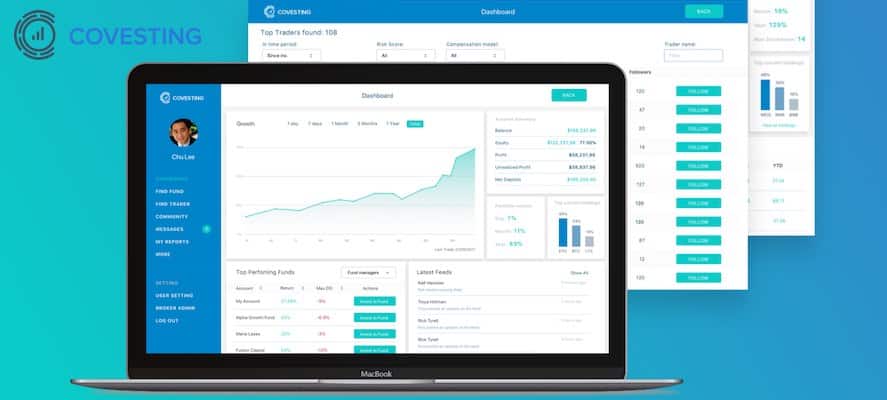

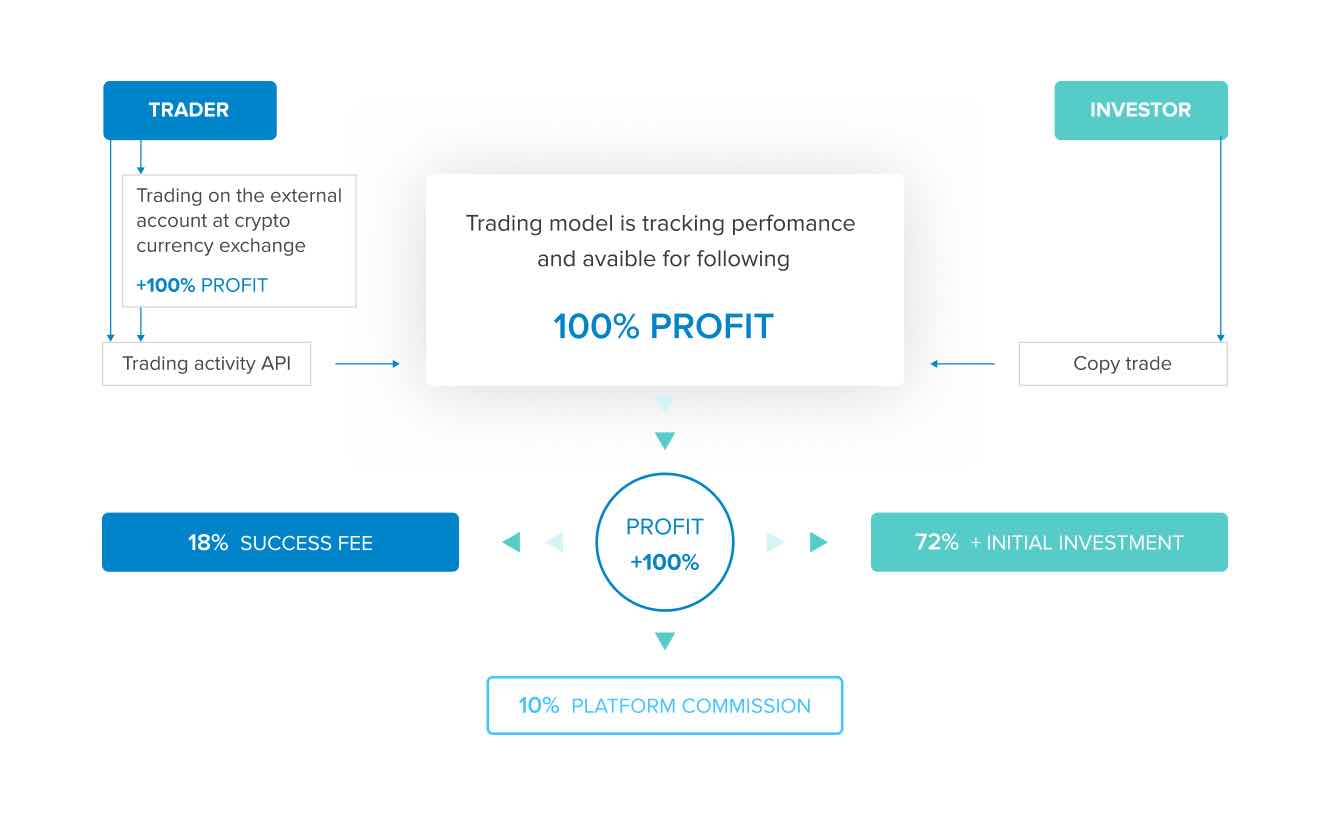

In short, Covesting is a peer-to-peer (P2P) copy-Trading Platform for cryptocurrency traders. The group’s token sale efforts are done to help continue building their platform, which they then can take a percentage from the traders to give a positive ROI to the coin holders.

Questions every cryptocurrency traders ask before investing

Cryptocurrency traders are increasingly taking part in ICOs as well. A recent study shows, as much as 20 percent of the cryptocurrency trading community regularly takes part in ICOs. These individuals believe ICOs to be a great source of quickly multiplying their investment.

Since the new coins are generally listed on the exchange as soon as the ICOs end and they often and instantly have the potential to grow multiple times higher than their initial offer price, it is a widely seen as a good source of quick profit, provided the trader knows which ICO to invest on.

In fact, professional traders have formed a strategy to start with a small capital and multiply it by timing their entries and exits perfectly during an ICO and new coin listing. This brings us to the important question, how to choose an ICO?

Choosing the right ICO

The influx of ICOs in the market is simply staggering. A seasoned investor or trader would be well served to choose an ICO by certain traits. First, he or she will want to see an experienced team in the core group, all of whom have displayed exceptional flair at what they do.

Second, investors will seek the answers of the aforementioned two questions: why is the ICO collecting money from the market and how do they plan to return a positive ROI? Individuals will also want to check the originality of the project as multiple players offering the same features gives less scope of growth for the ICO. For example, TenX and Monaco are both fighting for the crypto-backed debit card industry.

Introduction to Covesting: The bespoke solution

Covesting allows the investors to search and find hundreds of expert traders and compare their strategies. They are free to subscribe to and allocate funds to the traders whom they trust. Presently, Covesting allows an investor to subscribe to as many as 20 different traders. This provides the hedging safety layer, which is important for any investor.

COV is the native currency of the system and will maintain the uniformity across the system just like USD maintains uniformity in USA stock exchanges like NYSE. The charges, profits & losses, commission, and everything else will be calculated in COV.

Considering that Covesting takes 10 percent cut, plus a one time 2 percent cut on the deposited amount, the company is expected to make large profit as new traders join the platform and the trade volume grows.

This will look to increase the price of COV, which is helps legitimize investing in the business plan and project. One of the strengths of Covesting lies in its simplified profit, relative to other ICOs that are launching with arbitrary or vague concepts.

✔️ Officially listed https://t.co/VrvfFdduVP

— Covesting (@covesting) October 15, 2017

Lack of trust: the issue that never left the trading industry

The traditional asset management industry has been plagued with multiple issues, problems, scams, and corruptions since inception. Unethical and illegal manipulations by asset managers with a large sum at his disposal, Ponzi schemes and sweeping techniques are some of the common allegations faced by the industry.

Dmitrij Pruglo, CEO of Covesting and former Saxo Bank trader,commented: “Covesting is built to combat these issues by default and that is why we employed the transparent and immutable Blockchain technology. Moreover, this is a decentralized and peer to peer platform which gives no manipulation power to Covesting either. The deals are always directly between two traders and we merely charge some commission for using the platform.”

Thus far, the industry has fostered deep-rooted problems of mutual mistrust, opacity, unethical practices, and below-the-surface deals. Covesting will look to address all of these issues due to the underlying blockchain network and decentralized, P2P approach. By its own design, blockchains are incorruptible while smart contracts run without human intervention.

Covesting ICO and presale

In order to develop the platform within shortest period of time, Covesting's team has decided to go for an ICO. Covesting’s project provides the unique opportunity to take part in a crowdsale and benefit from its growth by purchasing Covesting Tokens prior to the beta-version launch of the platform. All proceeds from the token sale will fund the product launch, continued platform development, and user acquisition.

As previously mentioned, all members will be eligible to purchase COV tokens in order to follow one or several trading strategies, provided by the traders on the platform. Thus, demand for COV correlates with the copy-trading volume on the Covesting platform.

As the platform develops over time, more and more investors and professional traders will join community, automatically creating strong demand for COV tokens and positioning it for multiple digit price increase.

There will be a Presale arranged for partners willing to purchase COV tokens prior to the public ICO. Pre-ICO will occur on 20th October – 19th November, 2017. The token purchase rate is fixed at 1 ETH = 300 COV, which offers significant discount compared to an average rate during ICO, which will be 1 ETH = 150.

Only 1.5 million COV tokens (equivalent of 5000 ETH) will be issued at a special price for the limited number of contributors who managed to discover the project early. Pre-ICO shall be executed on first-come, first-served basis, therefore availability of tokens can’t be guaranteed for all interested participants.

All contributors will largely benefit from the early discovery of Covesting project, which provides a fantastic opportunity to purchase Covesting Tokens at a significant discount. Interested individuals are invited to read over the project’s white paper.