Dodd-Frank is a US federal law that places strict restraints on the financial industry by centralizing power in the hands of the government. This is otherwise known as the Wall Street Reform and Consumer Protection Act and was passed by President Obama as a response to the Financial Crisis that began in 2008.

Two US lawmakers sponsored Dodd-Frank, including Barney Frank and Senator Christopher J. Dodd. The legislation is fully comprehensive, and covers 2,300 pages to be implemented over several years. For the critics of Dodd-Frank, there is the concern that the legislation will prevent the US economy from reaching its full potential by placing constraints on the financial sector.

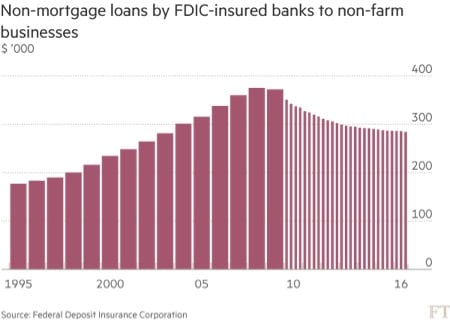

Many Republicans believe it harms the competitiveness of US financial institutions, relative to their overseas counterparts. For example, small financial companies and Community Banks are heavily burdened by Dodd-Frank legislation despite the fact that they had nothing to do with the global financial crisis that began in 2008.

Bloomberg

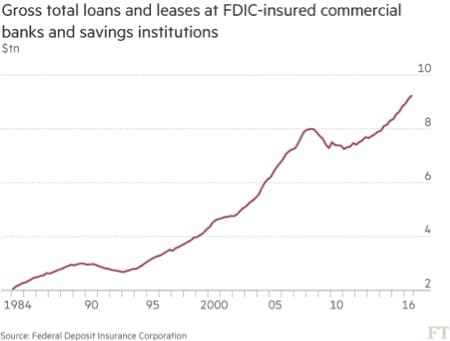

The problems, according to Carl Icahn, Jamie Dimon, and Larry Summers is that safety has been substituted for Liquidity . This is especially detrimental in the bond market where there is an irregular supply of buyers/sellers. Under Dodd-Frank, higher capital reserve requirements mean that banks are required to maintain a larger stockpile of their assets in cash holdings.

This decreases how much is available for marketable securities. Ultimately though, critics are convinced that economic growth will never reach its full potential under Dodd-Frank, and it will result in higher unemployment, slow wage growth, and declining living standards. That’s precisely why President Donald Trump has pushed forward with his policy of deregulation.

With hundreds of rules with Dodd-Frank Regulation , it’s ultimately taxpayers who bear the burden of maintaining compliance by the big banking institutions.

How Will Changes to Don-Frank Regulation Affect Trading Activity?

The executive and legislative branches of government have attempted to overhaul the manner in which banks conduct themselves every time a financial crisis has taken place. Throughout recent history, examples of this type of sweeping legislation have come to pass. In 1907, a financial panic resulted in the Federal Reserve act of 1913.

More legislation was passed during the Great Depression, with the passage of the Glass-Steagall act of 1933 which gave rise to the FDIC (Federal Deposit Insurance Corporation). Since then, Congress has been hard at work with a series of legislative acts.

The peripheral effects – the knock-on effects of a credit crisis – are far-reaching

The Dodd-Frank Act was created with the best interests of the US economy, and consumer in mind. Of course, there is ample evidence to suggest that a liquidity crisis is entirely possible when major banks refuse to allow clients to access their capital. The failure of Lehman Brothers is a case in point, and it was the fourth largest investment bank in the US at the time.

When Lehman Brothers collapsed, credit dried up and the stock market tanked. The peripheral effects – the knock-on effects of a credit crisis – are far-reaching. This is where the US government stepped in to arrange emergency financing for major corporations including a bailout of Merrill Lynch by Bank of America.

Bloomberg

Other measures included the nationalization of American International Group and massive economic injections into Wells Fargo & Company, Bank of America, JPMorgan Chase and Citigroup. If the Trump administration wants to roll back legislation on Dodd-Frank, we can expect far greater liquidity in the banking sector, and short-term appreciations in the stock prices of BAC, C, WFC, JPM, and others.

The wheels are in motion for the dismantling of Dodd-Frank

Indeed, we saw slivers of this taking place when one of the Federal Reserve Bank presidents, Tarullo announced his early resignation on the 7-member board of governors of the Fed. The wheels are in motion for the dismantling of Dodd-Frank, and the deregulation of the financial sector.

It may not come from Congress, since there is significant disagreement among Republicans and Democrats, but it may come from the Federal Reserve Bank with Trump appointees.

Are US Banks Too Big to Fail, or Will Lightning Strike Twice?

Unfortunately, greed has been the undoing of many a financial juggernaut. Without legislation to prevent improper financial practices, a repeat of past failures is entirely possible. Large financial institutions have routinely failed throughout America’s brief history, and they have given rise to massive financial crises.

This is indeed the reason the FDIC came into being in the first place. The Great Depression is the clearest such evidence that banks need to be kept in check. Dodd-Frank requires compliance with multiple regulatory requirements. If a bank has assets greater than $50 billion on its balance sheet it must be subject to a stress test.

This stress test determines whether the bank is capable of surviving another 2008-style global financial crisis. The biggest banks are required to hold substantially more capital reserves, and this is categorized as G-SIB surcharge.

Are US Banks Too Big to Fail, or Will Lightning Strike Twice?

Unfortunately, greed has been the undoing of many a financial juggernaut. Without legislation to prevent improper financial practices, a repeat of past failures is entirely possible. Large financial institutions have routinely failed throughout America’s brief history, and they have given rise to massive financial crises.

This is indeed the reason the FDIC came into being in the first place. The Great Depression is the clearest such evidence that banks need to be kept in check. Dodd-Frank requires compliance with multiple regulatory requirements. If a bank has assets greater than $50 billion on its balance sheet it must be subject to a stress test.

This stress test determines whether the bank is capable of surviving another 2008-style global financial crisis. The biggest banks are required to hold substantially more capital reserves, and this is categorized as G-SIB surcharge.

Banks like BAC, C and JPM are required to hold as much is 3% of all shareholders’ equity reserves in a low-yield account to maintain liquidity. According to Dodd-Frank and the Glass-Steagall Act, trading at banks is also limited. From a consumer perspective, there is significant benefit against unchecked abuse of powers by banks and financial institutions.

The CFPB (Consumer Financial Protection Bureau) is one such watchdog that guards against deceptive conduct by banks. In short, banks are not too big to fail, and if left to their own devices will happily limit the capital reserve requirements and overinvest for maximum profitability. For trading purposes, this is going to be a period of short-term bullishness for bank stocks and call options will certainly dominate.

Some doomsday analysts believe that the removal of Dodd-Frank will bring us back to the precipice of another global financial crisis

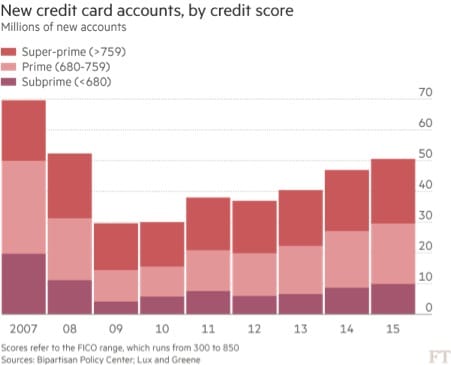

Major banks like WFC and JPM reported that loans are growing at a robust rate. Dodd-Frank has been instrumental in making banks especially cautious of lending to low-income earners or scant credit. According to the bipartisan policy Center, customers with sub- prime credit scores were awarded just 20% or less of all new credit cards issued in 2015. This is down 29% from the 2007 figure.

Lesson Learned?

The removal of regulatory constraints with Dodd-Frank will not make banks less cautious, it will simply free them from regulatory accountability. In the years since the financial crisis, banks have rebuilt their capital. It is precisely this regulation that has allowed banks to prosper.

A lesson learned? Perhaps, but Republicans and several Democrats remain convinced that this legislation must go. Some doomsday analysts believe that the removal of Dodd-Frank will bring us back to the precipice of another global financial crisis. Clearly, that would warrant put options on bank stocks if you looking to profit off a pessimistic approach to the economy.

Idan Levitov, AnyOption

This article was written by Idan Levitov, VP trading for anyoption.com. Read more by Anyoption.