2020 has been defined by the outbreak of Covid-19, which according to many health experts has yet to even reach its peak.

To date, a vaccine has not yet been created to combat the virus, though pharmaceutical companies worldwide are aggressively pursuing one.

This has made investing in pharmaceutical stocks one of the most attractive options in 2020, given the huge potential upside of rolling out the first vaccine for Covid-19.

EuropeFX is clearly cognizant of this demand, having recently expanded its own offering to include a basket of Pharma Stocks.

The brokerage is now offering exposure into seven different pharmaceutical companies that are currently the frontrunners for a Covid-19 vaccine.

Why Now Could Be an Interesting Time to Invest in Pharma Stocks

Hundreds of thousands have died worldwide and the demand for a vaccine has never been higher. This has created an unprecedented demand, which could catapult a pharmaceutical’s valuation through the roof overnight.

Traditionally, pharmaceutical companies face long roads to inventing vaccines. Long before these get to the market, a vaccine has to pass multiple stages of trials to ensure its safety.

These are decreased, however, once the World Health Organization (WHO) has announced a pandemic, which is the case for Covid-19.

As a result, several pharmaceutical companies have seen an extraordinary level of speculative interest from investors during the trial stages of a vaccine.

Which Companies Could You Invest in?

EuropeFX now has seven pharmaceutical companies leading the race for a Covid-19 vaccine globally on offer. This includes the following companies:

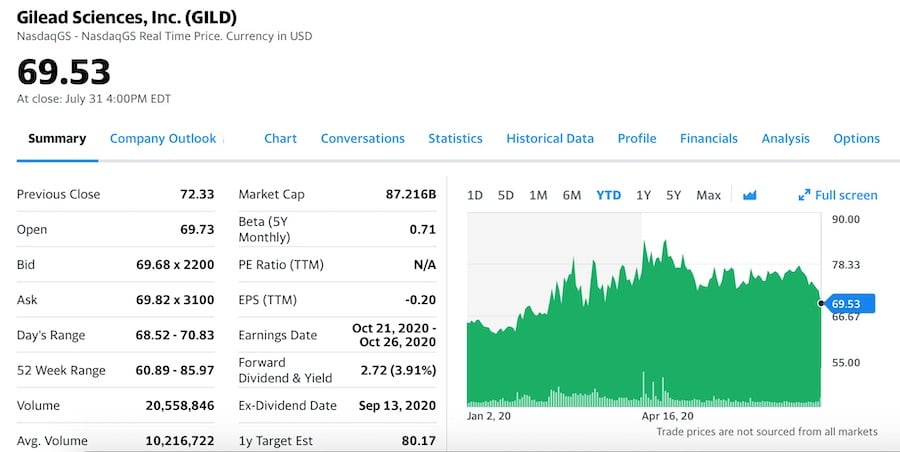

Gilead Sciences Inc.

(NASDAQ:GILD)

A research-based biopharmaceutical company, Gilead Sciences, currently carries over twenty-five marketed treatments in the United States for HIV and Aids, Liver Diseases, Hematology and Oncology, Cardiovascular Disease and Inflammation and Respiratory Disease. Gilead is currently in Phase-3 trials for Remdesivir, a Covid-19 drug.

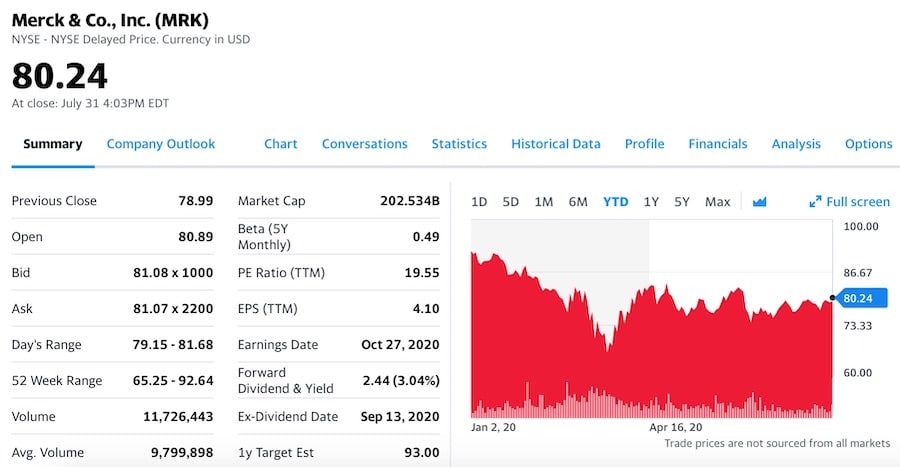

Merck KGaA

(NYSE:MRK)

Founded in Darmstadt, Germany, Merck & Co is active in sixty-six countries and with around 57,000 employees, the Company generated sales of €16.2 billion in 2019. The Company is active in all areas of pharmaceutical production and food safety and is heavily involved in the performance material sector for a broad and diverse range of industries.

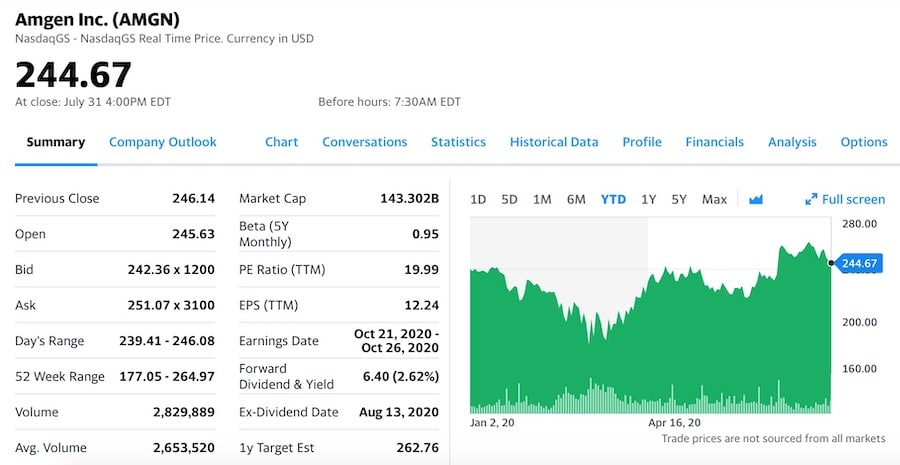

Amgen Inc.

(NASDAQ:AMGN)

Founded in the United States in 1980, Amgen has grown to be one of the world’s leading independent biotechnology companies. Amgen is currently focused on six therapeutic areas: cardiovascular disease, oncology, bone health, neuroscience, nephrology, and inflammation. The Company generated sales of $22.2 billion in 2019.

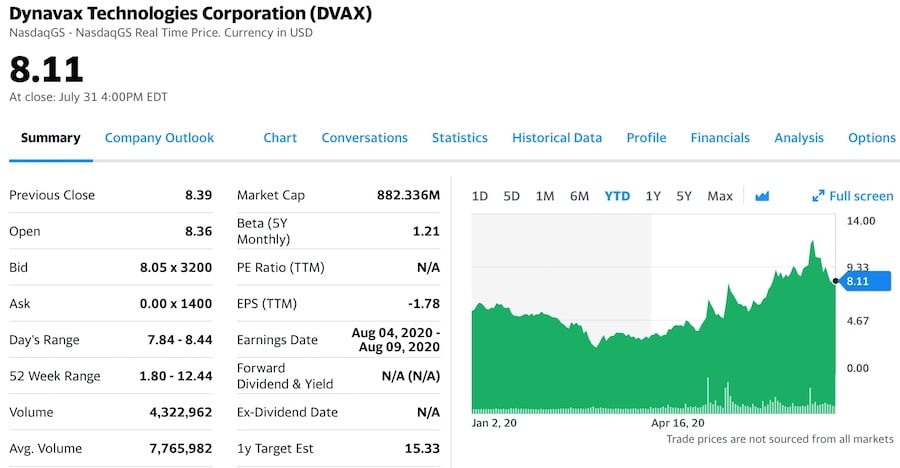

Dynavax Technologies Inc.

(NASDAQ:DVAX)

Dynavax Technologies Corporation develops and commercializes novel vaccines. The Company’s first commercial product, HEPLISAV-B [Hepatitis B Vaccine (Recombinant), Adjuvanted], a hepatitis B vaccine for adults, is approved in the United States. 2019 saw product revenue of $34.6 million.

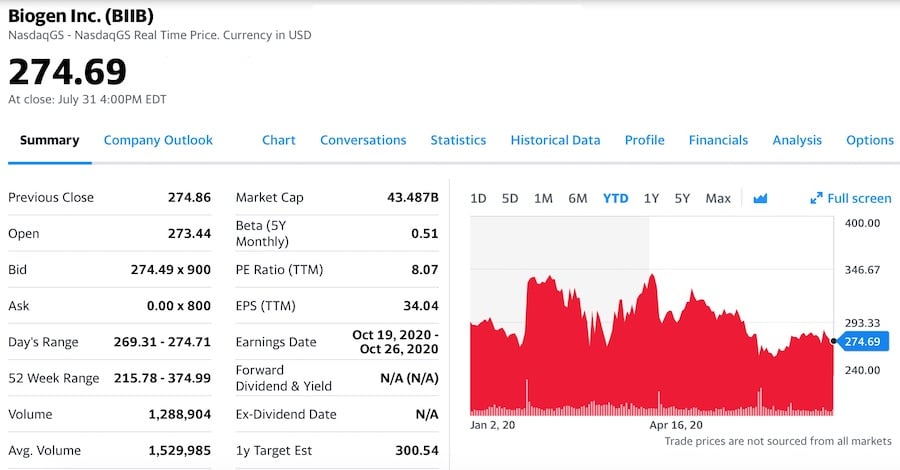

Biogen Inc.

(NASDAQ:BIIB)

Founded in Geneva, Switzerland, Biogen helped pioneer the biotechnology industry. A leader in the development of treatments for Multiple Sclerosis, Spinal Muscular Atrophy, and Alzheimer’s Disease, Biogen’s revenues in 2019 were over $14.3 billion, for a 4.5% increase in total revenues year over year.

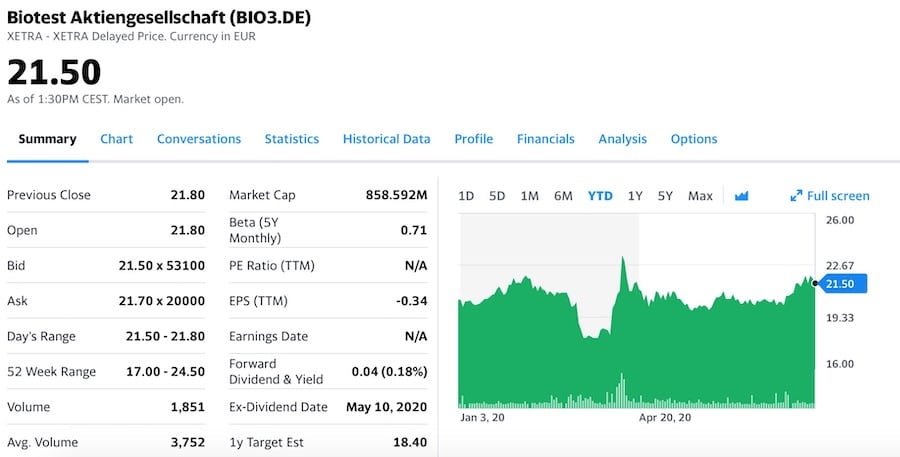

Biotest Aktiengesellschaft

(XETRA:BIO3.DE)

Founded in Germany, Biotest markets different products in three therapeutic areas: clinical immunology, haematology, and intensive care medicine. The Company is active globally, with locations in Europe, South America, and the Russian Federation. 2019 saw revenues of over €419 million, and the Company embarked on an ambitious expansion program with investments of over €300 million planned for their Dreieich location with the creation of over 300 new jobs in the region.

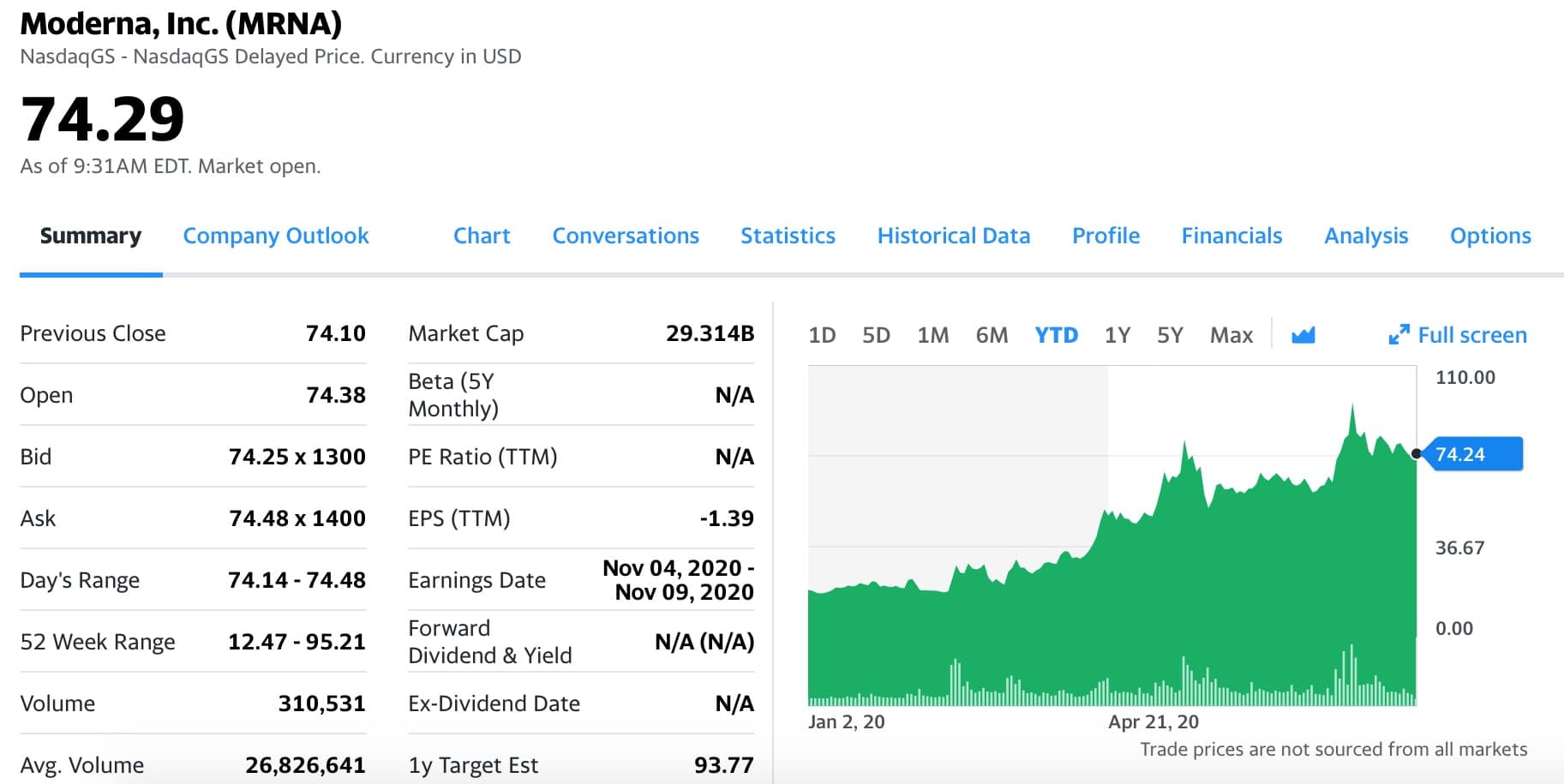

Moderna, Inc

(NASDAQ:MRNA)

Moderna, Inc., a clinical stage biotechnology company, develops therapeutics and vaccines based on messenger RNA for the treatment of infectious diseases, immuno-oncology, rare diseases, and cardiovascular diseases.

About EuropeFX

EuropeFX is a global leader in Forex , CFDs, stocks, commodities, Cryptocurrencies , and more. The company utilizes STP trade execution, offering live webinars and education sessions and an extensive lineup of tradable assets, markets, platforms and trading options.

Risk Warning: CFDs are complex instruments and carry a high risk of losing money quickly due to leverage. 78.94% of retail investor accounts lose money when trading CFDs with this provider. The information contained in this market overview should in no way be construed as investment advice and/or as a proposal and/or request for trading activities and financial transactions. The data contained in this market overview is not necessarily real-time or error-free. The data and prices on the material are not necessarily provided by a market or exchange, but by market makers, so that prices may not be accurate and may differ from the actual price in a particular market, meaning that prices are indicative and not suitable for trading purposes. There is no guarantee and/or prediction of future performance. EuropeFX, its affiliates, agents, directors or employees do not guarantee the accuracy or validity of any information or data provided and shall not be liable for any loss arising from any investment based thereon. Trading Forex/CFD's carries a high level of risk and may result in the loss of your entire investment. Forex/CFD's are leveraged products and therefore trading Forex/CFD's may not be suitable for all investors. It is recommended not to invest more money than you can afford to lose in order to avoid significant financial problems in case of losses. Please make sure that you define the maximum risk for yourself.