B2Broker, a leading Liquidity and technology provider of solutions to the forex and crypto industry, is pleased to introduce B2Core, a major upgrade to its client cabinet solution Trader’s Room, which has undergone a major overhaul in response to client demand and to meet today’s exacting business needs.

All New Client Cabinet Concept

B2Core takes on a whole new guise embracing a vast new range of new capabilities, culminating in an innovative and unique bespoke service for clients. B2Core offers an all-round, greatly improved user experience compared with the company’s previous version.

It consolidates all previous aspects of Traders room, including clients area, etc, elevating the company’s existing SaaS solution to the top of its league in the financial services industry.

Businesses looking for a solution with functionality that can handle a broader and more customised range of demands than the industry-standard traders room solution will find B2Core exceeds their expectations and outperforms other products in the market with a range of advanced features that can be tailored to fit each type of organisation.

With B2Core, businesses no longer need to accept a one-size-fits-all solution.

Unique Pack-Based Solution

From basic tasks such as organising the work of forex brokers and crypto exchanges, back office for employees and administrators, front-end for traders, verification and registration of customers and a huge range of payment functions, B2Core brings to the market a whole new concept of a pack-based solution.

This essentially means that B2Core clients can now choose a package that suits their requirements best. For example, the B2Core Standard pack includes a basic set of features and offers a budget-friendly solution.

Alternatively, businesses can opt for an Advanced pack with many more potential features and modules such as bonuses, IB Room and Converter, and integrations with a large choice of payment solutions and external platforms such as B2Trader, MetaTrader, CTrader, DXTrade, AlphaPoint, OneZero and PrimeXM.

At the top end of the scale for larger corporates, B2Core offers an Enterprise pack, a solution which is ideal for where the client has their own specific requirements and demands regarding the type of solution they want.

In this respect, B2Broker develops and maintains the solution accordingly.

The newly adapted B2Core pack-based solution means that B2Broker can offer a product which is more responsive to its clients requirements and more flexible in that the solution can be adjusted to meet a wide range of needs.

B2Core is a must-have choice for any professional business including FX and crypto brokers, converters, spot and margin exchanges, EMIs and crypto wallets, adding an extra dimension to the existing Trader’s Room offering with the following all-important features:

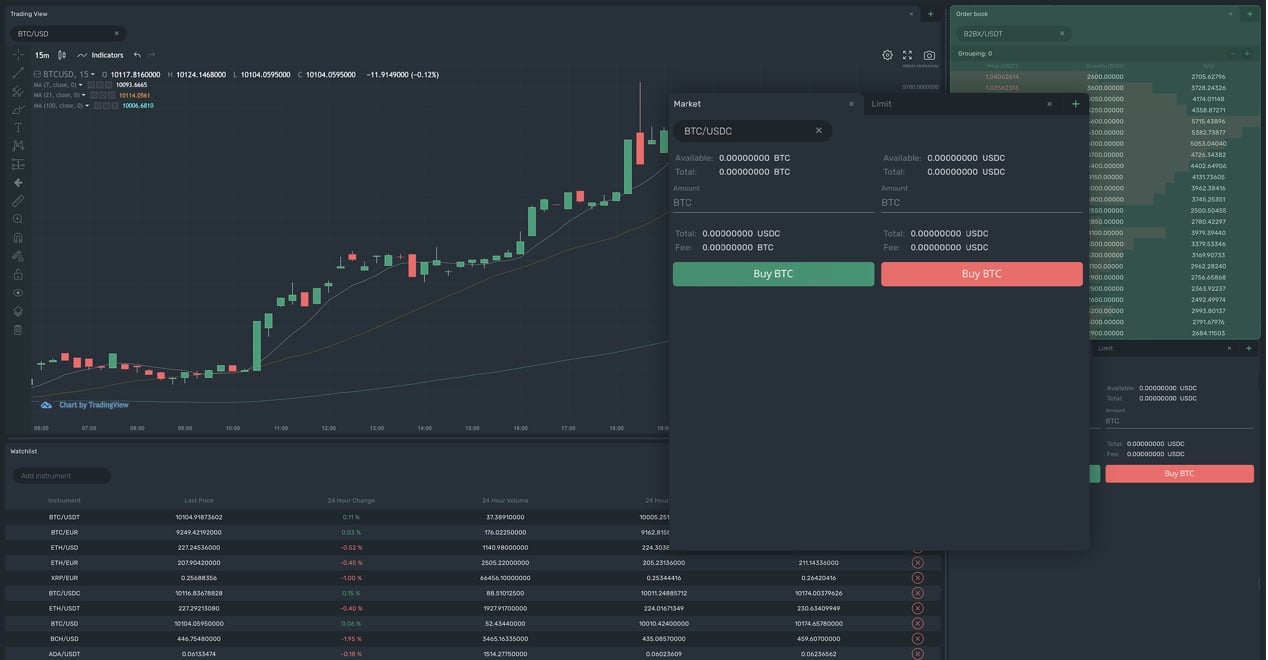

Dynamic Advanced UI Layout

The first of the new features is an ideal opportunity for all Exchange clients to obtain one of the most advanced front-end layouts on the market.

The end-user of the Exchange will be able to fully customize the workspaces in order to maximize the efficiency of their trading performance and combine it with the satisfaction of usage.

For example, users can now organize the blocks of order books, watchlist, charts, history of trades, change the size and order of these windows without any limitations to get the best usability and maximum customization of the platform.

It is also possible to create several workspaces to enable users to have separate areas for different trading purposes.

Another new feature is Market Depth which shows the market's ability to sustain relatively large market orders without impacting on the price of the asset in question.

Market depth takes into consideration the overall level and breadth of current open orders within an individual currency pair.

Grouping of volumes is a significant part of the update which allows users to analyze the deepest liquidity available on the platform. It can be accessed in the order book of every instrument.

Finally, the Watchlist widget can now be added to the workspaces of the Trading UI. Users are able to make a list of the pairs that they wish to monitor and display the current prices, volumes and 24 hour highs & lows in one place.

Overall, the Trading UI is now capable of fulfilling all the demands of professional traders who frequently use it to monitor large amounts of information.

A working version of the dynamic layout

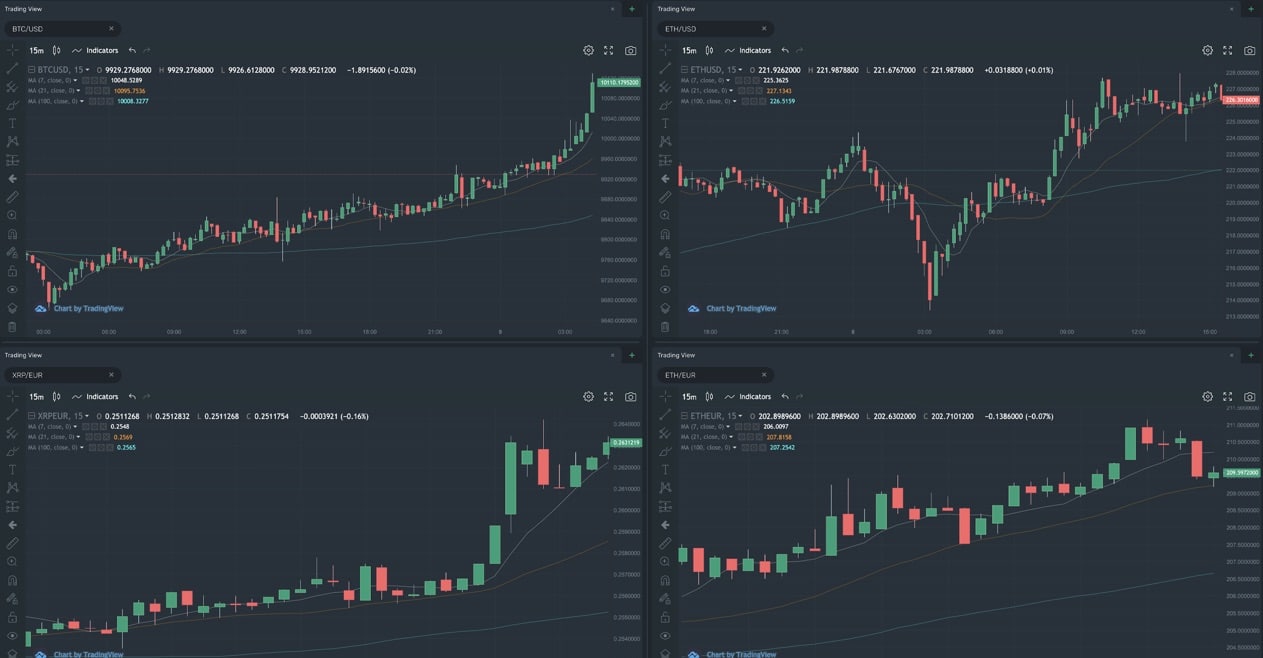

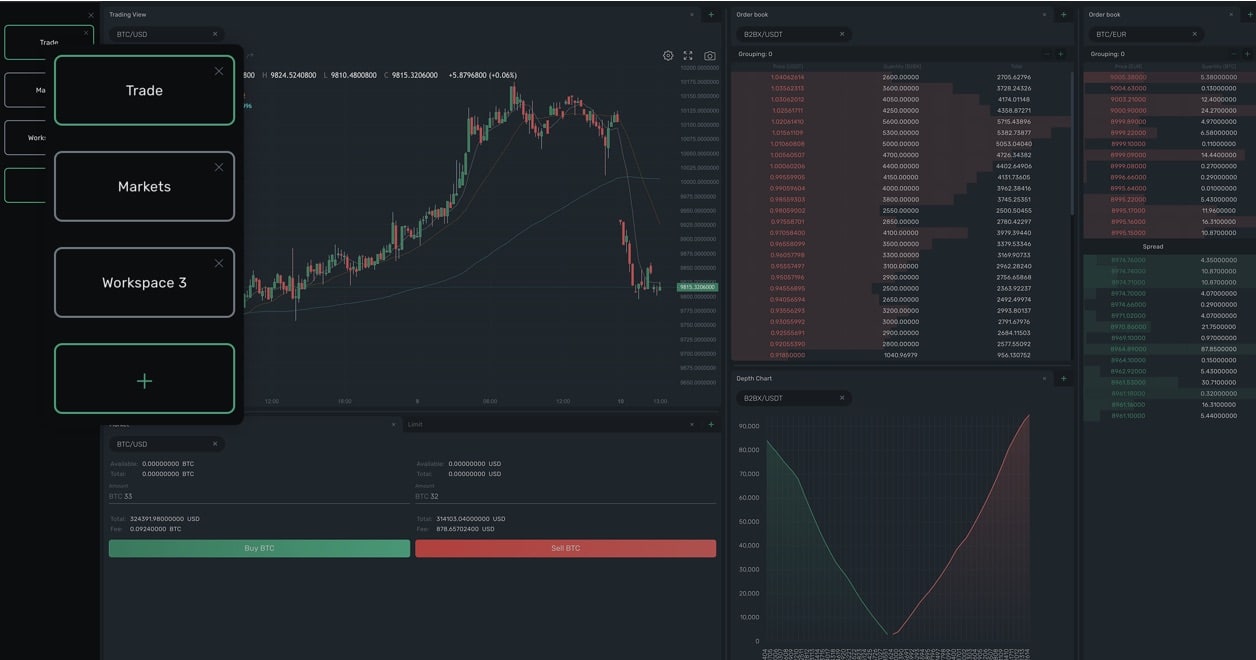

A further working version of the dynamic layout

Watchlist widget with different workspaces

Advanced Anti-Fraud Homemade System

B2Core’s Advanced Anti-Fraud Homemade System is an automatic withdrawals system featuring security alerts and other procedures to avoid money-laundering and trading cheating procedures on the platform.

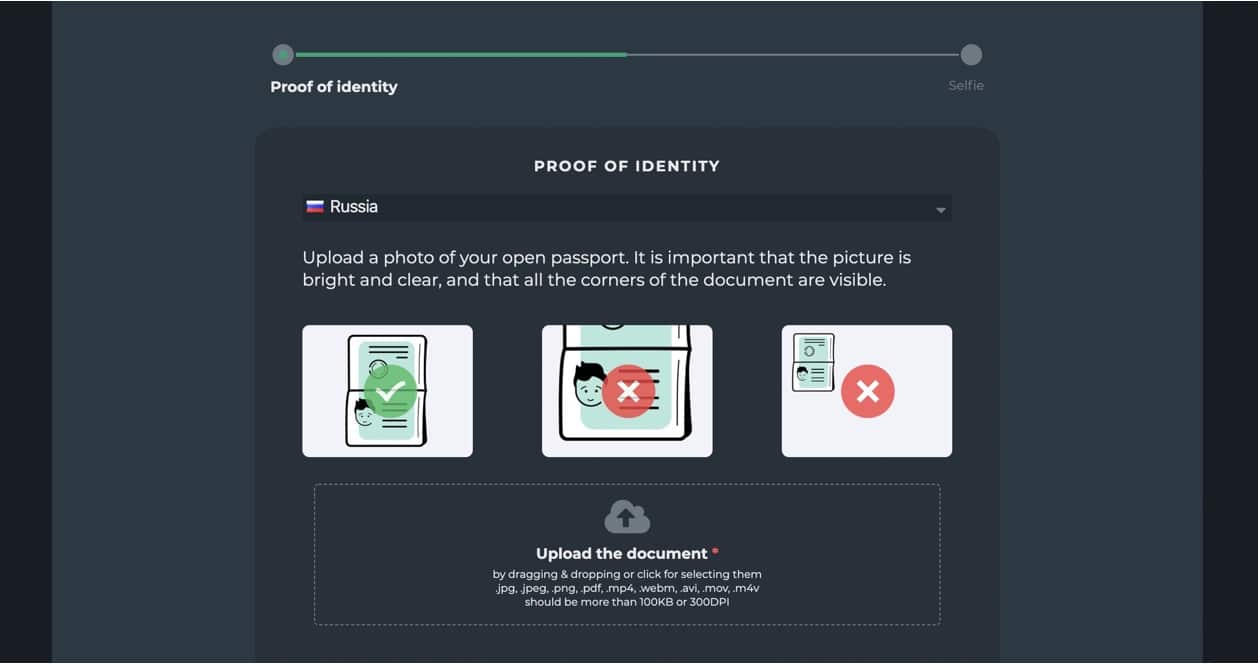

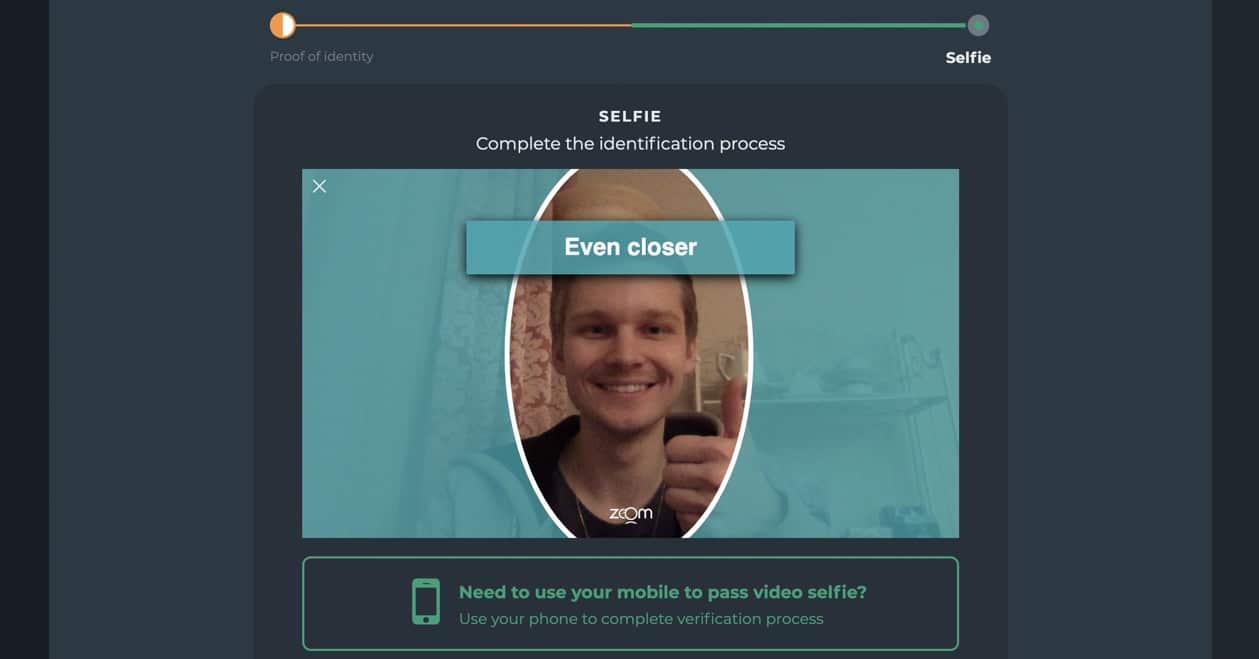

Sum-Sub WebSDK Integration

Sum-Sub WebSDK integration provides advanced and highly customizable Know Your Customer (KYC) procedures that will enable a business owner to avoid legal department costs as everything is handled automatically by the technology provider.

The verification procedure in profile settings

The product manager after successfully uploading photo

PrimeXM/OneZero Integration

As well as deep integration with the industry’s flagship Trading Platform MetaTrader 4 and 5, B2Core is now integrated with PrimeXM, OneZero, dxTrade and B2Trader, making a total of 6 trading platforms. B2Broker can now offer its customers the opportunity to target a wider range of end-customers across the globe.

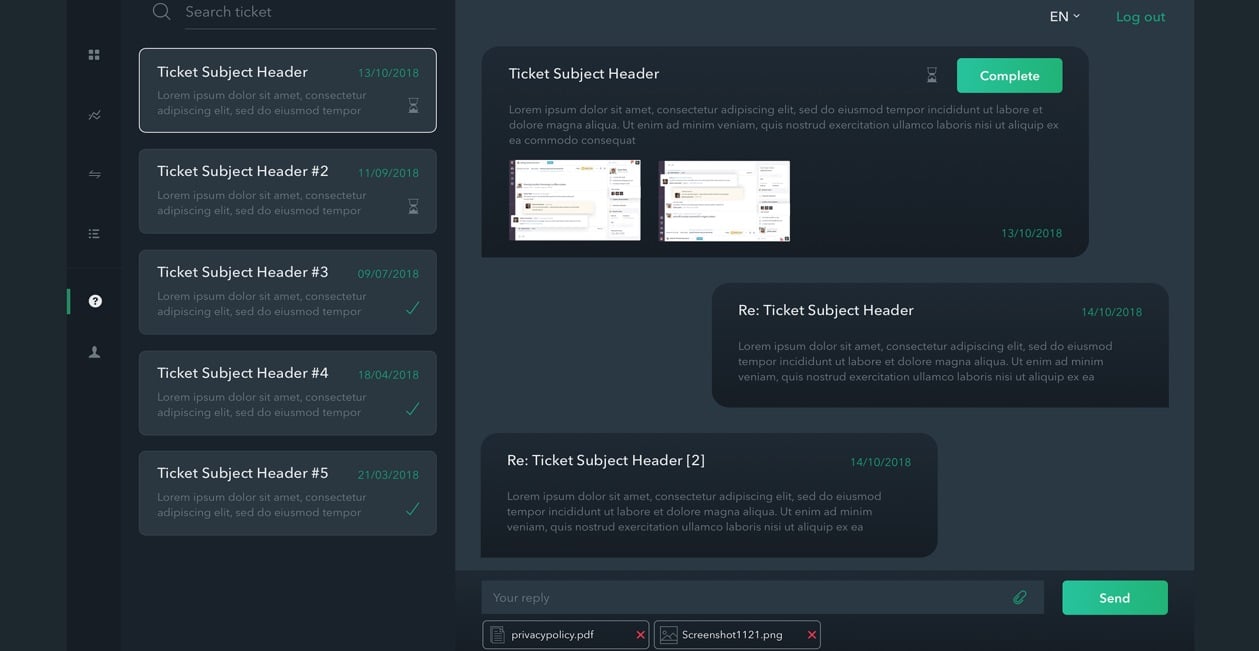

Ticket System

B2Core, currently integrated with SupportPal, can now enable clients to offer a ticket-based customer support service within B2Core as a module.

Rather than conducting support via Skype and other social networks where information is likely to get lost, using the Ticket System ensures everything is recorded and processed as part of the same procedure.

The Ticket System module

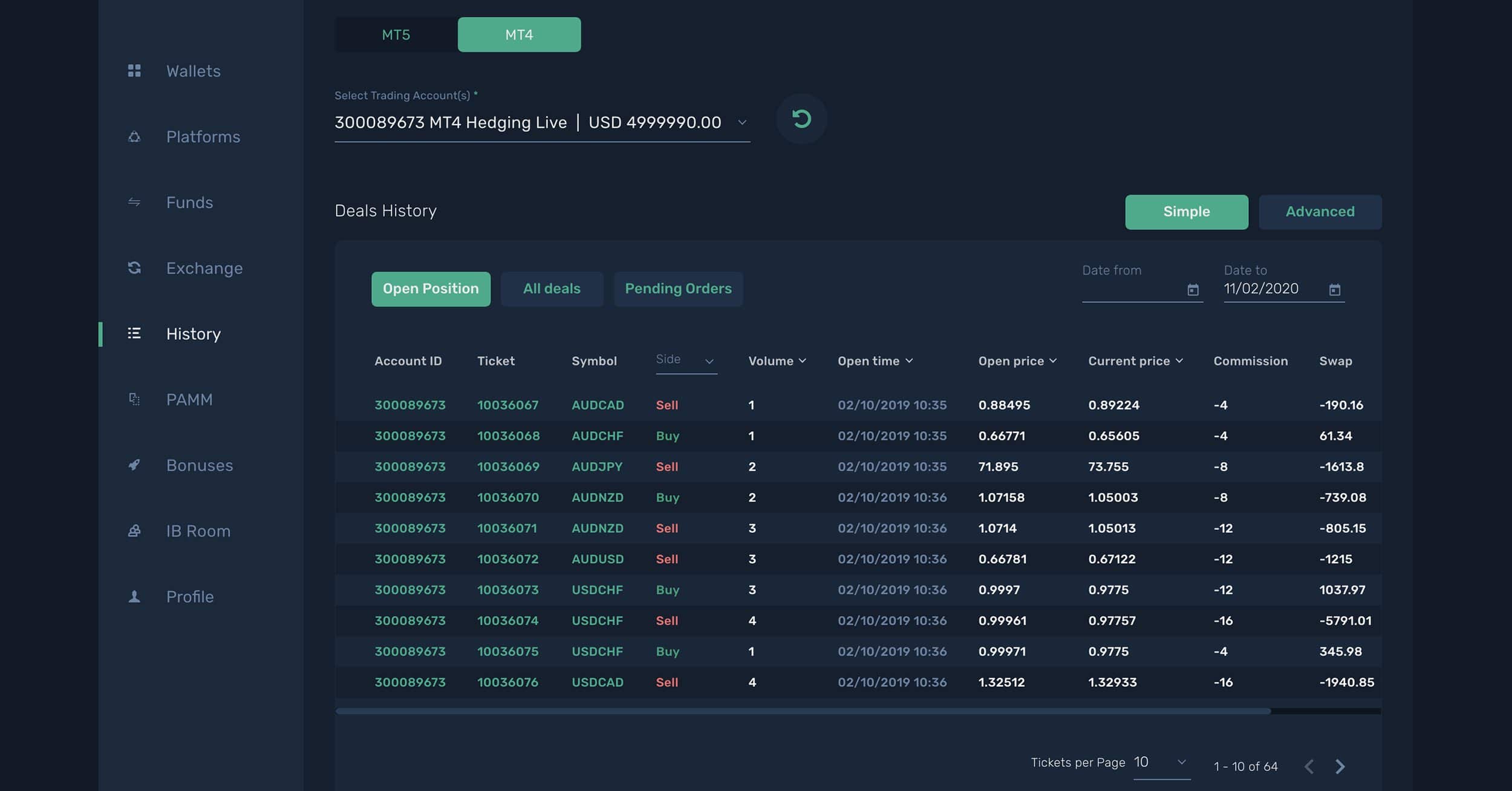

Detailed MT Analytics

B2Core’s main trading platform integration with MT 4 & 5 allows the end-users to monitor all activities occurring on the MT account directly from their Trader’s Room account.

This allows the user to check his requirement and actions with one solution as illustrated:

Trading Report (History module)

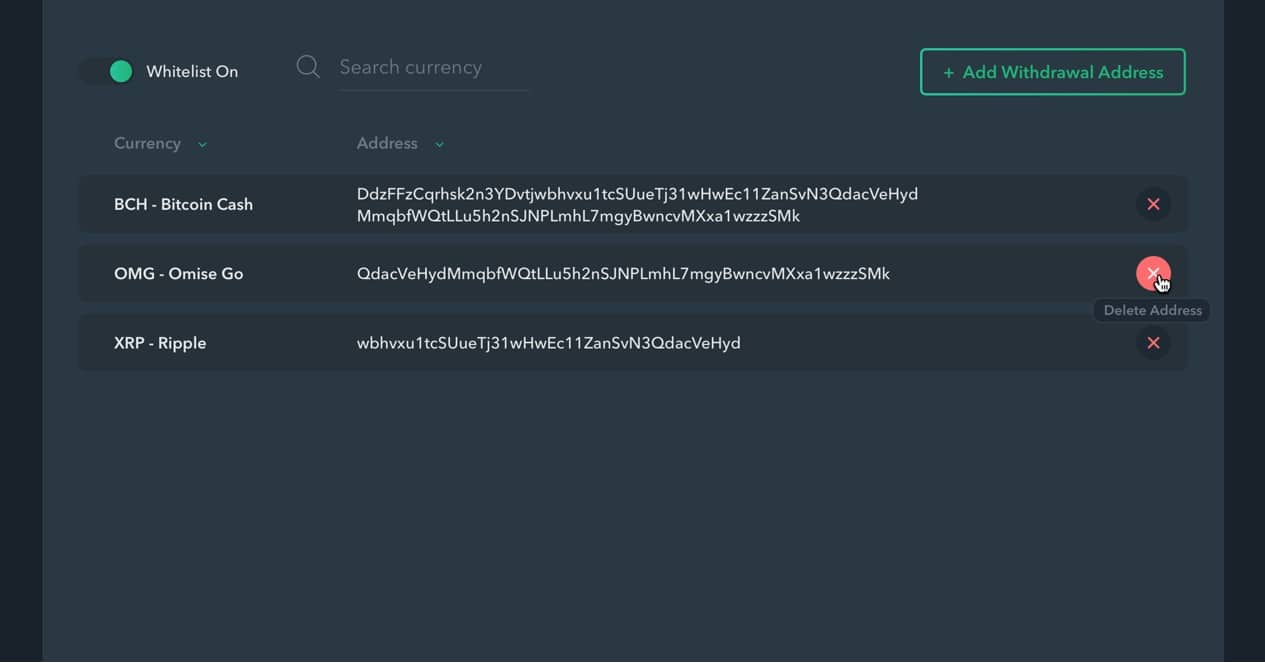

Withdrawal Address Whitelist

A new whitelist function has been added which is essentially an address whitelist for withdrawal purposes. This is an additional security measure for end users, where they are able to specify their chosen, trusted wallets for withdrawal which means that only these wallets will be logged out of the system.

The new security measure has been developed in conjunction with 2FA Google Authenticator.

Withdrawal Address Whitelist

A Multi-Featured Package to Suit Every Business Need

All in all, B2Core offers a huge range of vital new adjustable features, providing users with the means to pick and choose what suits them.

It is the must-have solution for every company and one which is capable of handling client-facing operations of every type of financial business, regardless of complexity.

Not only is B2Core highly-customisable, it is an efficient, high-performance system that overrides all the one-size-fits all client cabinet solutions in the market, and most importantly, one which your users will thank you for choosing.

About B2Broker

B2Broker is a liquidity and technology provider of solutions for the crypto and foreign exchange (FX) industry. The company specialises in the sphere of B2B services and products, catering for a wide range of clients including large licensed brokers, crypto exchanges, crypto brokers, forex brokers, hedge and crypto funds and professional managers.

B2Broker’s advanced base of ready to use technical solutions enable brokers to save time and money on consuming infrastructure projects and focus on enlarging their client base and increasing their revenues.