More companies are going green each year. Yes it’s trendy. Yes it works as a marketing campaign. And yes it truly does help this earth which we call our home. However, there’s another reason why it’s advantageous for a company to ditch the paper and go digital – money.

Companies can save a lot of money by going green. For example, green companies can get legal and tax advantages. These breaks exist at both the state and federal level for green companies. Companies can also save money by reducing waste. It’s a chain reaction. And the first domino that needs to fall is often the hardest one – paper.

Is going green risky?

Every company uses paper. Some use it more than others, while reducing paper use can dramatically cut operating cost. Obviously, less paper means less money spent on paper. But it also means less ink, which is the real money saver – less ink also means less ink cartridges. And less ink cartridges means less waste and plastic. Oh and don’t forget about toner and toner cartridges.

One industry that has yet to embrace going green are pharmacies. While it may come as a surprise to the healthy, pharmacies go through a lot of paper each year. One of the main causes of high paper volume in pharmacies is due to the sheer number of drug sheets that are printed with each prescription issued. Think also of the volume of paper prescriptions that are turned into pharmacies each year.

Many in the pharmaceutical industry have been unwilling to shift to a digital system because of the potential risk of fraud and forgery. Particularly with the opioid epidemic in the US, companies are seeking ways to secure pharmaceuticals and prescriptions, and digitizing them may seem risky.

Pixabay

Forgery and Fraud

However, the reality is that digitized prescriptions can accomplish both goals for pharmaceutical companies, and particularly regarding medicine abuse. Medicine abuse is a widespread issue in the United States.

One of the chief causes of medicine abuse is directly linked to paper prescriptions. Paper prescriptions are easily altered, tempting patients to forge prescription amounts. This results in more prescription painkillers being sold on the black market, driving up the cost of the pill.

But are these problems even solvable? Aren’t drug sheets and prescriptions the most vital parts of the prescription process next to the medicine itself? The answer is a resounding yes on both fronts.

Blockchain for Big Pharma

Enter blockchain. The revolutionary technology that is changing the way we use money through Bitcoin can also help pharmacies reduce waste. Blockchain technology takes something that is typically centralized and operates it on a peer to peer network. With the example of Bitcoin, it takes money, which is centralized in banks and government issued currencies and distributes it across a network of participants.

As time goes on, ways to use blockchain other than simply as money have emerged. It’s already helped other industries like finance and electronic security And the latest industry it can help is healthcare.

Blockchain streamlining and digitizing the entire prescription process

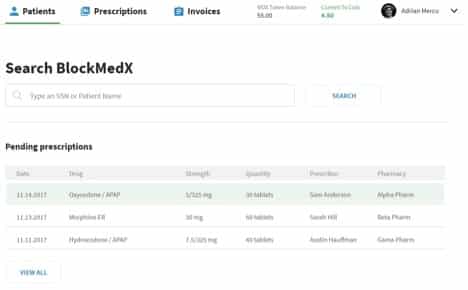

One of the ways blockchain can aid the healthcare industry is by streamlining prescription writing into a single platform. By pairing prescription writing with blockchain, every aspect of the process will be completely digital. Doctors will digitally submit prescriptions. No more paper.

One company, BlockMedx, is creating a blockchain-based prescription tracking system that will completely digitize the prescription process, providing both substantial reduction in loss, and increase in security.

Using digital prescriptions over paper prescriptions is advantageous for a number of reasons. The first is the amount of paper waste that is being reduced. Drug sheets will be sent electronically, saving pharmacies money on paper, ink, and supplies.

The second reason is because a digital prescription sent over a blockchain paired with a token is impossible to forge or alter. While paper prescriptions can easily be altered, copied or forged entirely, digital prescriptions sent over a blockchain cannot be altered.

Blockchain is so secure that it wouldn’t even be possible for hackers to go in and change the prescription quantity. Other digital prescription programs that aren’t blockchain based can’t make the same claim. By digitizing prescriptions through blockchain technology, pharmacies can help substantially diminish the amount of medicine abuse in our country.

In order for a pharmacy to go green, it needs to figure out how to provide patients with the vital information contained within the drug sheet, but without paper. Blockchain can handle this problem as well.

As is the case with almost all new blockchains, it should have a user friendly mobile app that allows patients to view all of the details of their prescriptions in a single location. This solves the drug sheet, the cause of the majority of the paper waste.

With the entire process streamlined through blockchain, pharmacies and hospitals can work together to help the healthcare industry become less wasteful as a whole while at the same time providing security to counteract the opioid epidemic.

Companies like BlockMedx can save pharmacies money by not buying and printing paper. Hospitals also benefit because the prescriptions they write and send through the blockchain will be more secure than traditional paper prescriptions. Lastly, the patients benefit because less waste is being produced and dumped into the earth, and with less waste, prescription costs will reduce.

Disclaimer: The content of this article was provided by the company, and does not represent the opinions of Finance Magnates. Finance Magnates does not endorse and is not liable for any content presented on this page.