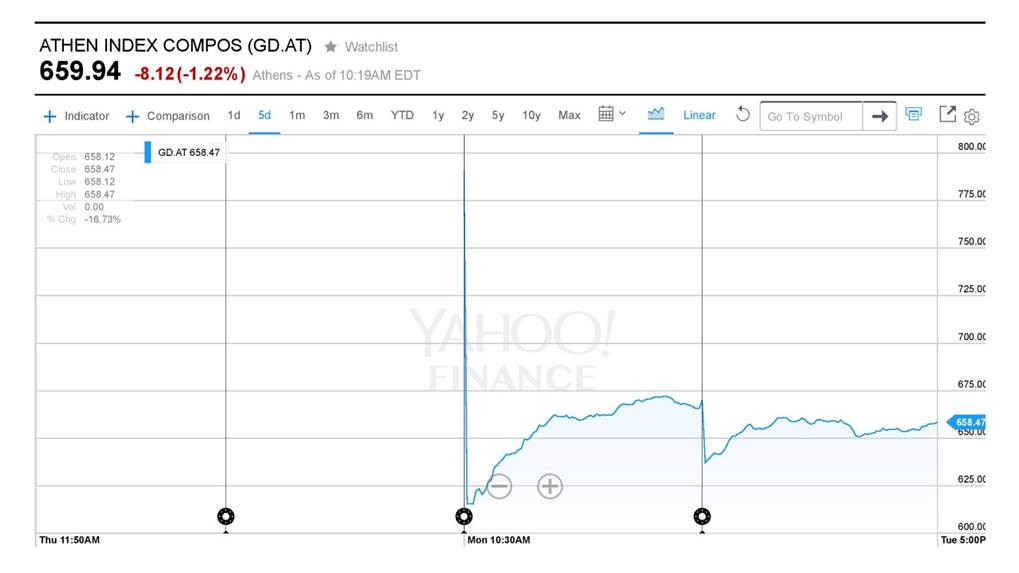

Since re-opening on Monday after a five-week hiatus, the Greek Stock Exchange has sustained heavy losses. While the Athens Stock Exchange General Index (ASE) lost a modest 2.7% of its value on Tuesday vis-à-vis Monday’s hefty 16% drop, shares of the struggling Greek banks continue to plummet.

Indeed, Monday saw the troubled return to trading on the Athens Exchange, which had been shut down as Greece and its international creditors have been wrangling over bailout packages and loan repayments. Soon after opening, the market nosedived, losing almost 23% from the start of trading to finally close 16% down.

Athens Stock Exchange General Index , Souce: Yahoo! Finance

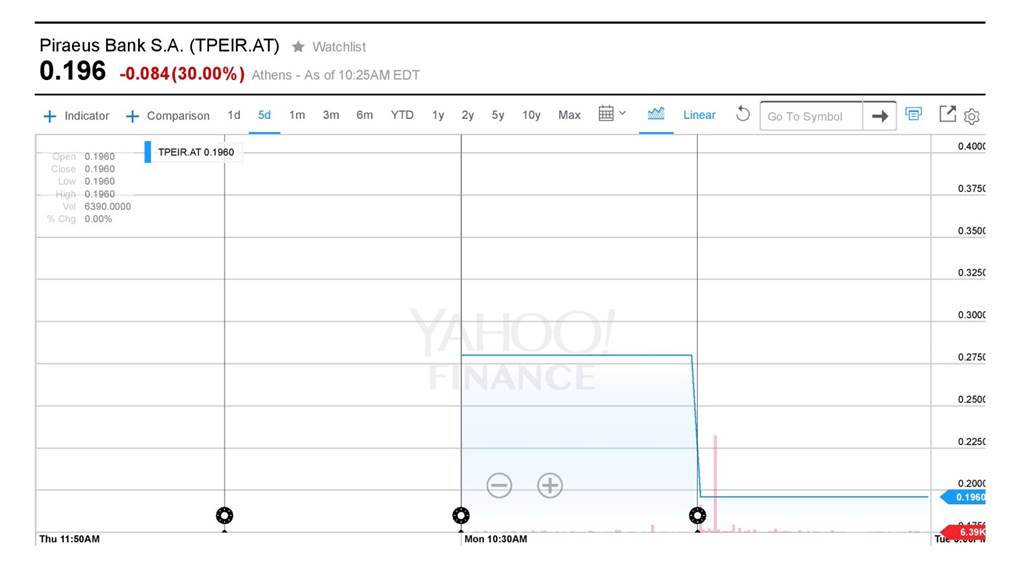

The banking sector has sustained the heaviest losses. For the second consecutive day, Greek banking shares fell by about 30%, the bottom of their daily limit.

Piraeus Bank (TPEIR.AT) has been the worst hit, hitting the 30% line two days running, taking its shares to €0.196. Its compatriots, the National Bank of Greece, Alpha Bank and Eurobank Ergasias, also fell significantly, down 26.1%, 29.7% and 29.7% respectively.

Piraeus Bank Share Price, Source: Yahoo! Finance

The tumbling shares in troubled Greek banks reflect weeks of closure and capital controls following the lack of additional Emergency Liquidity Assistance (ELA) from the European Central Bank (ECB). And economic data looks dismal, prompting investors to remain cautious.

With the capital controls remaining in place until the European Central Bank increases the ELA facility for the Greek banking system, the turmoil on the local markets is set to persist.

Other sectors fared better on the second day of trading. Namely, energy and utility stocks were up, with Terna Energy rising 4.2% and Public Power by 3.8%. Transportation also remained resilient, with Piraeus Port share prices rising 4.4% and Aegean Airlines up 2.6%.