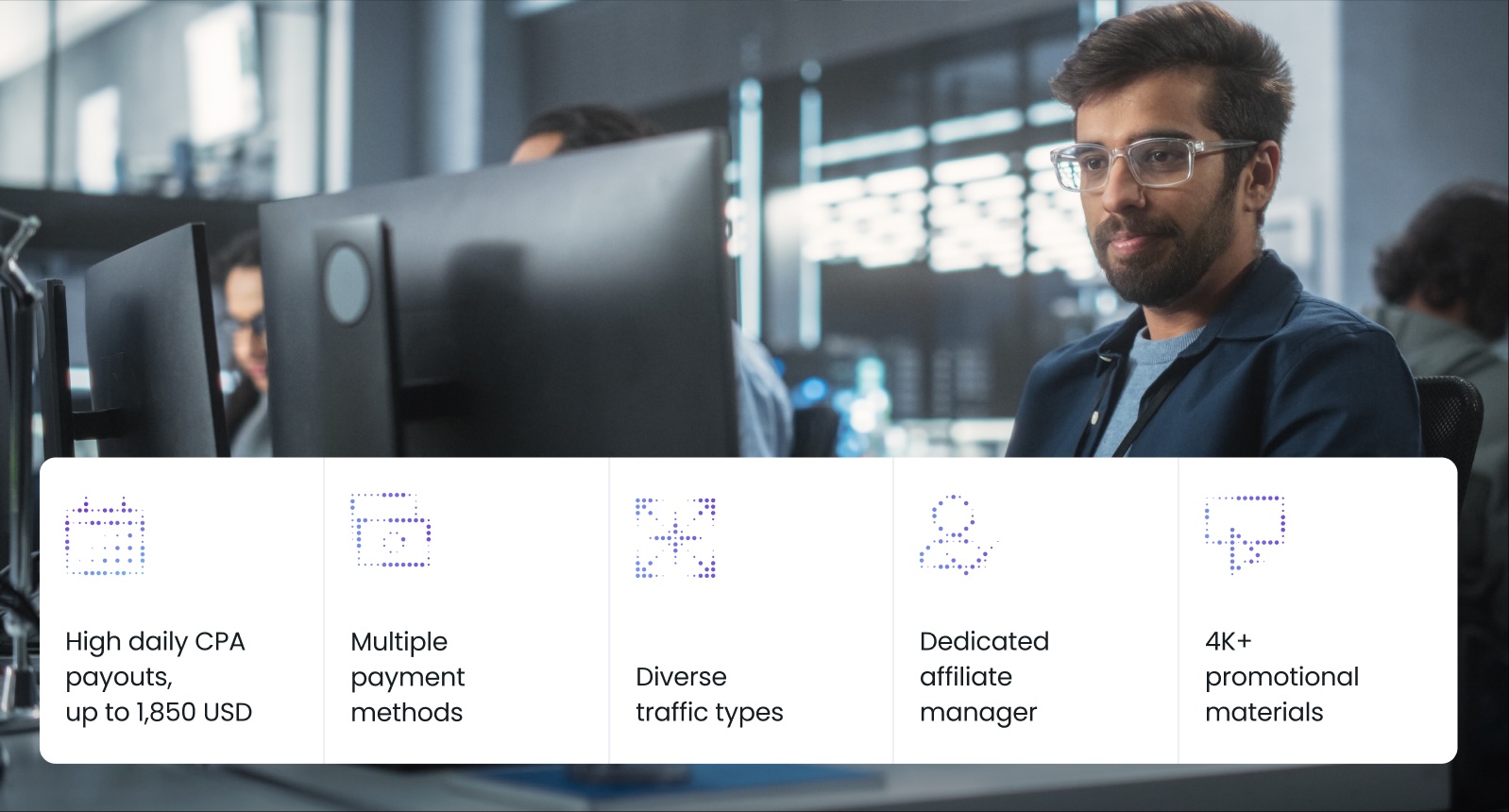

Exness has carved out a reputation in the industry not only for its distinguished online trading platform, but also for its high-paying affiliate program. The award-winning brokerage offers a CPA (Cost per action) payment model where marketers can earn up to $1,850 for each unique referral, depending on the referred client's location.

To celebrate the fifth anniversary of its landmark Exness Affiliate Program, Finance Magnates spoke with the team behind its success: Natalya Maxumova, Head of Partnership, Nir Iter, Affiliate Commercial Lead, and Jana Ivanov, Affiliate Marketing Lead at Exness, who each explained their perspective surrounding the program’s success.

This includes the impetus behind the initiative, as well as the overall strategy and community that transformed this trading affiliate program into an industry powerhouse. To date, the program has attracted over 50,000 affiliate partners and generated over $65 million in payouts since 2019.

The program creation: ‘Harnessing the expertise of our in-house product specialists, we developed a CPA program that is in tune with market demands.’

Congratulations on the Exness Affiliate Program reaching the five-year milestone. Could you share your reflections on its early days and how the concept grew into a successful launch?

Natalya Maxumova: Thank you. At Exness, we've always recognized the value and demand for partnership programs, starting with our thriving Introducing Brokers (IB) initiative.

We identified a vital opportunity to expand within the financial sector by creating a unique affiliate program. The introduction of the Exness Affiliate Program was a strategic decision to develop new income channels for the company while differentiating traffic flows.

Recognizing the potential of affiliates as a powerful revenue generation channel, Exness set out to create a program that would enhance brand visibility while fostering long-term relationships with marketing professionals.

Harnessing the expertise of our in-house product specialists, we developed a CPA program that is in tune with market demands. By embracing our values of transparency, technological innovation, and boldness, we have established an environment that benefits traders and our diverse partners.

Nir, can you explain what sets Exness’ affiliate program apart from the competition?

Nir Iter: Our goal has always been to surpass the competition. Our high commission structure—up to $1,850 per unique referral—coupled with robust support from our affiliate managers has propelled our program's growth and sustainability. The team has expanded from just a handful to 11 professionals, enhancing our ability to provide exceptional support and deliver stronger results for our partners.

Jana, how did you position the program to become one of the most recognized in the market?

Jana Ivanov, Exness Affiliates Marketing Lead: In the highly competitive financial sector, crafting an effective marketing plan for a new affiliate program is crucial. Our initial steps involved creating a solid brand identity and clearly communicating our value propositions based on the product features. We leveraged Exness' established reputation as a broker to promote their trading platform while offering attractive commission structures.

To increase awareness of our program, we implemented a comprehensive promotional strategy that went beyond product focus. We engaged with other affiliates through various channels, including email marketing, social media, and direct interactions at industry events.

By employing a 360-degree approach, we established fruitful partnerships with top affiliate networks and media buying teams in key markets. This allowed us to gain a considerable foothold in the market and foster sustainable, mutually beneficial relationships.

Continuous growth and challenges along the way: ‘We aim to position ourselves as one of the premier affiliate trading programs in the marketplace.’

The Exness Affiliate Program has shown remarkable growth. What strategies have you implemented to maintain this trajectory, and what challenges have you encountered?

Nir: Our core strategy focuses on addressing our affiliates’ needs and cultivating beneficial long-term relationships. We aim to position ourselves as one of the premier affiliate trading programs in the marketplace. We offer competitive commissions, seamless daily payouts, integration tools, marketing materials, and the advantage of partnering with a trusted broker like Exness.

However, scaling into new regions has been challenging as our program has expanded rapidly. For example, the number of countries from which we accept traffic grew from 18 to 115 in an extremely short time.

Jana: The success of the Exness Affiliate Program can be attributed to continuous product development and the establishment of strong global partnerships. Our marketing team elevates awareness about our CPA program while empowering our affiliates with the resources they need to launch successful campaigns. We equip them with diverse marketing materials and continually share insights regarding target demographics.

To cultivate competitiveness, we’ve introduced GEO-targeted promotional campaigns, allowing our affiliates to earn additional bonuses for increased traffic.

Natalya: From the product approach, we ensure constant updates that align with our partners' needs. We continuously enhance our analytics and marketing tools, automating previously manual processes, significantly boosting efficiency and elevating affiliate satisfaction.

Feedback mechanisms like surveys and a feedback form available on the platform help us refine our offerings. We've already enhanced onboarding automation, streamlined payment processes, and added new methods to withdraw commission.

Of course, we are continuously improving our program and seeking ways to better incentivize our top-performing partners who deliver high-quality traffic, with the goal of motivating and supporting their growth.

Jana, could you elaborate on affiliate events and conferences? Were these always a part of your strategy?

Jana: Absolutely! The affiliate industry places significant importance on expos and conferences, and Exness Affiliates has actively participated in this community. Attending high-profile affiliate conferences enables us to forge invaluable face-to-face connections with partners, facilitating successful campaign launches and expansions. Additionally, we're focusing on organizing appreciation events to engage with our top partners.

What's next? ‘Together, we are shaping the future of affiliate marketing.’

Looking ahead to 2025 and beyond, what are the upcoming plans for the Exness Affiliate Program?

Nir: Our future ambitions include solidifying our leadership position in the industry by entering new markets and continually enhancing our offerings. Moreover, we plan to implement a sub-affiliate program to grow our network further.

Jana: Our strategy includes adopting a “glocal” approach, expanding into new local markets, and implementing targeted promotional campaigns tailored to them.

Collaborating with social media influencers and expanding our digital presence will allow us to tap into new audiences. Another major initiative is expanding our educational resources and increasing the number of webinars and learning courses we offer our affiliates. I'm sure that by working together, we are shaping the future of affiliate marketing.

Natalya: Continuous innovation is a cornerstone of our commitment to our partners. We will remain at the forefront of technological advancements, ensuring our affiliates can access the most effective tools. The future is bright, and our journey is just beginning.