Success depends on how well a business listens to what a customer is saying. This requires evolving from simply analysing touchpoint data to extracting value from the entire customer journey. Impact Tech enables every business to deliver premium customer satisfaction by providing Sentiment Analysis using Natural Language Processing and Machine Learning algorithms.

Leading companies understand that how they deliver has become as important as what they deliver. This explains the growing focus on improving customer satisfaction.

Today’s technology has redefined how goods and services are purchased which has in turn changed customer expectations. 75% of consumers now expect a response within five minutes after making contact online. Research also reveals that 25% of customers will not return after just one bad experience.

The omni-presence of companies like Google, Apple and Amazon means customers now expect to receive the same levels of immediacy, personalisation and convenience from every supplier.

Apple enjoy 90% customer loyalty because of the first-class customer experience they deliver. Apple’s products are good but there are many cheaper options that perform as well if not better. The key to Apple’s success is the iOS eco-system its customers become a part of. The App store and iCloud storage integrate effortlessly with their products and enables Apple to offer a highly personalised customer experience.

Fractured customer engagement systems are one of the biggest hurdles businesses face as they struggle to increase customer satisfaction and extract value from the data gathered by customer touchpoints. The solution is to combine the touchpoints to create a customer journey which enables the business to see the world through their customers’ eyes.

Companies fail to extract full value from their data because they are focussed on individual touchpoints such as billing or service calls. Even when an employee executes their individual role well, the overall customer journey may still disappoint. The key to satisfying customers is not just to measure what happens, but also to use the data to drive action.

Premium Customer Satisfaction Using Advanced Analytics

Armed with the advanced analytics available from Impact CRM, Impact Telecom and Impact AI businesses gain rapid insights that build customer loyalty, make employees happier, achieve revenue gains and reduce costs.

The ideal customer experience measurement system puts the journey at its centre and connects it to other critical elements such as business outcomes and operational improvements. Impact CRM makes unifying customer touchpoints possible through its unparalleled API architecture.

It creates a seamless connection between the business and customers where every communication is collected, visible on a single interface and accessible by all departments.

The path to exceptional customer satisfaction requires having a deep understanding about the mood and needs of clients during their journey. To achieve this requires a tool that accurately gauges and quantifies customer feelings.

Impact AI achieves this using Artificial Intelligence. Natural Language Processing (NLP), Machine Learning and Sentiment Analysis combine to determine the mood and highlight successful interactions which are used to model future interactions. Detection of negative sentiment in combination with Machine Learning enables brand protection. This process can be broken down into five steps:

Step 1. Call

A call takes place between a client or lead and an agent. It may be a sales call, or it could be from a client seeking support.

Step 2. Recording

Every call made using the platform is recorded and saved securely.

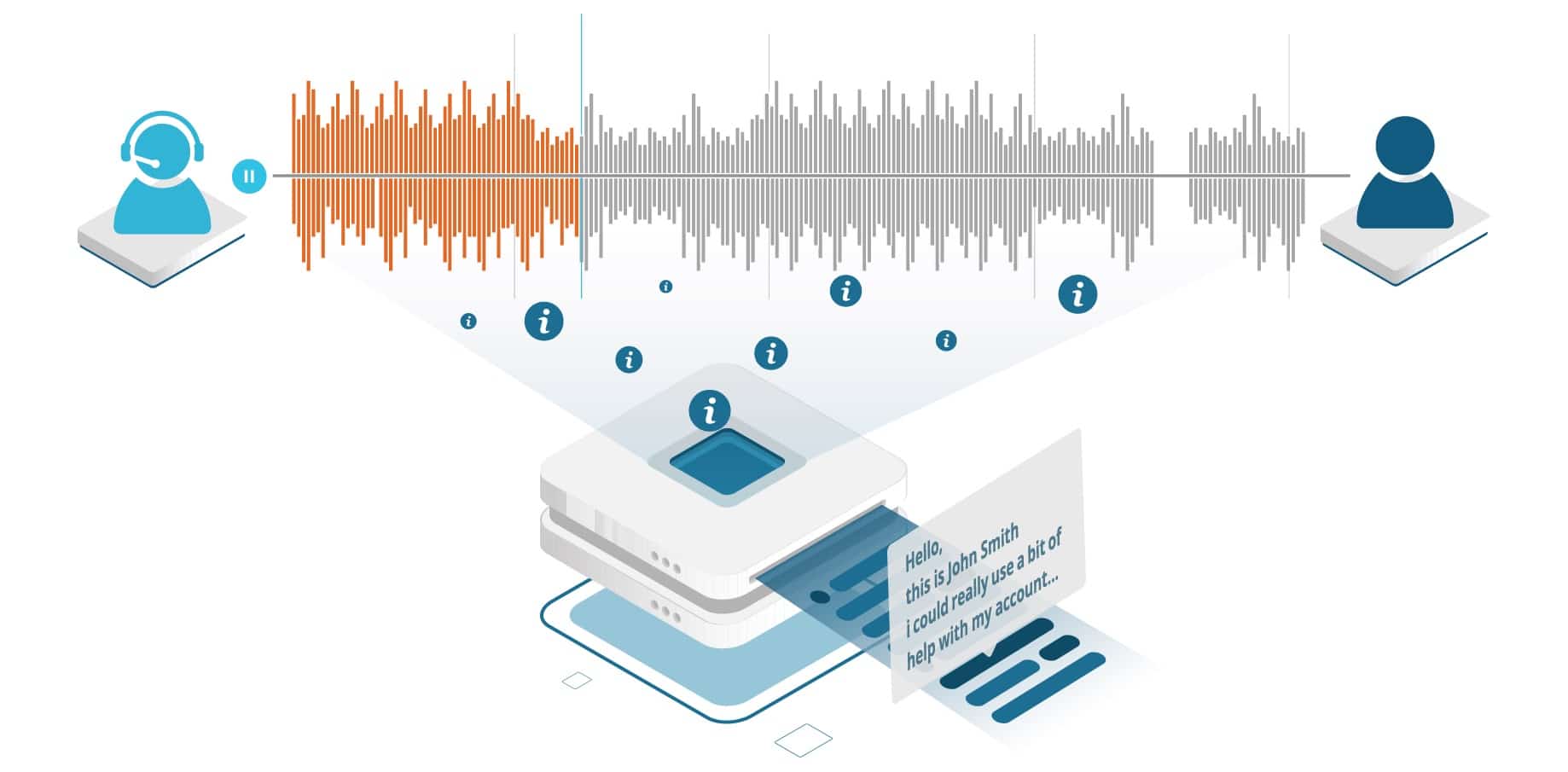

Step 3. Transcription

Speech to text analysis converts the call to text. NLP uses syntax analysis to give the text context and meaning.

Step 4. Sentiment and Compliance Analysis

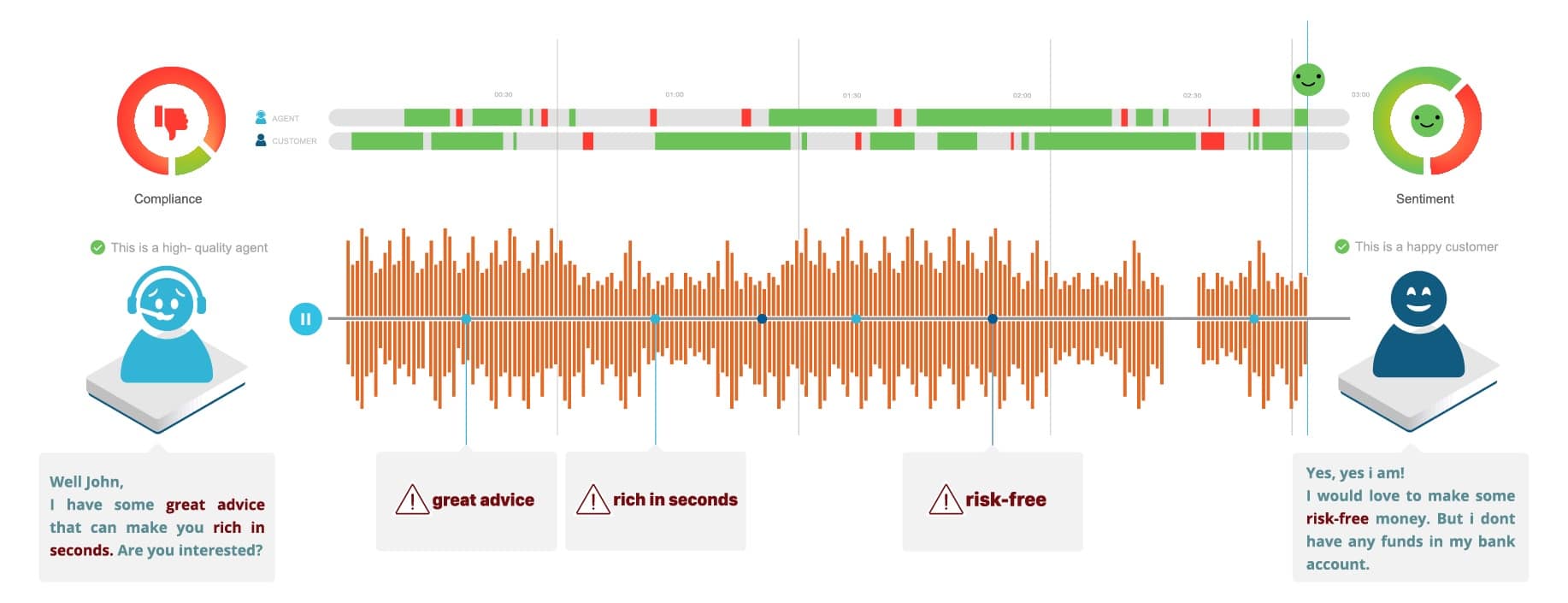

Sentiment Analysis determines the overall mood of the call. NLP and Machine Learning highlight potential compliance issues.

Step 5. Continual Learning

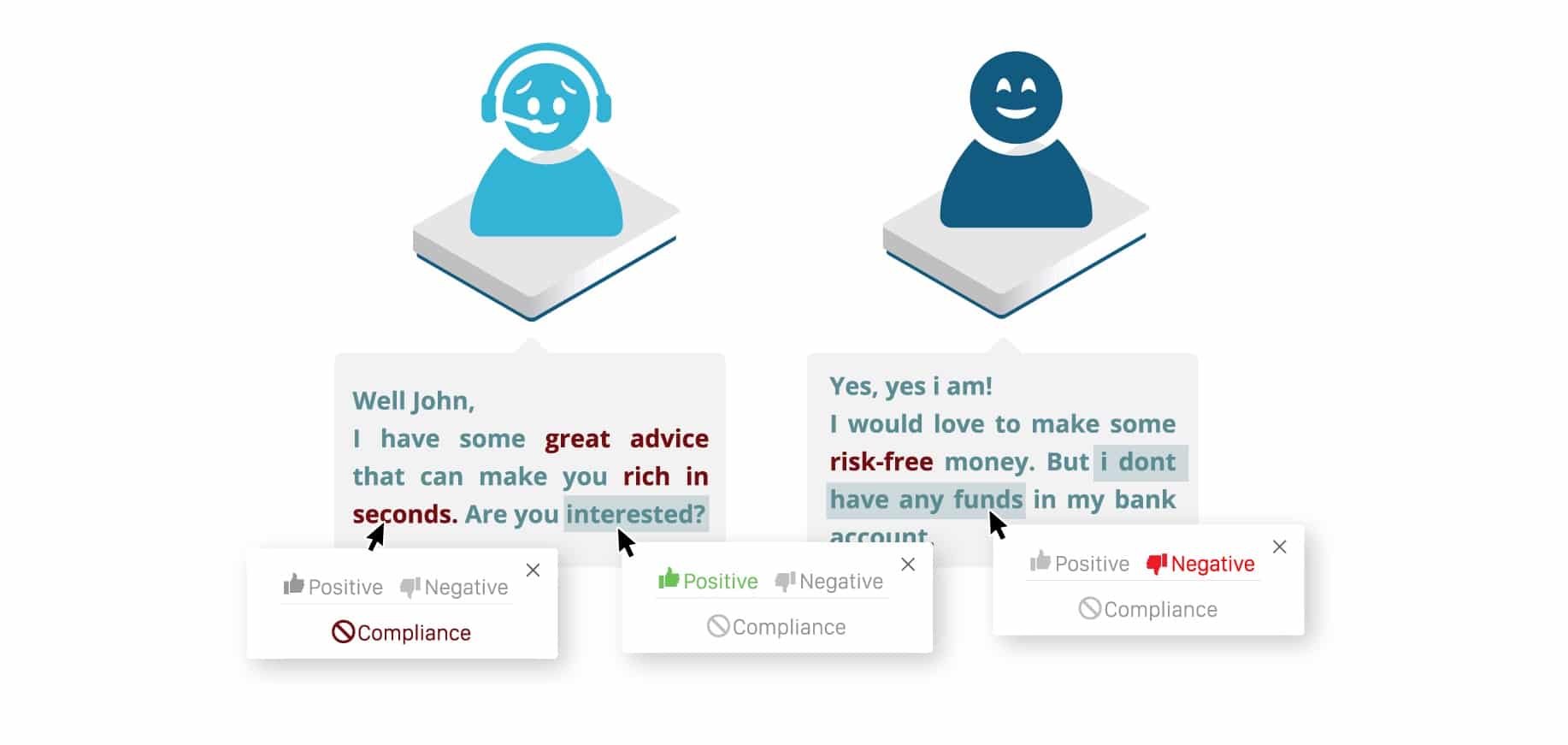

Words can be tagged manually to accelerate Machine Learning and tailor the platform to the terminology of the industry or territory the business operates in.

Sentiment Analysis Reveals Client Mood During Their Journey

By filtering all communication channels through Sentiment Analysis within Impact AI, it is possible to improve customer satisfaction and create deeper client relationships.

Impact CRM can analyze social media, chat, email and other online activity to create further insights to more fully understand a client.

Sentiment Analysis reveals the actions that result in customers satisfaction and pinpoints the interactions that lead to client unhappiness. When combined with Machine Learning, this enables a business to protect brand reputation by avoiding repetition of the same negative interactions and doing more of what results in positive outcomes. The importance of brand protection is underlined by the fact that companies risk losing 59% of potential business if a lead sees three negative postings in a search.

Impact AI ‘learns’ from the mood data collected and becomes more precise in its understanding about what results in a satisfied, loyal client. By also adding agent feedback through Continual Learning, the platform’s learning accelerates and delivers more meaningful insights.

Automation Increases Efficiency Throughout the Organization

If a company is to achieve the level of efficiency expected by today’s customers, automation is the only option. Impact CRM automatically directs enquiries and leads to team members who are appropriately skilled to deal with a customer request based on region, language and request type.

Businesses that attract clients from around the globe employ staff that are trained to communicate effectively with them. The full benefit of a multilingual, highly trained sales and support team is not realised unless there is a system in place to ensure enquiries are dealt with in the first instance with an agent who communicates in the native language and has relevant knowledge relating to the client’s enquiry.

In addition to removing a costly layer of manual administration, automation also minimises the time needed for requests and leads to be dealt with by the most appropriate people within the team.

Over time, the Machine Learning algorithm is able to predict which individual member of a team is best suited to convert a sale based on the previous conversions of leads with similar demographics. Context analysis and Machine Learning will combine to eventually enable the platform to automate Lead Scoring.

Make Compliance Management Your Strategic Advantage

Impact CRM, Impact Telecom and Impact AI form a fully integrated eco-system that enables a brokerage to monitor IBs, tied agents and ancillary white labels with the same business tools and subject to the same analytics.

Like many regulated industries including the Forex industry, meeting compliance regulations is a hurdle most brokers face. Impact CRM uses NLP to identify the calls that risk infringing regulations using a percentage ranking.

This can save brokerages costly fines for repeating infringements and increases efficiency by enabling the compliance team time to focus on the calls that need attention. A combination of Machine Learning and Continual Learning further improves the efficiency at which potential compliance issues are identified and eventually results in fewer employees being needed to monitor communications.

Sentiment Analysis will also help a company protect its online reputation by highlighting when an agent’s actions have resulted in negative sentiment. The same information can help to train members of the sales team about what is permissible to say. By flagging up words and phrases with potential compliance issues, managers can focus on the training needs of individual team members.

Training is further enhanced with powerful insights about the most effective sales techniques. This lifts the overall performance of sales teams and brings new members up to speed more efficiently.

In addition to identifying the keywords and the time of day that most frequently results in sales, other critical data like the optimal talk-to-listen ratio and what keywords work best and what to avoid by territory combine to create clearly defined sales guidelines per territory.

Make the Most Out of Every Penny Spent on Marketing

Predictive analytics enables every business to generate a greater return on advertising spend. By analysing the results of every campaign, Machine Learning identifies the most successful elements of each campaign. As more data is collected and analysed, predictive analytics reveals the most effective campaigns by territory, age group or any other pre-defined metric.

After defining the most effective keywords, a business can focus on which territories respond better to specific keywords plus other demographics like gender, age, education, profession, occupation and income level.

Many platforms offer customer-experience metrics, but to be truly effective they need to be able to hear the voice of the customer throughout their journey and allow a business to see as they do. Investing in Impact CRM offers an effective and complete system to measure the experience of the customer journey and the most efficient way to reap the rewards of customer feedback.

Impact CRM makes it possible for businesses to exceed customer expectations. The need to deliver the best customer satisfaction is never-ending. It’s imperative for a business to invest in a platform that delivers immediately and is built with the future in mind.

Disclaimer: The content of this article is sponsored and does not represent the opinions of Finance Magnates.