XTB, a Polish retail broker, generated revenue of PLN 580 million (USD 150.8 million) in the second quarter of 2025, which remained at the same level as the previous three months. However, the company’s pre-tax profits improved by 11.2 per cent to PLN 260.7 million (USD 67.8 million).

Another Profitable Quarter for XTB

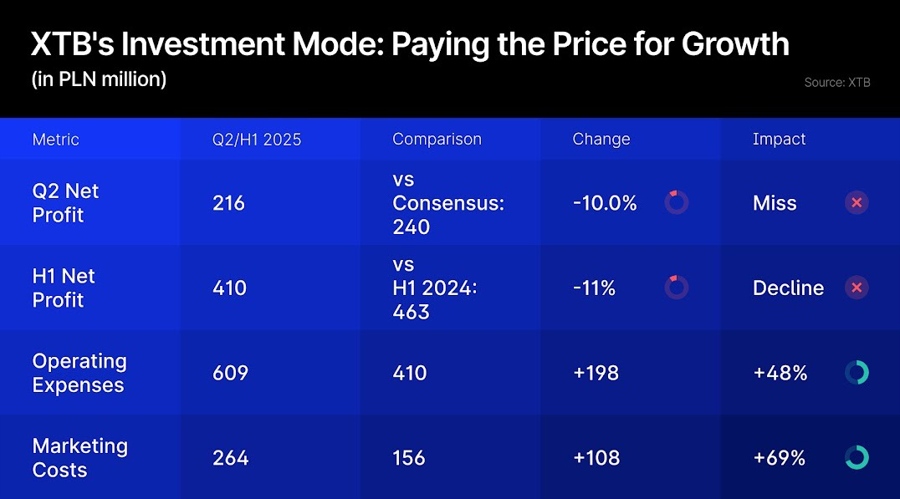

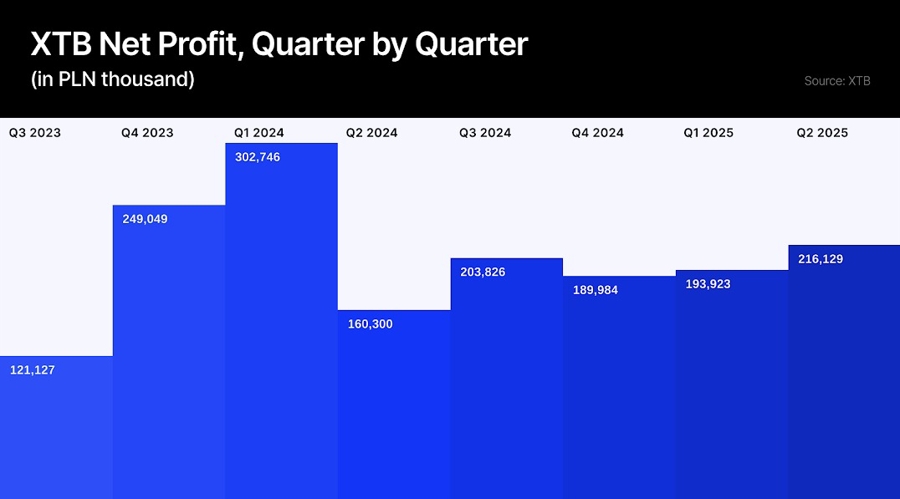

Following taxes, the broker closed the period netting PLN 216.1 million (USD 56.2 million), according to its preliminary financial results published yesterday (Thursday).

Although revenue did not budge, XTB managed to control its expenses and reduced them to PLN 292.9 million (USD 76.2 million) in Q2, a quarterly decline of 7.2 per cent. The broker spent PLN 123 million (USD 32.0 million) on marketing, down about 13 per cent. However, it continued to run online and offline adverts across Europe.

Read more: XTB's Revenue Mix Shifts From USD and Gold as Index CFDs Dominate Q1 2025 Results

Meanwhile, the Poland-listed broker added 167,339 new clients during the three months, taking the total number of clients to over 1.7 million. The number of active clients on the platform at the end of the quarter jumped to over 812K, from the previous quarter’s 735K.

Net deposits, however, dropped to PLN 3.1 billion (USD 806 million), compared to the previous quarter’s PLN 4.1 billion (USD 1.1 billion).

Crypto and Options in the Future

The Polish broker further confirmed that it plans to expand its product offering by adding physical cryptocurrency and options. It already offers crypto contracts for differences (CFDs).

Read more: IG Group to Offer Crypto Trading to Retail Clients

For crypto offerings, XTB is seeking an MiCA licence and is “working on both drafting the necessary legal documents and making technological changes” to its applications. Meanwhile, the broker is awaiting the FSA’s approval of the option pricing model for its options offering.

XTB is also focused on geographical expansion. It has already started offering equities and exchange-traded funds (ETFs) to clients in Indonesia and plans to add CFD instruments in late 2025 or 2026. It entered the country last year with the acquisition of a local broker.

It is also in the process of obtaining a licence in Brazil, which is expected to be completed in 2025. Earlier this year, it secured its first Latin American licence from Chile.