Classified as exotic options, binary options is a type of financial derivative that offers traders a fixed return on their investment if it expires in the money or nothing at all if the option expires out of the money. While in essence, binary options only has 2 possible outcomes, most binary options brokers nowadays offer traders several varieties in the ways they can trade binary options. The most popular of these is the classic High/Low (Call/Put) option.

It is important that the trader understands all the risks involved in trading this often misunderstood financial instrument

What makes binary options truly attractive to traders is their simplicity. An investor in binary options only has 2 main factors to worry about, the direction of the price movement and the expiry time. If the investor is able to determine the right direction of the price movement and the ideal expiry time for the option to close on the right side of the trade, then his investment will close in the money.

Unlike traditional or vanilla options, the quantum of the price movement for binary options is irrelevant and has no effect on the amount of the payoff. Nevertheless while binary options offers a simplistic way to trade the dynamic financial markets, it is important that the trader understands all the risks involved in trading this often misunderstood financial instrument.

Is Binary options trading gambling?

Many articles have been written about binary options, often equating binary options trading to gambling. This is largely due to the fact that many people misunderstand the simplicity of binary options as being nothing more than glamorized gambling. The fact is this is far from true. Before their debut to the retail trading sector in 2008, binary options have actually being around for decades.

They were initially used by the insurance industry to help insurance companies quantify insurance risks especially against catastrophic events such as storms or earthquakes. In fact without binary options, many people today would not have been able to insure their homes from damages caused by natural disasters.

Of course, there is also a tendency for some people to get carried away with binary options due to how simple it is to trade them. And when these people lose all their money, they tell themselves that it is gambling to justify their losses. The fact is binary options trading is like any other forms of financial trading. If you do not know what you are trading then chances are you are going to lose all your money.

This is why it is essential that you educate yourself properly regarding the markets and assets that you are going to invest in. Educating yourself in the financial market doesn’t just entail reading the financial news but also understanding how the markets work and how each piece of news can affect their movements. In addition, you to also learn how to trade the various markets using the proper trading strategies. With the right amount of trading education, you will begin to see more clearly how you can use binary options strategically to benefit monetarily.

Benefits of binary options

Although spot forex trading has been around for much longer than binary options trading, binary options trading have several distinct advantages over the former.

First of all with binary options trading, there is no leverage trading available. This means binary traders have better control over their trading risks than spot forex traders.

With binary options, you cannot lose more than what you invested unlike when you trade on margin. With binary options trading you also know beforehand how much you will be getting in return which makes it easier for you to calculate your risk/reward ratio.

Another benefit of binary options trading is the faster turnaround time. Comparatively, binary options trades are executed over a much shorter term than traditional financial trading. And because of the shorter turnaround time, binary traders can profit substantially more with their limited investment capital than forex or stock traders.

Finally, the average returns offered by binary options brokers ranges from 70% to 85% which is quite lucrative when we compared to what most investors earn from traditional investments. Given all the above-mentioned benefits, it is easy to see why binary options trading is becoming ever more popular.

Trading Binary Options

Apart from being simple to trade, binary options traders have a wide range of instruments that they can trade in. Nowadays, most brokers are able to offer traders binary options for currency pairs, commodities, stocks and market indices. In some cases, there are also binary options for bonds.

In order to look at the simplicity of this trade type let’s look at an example, let’s say you want to trade in forex binary options, the EUR/USD specifically.

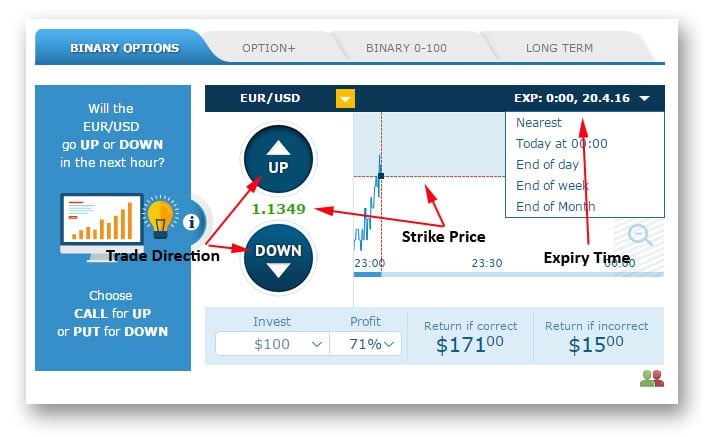

Using the screenshot above as a reference, you first determine if the EUR/USD is going to end up higher or lower (trade direction) than the strike price of 1.1349. Next, select the expiry time for the option which will correspond to what you predicted.

From the above example, you can chose the expiration time of 60 minutes (00:00), end of day, end of week or end of month. Once you have determined both the direction as well as the expiry time, decide how much you want to invest and after that just wait for the option to expire. If your option closes in the money, you will earn a profit of $71. And if your trade closes out of the money, the broker, in this case Anyoption, will refund 15% of what you invested.

Choosing a Reliable Binary Options Broker

if the broker claims to be regulated, check and see if they are regulated by industry recognized regulatory bodies

Despite having a large number of binary options brokers to chose from on the internet, it is important that you select the right broker to open a trading account with. Check if the broker has a wide range of assets to trade with and offers a choice of options contracts in addition to having a reliable Trading Platform . See if they also offer any special trading tools which can enhance your trading capability.

Apart from the range of assets and services offered by the broker, it is also important to see if the broker is regulated or not. And if the broker claims to be regulated, check and see if they are regulated by industry recognized regulatory bodies such as the Cyprus Securities Exchange Commission (CySEC ) and Malta Financial Services Authority (MFSA).

We cannot stress enough the importance of dealing only with regulated brokers as there plenty of scam brokers out there on the internet that are only interested in conning you out of your money. Some of the most common tactics used by these scam brokers is by preventing traders from withdrawing their money. They cite that this is due to non compliance with the terms and conditions tied to the bonuses previously accepted by the traders. So always make sure you read the terms and conditions set by the broker before committing yourself.

Binary options strategies

Earlier, we mentioned about trading binary options with a proper trading strategy. This is an area which most new traders tend to neglect as they are anxious to jump right into trading binary options. This is also the main reason why new traders tend to lose all their initial trading capital as they do not know what they are really doing.

Having a proper trading strategy is important as the strategy helps to keep you on track with your trade. Can you imagine driving a car without a proper destination? So why should you risk your money without having a clear direction on how to trade?

Developing a trading strategy is not difficult once you understand the market analysis that goes into developing one. A good trading strategy should encompass both fundamental and technical analysis. This is to ensure that you cover all the avenues and not overlook anything that might affect the price movements. Tools such as price charts and technical indicators are all there to help get a clearer picture of how the market is behaving as well as how it is going to behave in the future. Trending markets and ranging markets all call for different trading strategies and in order to come out ahead, you need to know what kind of trading strategy you can employ.

Binary options signals and robots

As online binary options trading becomes more mature, ancillary services such as binary options trading signals and binary options robots have sprouted up to help make binary traders’ lives easier. Binary options signals are trading signal services provided by a third party to alert traders who subscribe to the service of possible trading opportunities. Binary options robots on the other hand is software which operates within certain defined parameters specified by the trader to help the trader carry out his trade automatically.

The most obvious advantage of using these two tools is the time that it can save the trader. Instead of having to constantly monitor the markets, a trader can now use these two tools to help him automate the trading process and free him from being shackled to the computer. Nevertheless, relying on signal services and trading robots are not without drawbacks. The main drawback is having to relinquish direct control of your trading decision.

Conclusion

As exciting as binary options trading can be for most people, it is still a high risk activity and is not suitable for those who have a low appetite for risk. So before you decide to embark on a journey into the world of binary options trading, ensure that you can afford to lose the money that you are going to be trading binary options with.