Traditional banks are slowly losing their place to fintech companies and cryptocurrencies as younger generations look for more innovative solutions to solve their financial problems.

Top the list, Generation Z, born between 1997 and 2015, are the least interested in traditional finance with 83% of them stating they are frustrated with the traditional banks and credit unions as they are today.

Millennials and Gen Z consumers and workers are expected to account for $30 trillion in wealth by 2030, and every financial institution is planning for the transfer of wealth.

Traditional banks and credit unions are however falling behind the pecking order for the younger generations, particularly Gen Z, who prefer digital fintech companies, Blockchain , and mobile banking.

Traditional banks miss out on the Gen Z market

According to a PYMNTS report, Gen Z ranks as the least interested generation with the current financial system with 83% of them likely to be dissatisfied with the experience currently offered to them. That compares to 78% of millennials, 69% of Gen Xers, and 57% of baby boomers reporting similar dissatisfaction by traditional banking.

The tech-empowered generation demands better services from their banks, less expensive fees, and digital solutions in their financial journey, which unfortunately traditional banks lack and are doing little to remedy the situation. As such, 90% of the Gen Z and 67% of millennial respondents stated they are willing to open a banking account from a non-bank account and big techs.

Gen Z bankers are digital natives who choose to align more with fintech companies rather than the traditional banking systems, primarily due to the convenient and hassle-free experience fintechs offer. They are willing to turn to non-financial companies that offer faster banking services and better user experience abandoning the brick-and-mortar systems still in use today.

The main players in financial banking such as Barclays, Virgin Money, JP Morgan, RBS, and others are losing the hearts, trust, and minds of Gen Z clients. The main key seems to be that they do not understand the battlefield they are trying to win as most banks think having an app and offering online services constitutes being ‘digital’.

Not to mention, a report by Pepper in 2019 states that 42% of decision-makers at traditional banks did not see cooperation with fintech as a requirement for traditional banks to remain relevant.

You can clearly see the cracks in the traditional finance system hence the dwindling adoption rates amongst millennials and Gen Z clients. The failures of the traditional system have caused an exodus of Gen Z clients to newer and more innovative financial systems such as fintech apps, cryptocurrencies, and blockchain technology.

The new wave of financial products

According to a CBNC Millionaire report, Gen Zers are rapidly moving their financial assets to digital platforms and assets. Nearly half of the respondents stated that they had at least 25% of their wealth in digital assets. More than a third of millennial millionaires have at least half their wealth in crypto and about half own NFTs.

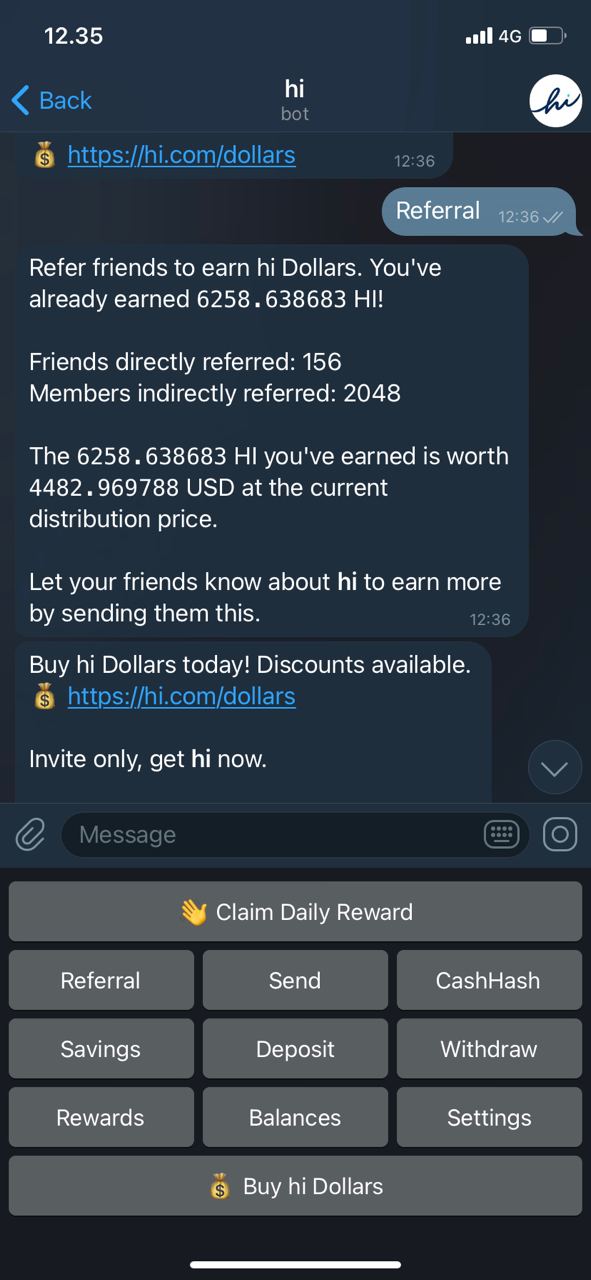

hi, a not-for-profit fintech, aims at bridging the gap between traditional banking, fintech, and crypto to increase the adoption of digital finance to millennials and Gen Zers. hi leverages blockchain technology to build services powered by the community and members. The firm focuses on maximizing the membership value by offering innovative products and better services to users.

Launched in 2021, hi offers an ultra-simplistic chatbot-based financial service that aims to solve the high costs, slow processing times, and trust issues in traditional banks.

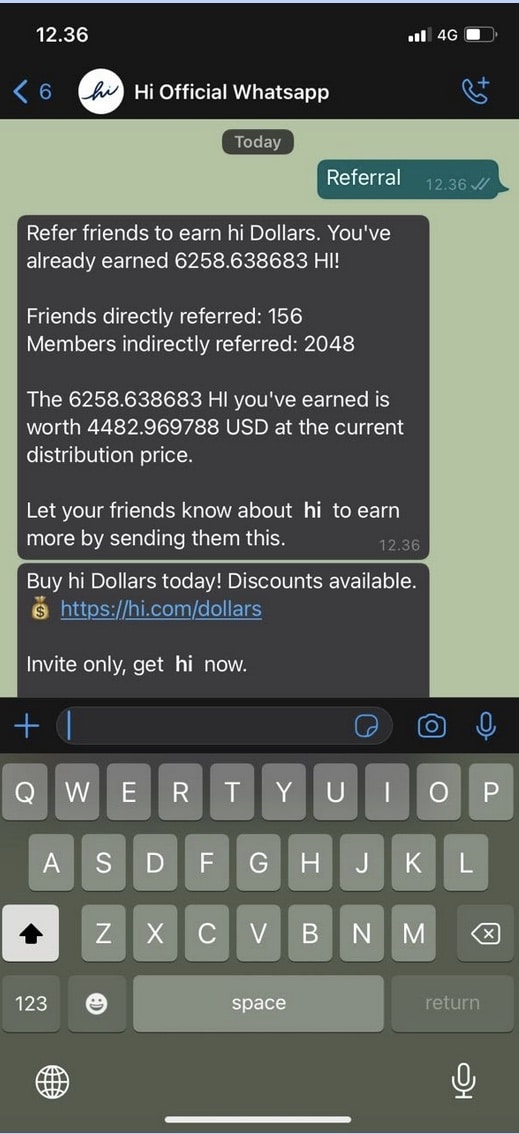

The first product is a digital wallet that provides members with the most seamless payment experience via social messengers (initially Telegram and WhatsApp, next LINE, Facebook Messenger, and others).

In its short time in existence, hi has launched its private beta, the hi Dollar (HI) token, and listed on Uniswap on August 8. Consequentially, the platform welcomed over 1 million customers less than 100 days after the beta launch, which shows massive support from younger generations in the digital finance space. hi’s global membership base already covers +150 territories.

“A million members in less than 100 days is astonishing. We are blown away and humbled by the overwhelming support from our community,” said Sean Rach, Co-founder of hi. “We are building out an ecosystem of banking and internet services to benefit our members and look forward to welcoming tens of millions of new members in the coming months.”

Once the hi mobile app launches members will be able to earn great rates, send funds, make Payments , and exchange both traditional and cryptocurrencies with no added fees and no markups.

Digital finance world in the future

As traditional financial firms look for better innovations to entice the younger generations, decentralized finance (DeFi) systems, and fintechs are quickly onboarding them.

Well, none of us knows what the future will hold, but to take a statistical guess - traditional financial banks will be soon replaced by digital and forward-looking applications and fintechs. Applications such as hi, and other forward-thinking services such as Revolut, Current, Venmo and others may very well take a considerable market share from traditional banks.

By reducing the barriers of entry, offering incentives via tokens, minimizing fees, and offering a top-notch user experience, Gen Z will slowly be siphoned to digital finance solutions.