Nomura Holdings Inc. is preparing to expand its operations in Japan’s digital-asset sector. The company’s wholly owned subsidiary, Laser Digital Holdings AG, intends to apply for a license to offer crypto trading services to institutional clients, as reported by Bloomberg.

The Switzerland-based unit is in pre-consultation talks with Japan’s Financial Services Agency, Chief Executive Officer Jez Mohideen said.

Institutional Interest in Crypto

A June 2024 survey by Nomura and Laser found that 54% of Japanese institutional investors plan to allocate funds to digital assets within three years.

Join buy side heads of FX in London at fmls25

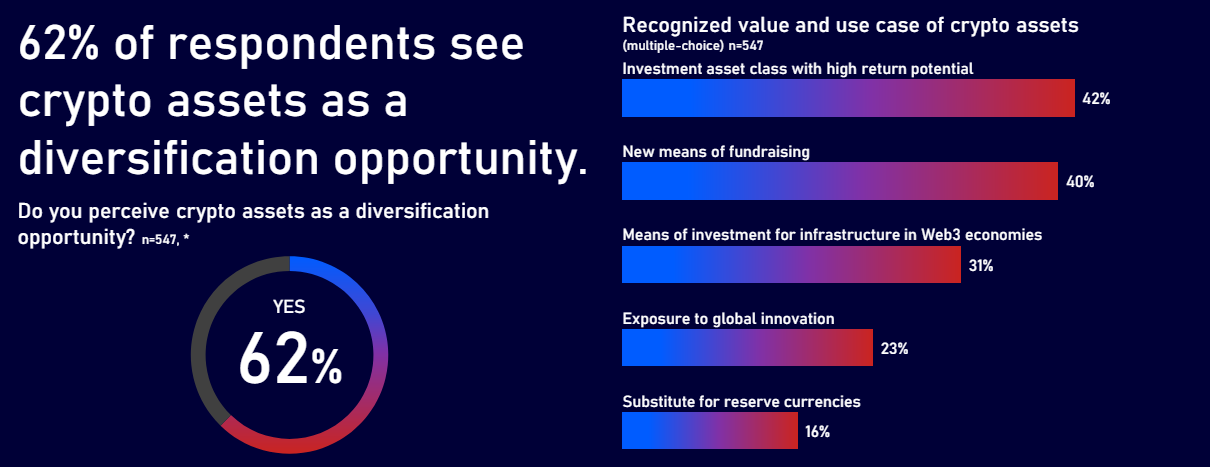

Most respondents see crypto as a diversification tool, with 62% indicating this view. Survey participants generally prefer allocations of 2–5% of assets under management. About half also expressed interest in Web3 projects, though concerns over counterparty risk, volatility , and regulatory requirements remain.

Crypto Trading Growth in Japan

Crypto trading in Japan surged in 2025, with transactions reaching $230 billion in the first seven months, about double last year. Analysts cite US pro-crypto policies and expected Japanese regulatory changes, including tax adjustments and crypto fund frameworks.

You may find it interesting at FinanceMagnates.com: Nomura Reports ¥68.9 Billion Net Income, Up 200% Year-on-Year.

Laser, launched in 2022, offers services including asset management and venture capital in digital assets. The unit received a full crypto business license in Dubai in 2023 and established a Japanese entity in the same year.

- Why Crypto Is Up Today? BTC Price Sees Biggest Rally Since June as XRP, Ethereum and Dogecoin Follow

- Nomura Makes Largest Overseas Purchase Since Lehman With $1.8 Billion Deal

- Georgia’s Tbilisi Free Zone Welcomes Bitget as Region Pushes Regulated Crypto Growth

Laser Struggles Europe, Plans Japan Expansion

Nomura has encountered challenges with Laser in Europe. In July, Chief Financial Officer Hiroyuki Moriuchi said the subsidiary’s results contributed to a quarterly loss. Mohideen had expected Laser to become profitable within two years of its launch, but noted last year that it might take longer to break even.

If approved, Laser will provide broker-dealer services to both traditional financial firms and crypto companies, including digital-asset exchanges operating in Japan.