In the dynamic trading industry that relies on trader conversion and retention, you need to understand what your customers want. To understand what drives your customers towards achieving their (and your) goals, we need to analyze their digital behavior over time, applying the behavioral analytics approach.

Behavioral analytics goes beyond traditional analytics, providing insights on trader behavior over time

When saying analytics, we all think of Google analytics, which gives us a basic understanding of our visitors and customers. How many visitors are on the site now looking at which pages, what geographic region did they come from, or what advertisement did they click? But that’s not really shedding any light on their behavior. This is what we call static data, a one-dimensional snapshot, of one single touch point, the website.

If you're thinking Google Analytics is enough for you, perhaps this article will make you see things differently.

Behavioral Analytics: What is It?

“Behavioral analytics utilizes the massive volumes of raw user event data captured during sessions in which consumers use application, game, or website, including traffic data like navigation path, clicks, social media interactions, purchasing decisions and marketing responsiveness.” – Wikipedia

Behavioral analytics presents you with a timeline of user actions. This isn't just about a single trading action, but a complete picture of the trader's journey, a series of events over time that brings you insights into their behavior. This alone will enable you to analyze retention by user and optimize the customer path to becoming a loyal one and thus boosting your retention.

Behavioral analytics presents you with a timeline of user actions

Just a short while ago, being able to analyze a trader's behavior was not an option. A new dawn is upon us, as with all the data from your Trading Platform and MetaTrader for example, combined with your CRM and financial data, you'll be able to learn where your leads congregate and what the hottest trading trends on the market are. THIS is the disruption that Behavioral Analytics brings to the industry.

Connecting the Dots

The trader's journey to successfully opening a position and making their first deposit is comprised of a few different touchpoints. Take repeat deposits for instance, your most loyal customers pretty much follow similar paths towards that goal. It most probably starts with a click on an ad campaign, perhaps a banner on a popular trading site, then to a short video and an invitation to open a demo account, then to their first real trade.

The trader journey to that first deposit with your company, and to future loyalty to your brand, is comprised of those many different “touch points”, with user action data created for each of these events.

The ability to understand trader behavior heavily depends on being able to stream and unify the plethora of data from across the different touch points; The marketing campaign data, combined with the web and mobile action data, joined with the MetaTrader trading data and the CRM financial data.

Finally, it is ripe for analysis. Now imagine what you could do with streams of data from all sources, fully managed in a cloud-based data warehouse, that you don’t need to worry about maintaining or paying extra for. The raw data is just there, waiting for you to query and ask the most complex business questions and get immediate answers from.

Unified Data in Action

How are your new users getting from registration to FTD? Who are the top 10 affiliates? Which campaigns brought the most First Time Depositors? Let's take an example from Fibiz, a smart trading app business, who implemented behavioral analytics and used the power of unified data with advanced conversion funnel analysis.

Fibiz compared the same conversion funnel from app install to opening a trading position, between users who watched the tutorial videos, and the ones who skipped it. That comparison, gave them the insight that traders who watched the video, continued to the conversion step at a much higher rate of opening a trading position.

This is what unifying data is all about, being able to analyze the conversion funnel right from the app install (provided by Appsflyer mobile attribution) together with actions done on the mobile app, provided those valuable insights.

“Being able to get fast insights early on the beta launch, enabled us to implement changes that ensured a better experience to our users. This gave us a serious edge in a fiercely competitive industry” -Shahar Nachmias - VP Product at Fibiz

You can then bring in the campaign data from the different marketing acquisition channels to identify the channels that bring those successful traders.

Retention - What is the retention rate and who are my most loyal customers?

I’m sure you know that retaining customers is just as if not more challenging than generating leads. You might as well nurture the known (current customers), rather than trying to bring in the unknown.

You might as well nurture the known (current customers), rather than trying to bring in the unknown

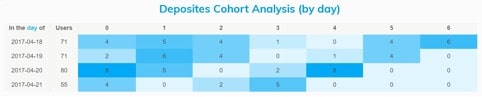

Utilizing retention cohort analysis, you'll be empowered to see all your clients from when they registered to how often they came back to perform an action or a set of actions over a period of how many days you specify. You'll be able to drill down into the cohort to find groups of users to target. Utilizing behavioral segmentation, you can put a targeted group of users into their own segment and hone in on them with any campaigns you'd like in a timely and efficient manner, whether it be an email, push notification or Facebook ad campaign.

Source: Cooladata Trading analytics

Deep Analytics Serving Risk Management

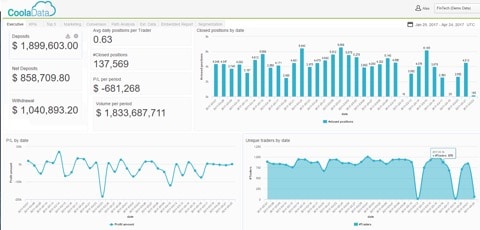

Assessing risk is a major aspect of operating a Forex brokerage. You must be able to see data in real-time along with getting alerts based on specific preferences, market statuses, P&L, Symbol exposure and volatility of the market. Performance managers can obtain a top-down view on platform performance giving them immediate awareness. The key to obtaining such a view is the unified data emanating from the entire spectrum of resources (Web, Mobile, Social, CRM, Affiliates, etc...)

Risk Managers can then drill down further to get a granular view of risk by user. What's more, sharing this data in a highly secure manner is paramount, so that all stakeholders are involved and engaged in quick and efficient decision making.

This way of analyzing trading data has already been implemented at some industry leading companies with great success.

Source: Cooladata Trading analytics

Remember, every trader action or series of trader actions whether it may be on mobile, web or social when integrated with CRM and financial data is a paragraph in a story waiting to be told. Behavioral Analytics is your tool to uncover those stories and grow your business.

Download your essential guide to trading analytics.

Tsahi Levy, CMO of Cooladata

This article was written by Tsahi Levy, CMO of Cooladata. He is a business executive with proven experience in global marketing, sales, business development and strategic planning in enterprise software, telecom and gaming industries. Prior to Cooladata, Tsahi co-founded Numgames, an end-to-end solution for companies that require e-commerce platforms. Tsahi also served as Microsoft’s business development manager for seven years. He can be reached at goFX@cooladata.com.